Investor sentiment towards Bitcoin is once again under scrutiny. Following a dip below $66,000 that resulted in approximately $177 million worth of long positions being liquidated, $BTC swiftly rebounded past the $69,000 mark, leading to nearly $140 million in short positions being closed. This volatility indicates that the market is currently influenced more by leveraged trading rather than consistent buying or selling activity.

As of now, Bitcoin’s price hovers around $68,752. However, the overall market sentiment remains bearish. The Bitcoin Fear and Greed Index has plummeted to 9, indicating a state of Extreme Fear among investors. Despite appearing stable at this moment, many traders are feeling uncertain about their next steps.

Key Price Levels for Bitcoin to Monitor

The current price action is centered on crucial support and resistance levels.

The support zone lies between $63,000 and $65,000; should selling pressure intensify further downwards movement could see Bitcoin revisiting this area. A drop below these levels might lead to additional declines.

<pConversely,the resistance range between $69,000 and $71,000 presents a significant barrier for upward movement.

If buyers can push prices above this threshold and maintain it there could be potential for higher targets ahead.

If they fail however,a retracement may occur before another attempt at an upward move.

<p data-raw-text='Data from Glassnode indicates that although recent fluctuations have kept Bitcoin within the bounds of$65,'’$73′, traders in options markets anticipate larger price movements soon,suggesting that current tranquility may not persist.’>.

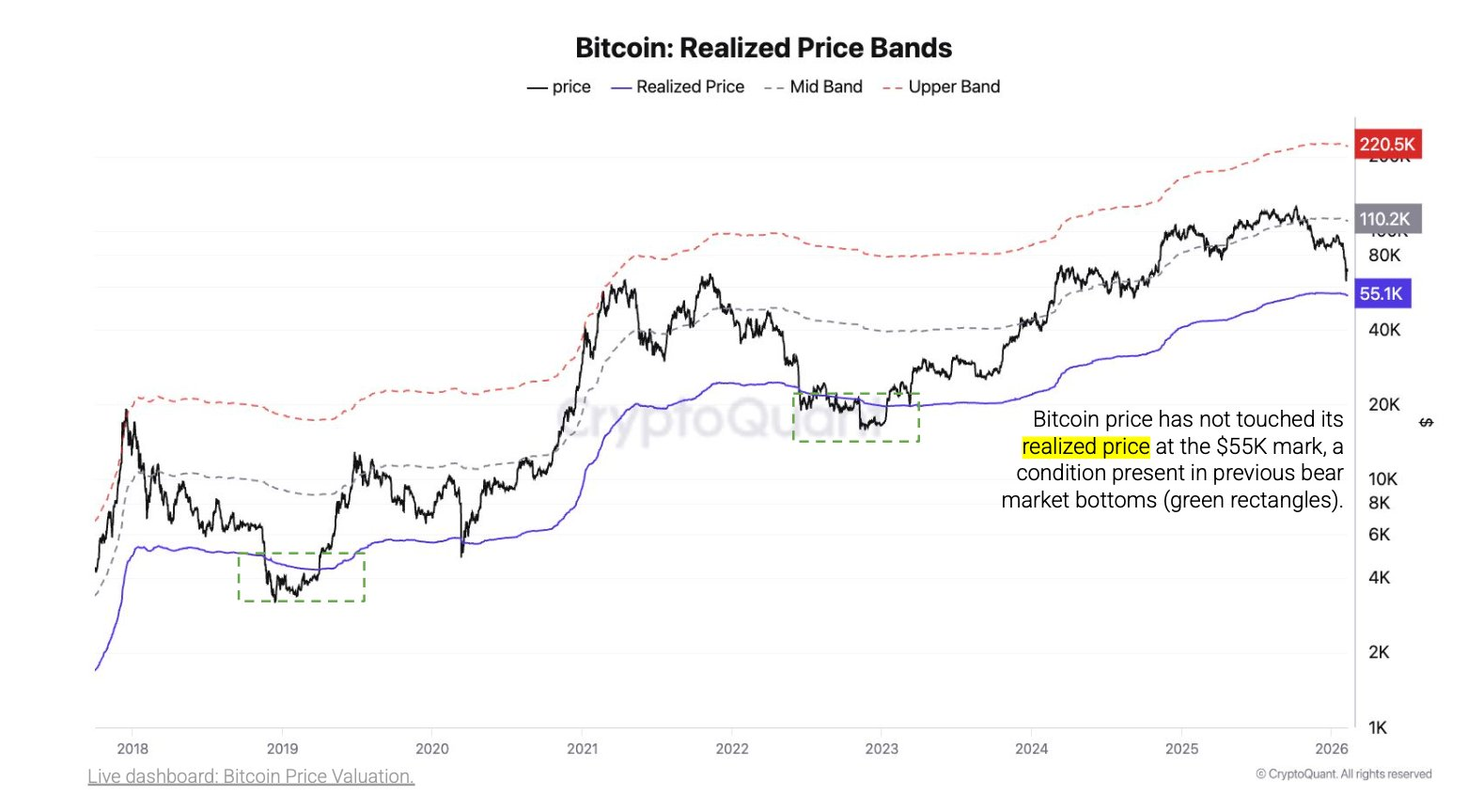

The Significance of the $55k Mark for Bitcoin Prices

A report from CryptoQuant reveals that the realized price for Bitcoin is nearing the pivotal level of $55k—this figure represents an average cost at which coins last transacted on-chain.In previous bear markets,Bitcoin typically fell by 24%to30% beneath this threshold before establishing solid bottoms.

Permanently positioned above$55k currently signifies no widespread panic selling within market participants.On-chain analytics further indicate over half its circulating supply remains profitable.Long-term holders appear reluctant to sell significantly suggesting we haven’t reached critical crisis territory yet.

Historically speaking major bottoms seldom form due solely through abrupt crashes but rather evolve through months filled with sideways trends alongside repeated testing against established supports..

The Future Outlook For $BTC

If pressures mount from sellers then we might witness moves toward levels around fifty-five thousand dollars—or even into low fifty-thousands territory.On contrary should bullish forces propel prices beyond seventy thousand while sustaining such heights then confidence could gradually restore itself back into play!

At present time bitcoin finds itself amidst sensitive conditions where fear looms high alongside growing volatility while oscillating between essential supports/resistances .The forthcoming months will likely determine whether we’re entering deeper corrections or witnessing initial stages towards recovery!