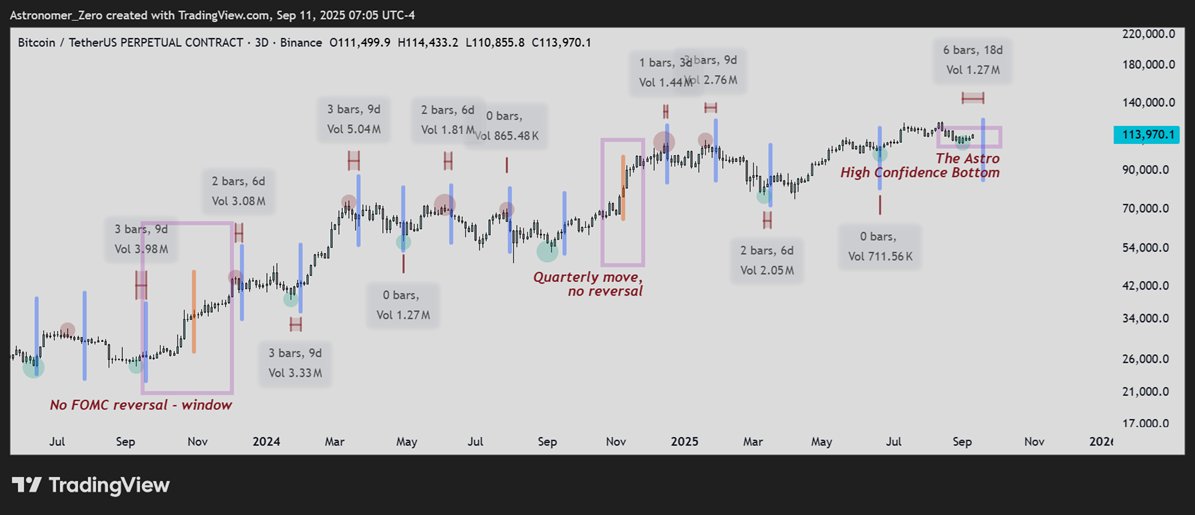

The recent bounce back of Bitcoin from its low of $107,200 has reignited discussions about whether the cryptocurrency market has already established a local bottom and is gearing up for an upward movement. Independent analyst Astronomer (@astronomer_zero) asserts that there is over a “90%” likelihood that this low point has been reached, backing his claim with both price patterns and his recurring framework known as the “FOMC reversal confluence.”

Analyst Suggests 90% Probability That Bitcoin Has Hit Its Bottom

Astronomer, who had previously documented his bearish stance as Bitcoin dropped from $123,000 to the $110,000–$111,000 range, disclosed that he switched to a long position once this target was achieved in late August. He stated: “As if my confidence in identifying the bottom around $110k at the end of August wasn’t already strong… another confluence is now aligning.” He pointed out that historically, meetings held by the Federal Reserve have acted as pivotal moments for shifts in Bitcoin’s trends.

He elaborated: “Data from FOMC meetings tends to reverse ongoing trends either on or up to six bars before these dates—this pattern holds true over 90% of the time. The few exceptions occur when our quarterly long trend takes precedence (which generally carries more weight).” In practice, Astronomer believes markets often anticipate these events ahead of time since insiders and well-funded players dictate post-FOMC price movements before retail investors can fully process outcomes.

With another FOMC meeting set for September 18th, he argues that the downtrend from $123k to $110k may have run its course prematurely. “Now with FOMC approaching… it’s likely we’ve already seen our low point and are reversing back upwards,” he noted.

The analyst contrasted his approach with prevailing sentiments within broader crypto commentary circles where many influencers continue predicting further declines and a bleak September. He dismissed such perspectives as “complete nonsense,” arguing they stem from superficial seasonal analysis. “Whenever it does work out positively for them; it typically establishes its bottom prior to actual meetings due to anticipatory moves… insiders have already determined post-FOMC pricing regardless of results,” he emphasized while cautioning against generic warnings like “be careful” leading up to central bank events which overlook structural changes.

Since entering a long position at around $110k, Bitcoin has surged past $115k prompting Astronomer to declare September’s bearish outlook invalidated. “September will close positively; yes indeed! The ‘Septembears’ are officially down by 6%. Given September started at 108299 and now sits at 115000 puts us in one of historically greener quartiles,” he remarked.

He also referenced data from previous years indicating that September’s reputation as traditionally weak month for Bitcoin appears less statistically significant now than before. “A specific month doesn’t need always be green; ‘seasonality’ merely represents an oversimplified method of analyzing cycles—look back two years where even September turned out positive against bears,” he added.

Astronomer’s conclusion seems straightforward: “When multiple indicators align towards one direction—it usually indicates you’ve successfully solved your Rubik’s cube correctly thus allowing you confidence.” However, he tempered this conviction with prudent risk management advice stating: “Of course I could be mistaken; although it’s been quite some time since we faced losses—never go all-in! Take reasonable risks so you can rest easy.”

With Bitcoin maintaining levels above $115K just days away from an important FOMC meeting—the market might soon reveal whether a sustainable bottom truly exists or not.