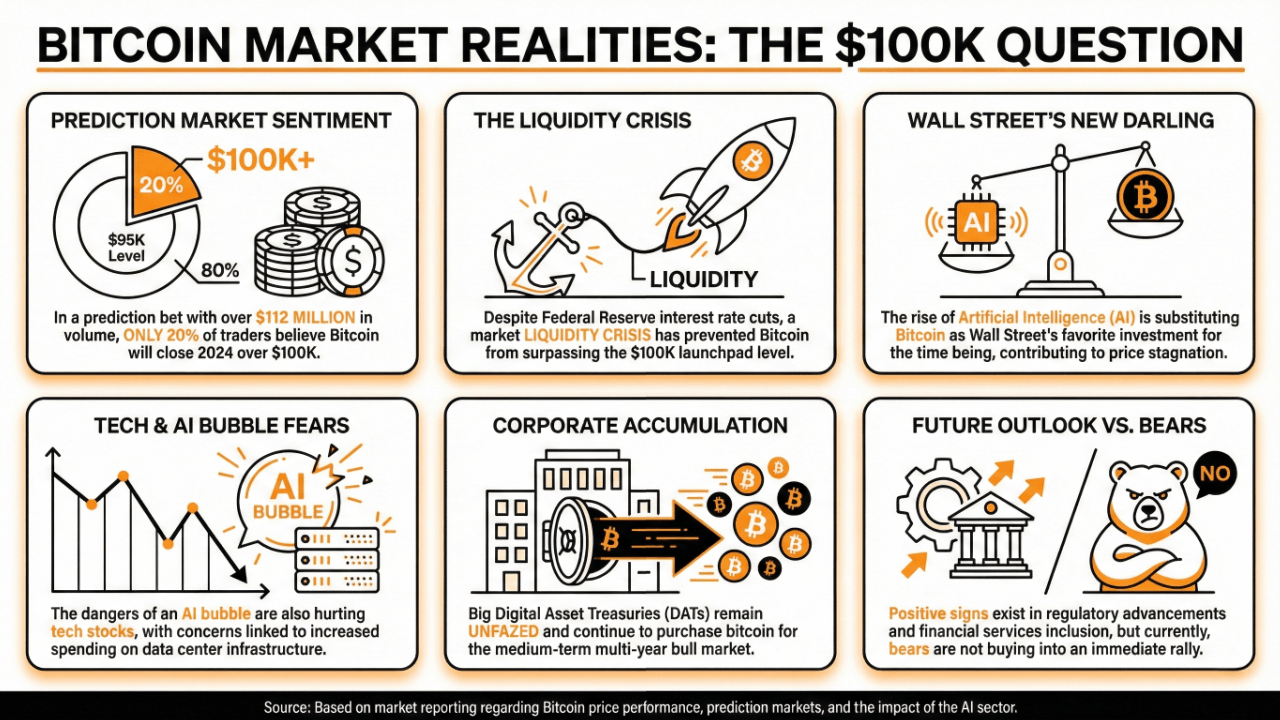

The cryptocurrency landscape is currently dominated by a strong bearish outlook, with even dedicated crypto platforms displaying doubts about bitcoin’s price movements in 2025. This sentiment is evident as only 20% of traders on Polymarket believe that bitcoin will exceed the $100,000 mark by the end of this year.

Bearish Outlook: Polymarket Traders Doubt Bitcoin Will Hit $100K in 2025

Despite a plethora of positive developments surrounding bitcoin and cryptocurrencies this year, the market performance has not mirrored these advancements, leading prediction markets to adjust their forecasts accordingly.

In a wager totaling over $112 million in volume, just one-fifth of participants are optimistic that bitcoin will finish 2025 above $100K. The majority anticipate that while bitcoin may breach the $95K threshold, it will ultimately stabilize around that level.

While some long-term bulls had hoped recent interest rate cuts from the Federal Reserve would propel bitcoin past the coveted $100K milestone, this expectation has not materialized due to ongoing liquidity challenges and other factors weighing down its value.

This year’s tumultuous journey for bitcoin could also be linked to the burgeoning interest in artificial intelligence (AI), which has temporarily overshadowed cryptocurrency as Wall Street’s favored asset. This theory offers an explanation for why we have seen a decline in bitcoin’s annual performance.

The impact isn’t limited to just bitcoin; concerns regarding an AI bubble have recently led to declines across tech stocks after Oracle shares fell more than 10%, driven by worries over rising expenditures on data center infrastructure.

Read more: The AI Bubble Isn’t Just Affecting Bitcoin; Even Stocks Are Floundering – Markets and Prices Bitcoin News

Nevertheless, significant digital asset treasuries (DATs) like Strategy remain undeterred and continue acquiring bitcoins with hopes that it can sustain its multi-year bullish trend moving forward.

Encouraging signs are emerging from regulatory progress and an increasing integration of crypto services within financial institutions—indicating potential adoption trends that could bolster both bitcoin and other cryptocurrencies’ performances.

The ultimate effect of these developments on bitcoin’s pricing remains uncertain; however, some analysts maintain optimistic expectations. For now though, bearish sentiments prevail among traders.

FAQ

What recent predictions are traders making aboutbitcoin’s price bythe endof2025?

Only20%oftradersbelievebitcoinwillexceed$100Kbytheendof2025withmostexpectingittostayaround$95K。

What factorsarecontributingtobitcoin’sstruggleinthemarket?

AliquiditycrisisanddeclininginterestinbitcoinamidtheriseofAIhavenegativelyimpacteditspriceperformancedespiteitsearlierexpectations。

Howhasth eAIbubbleaffectedthebroader market,includ ingbitcoi n?

TheconcernsoveranAIbubblehaveledtoadeclineintechstocks,influencingoverallmarketsentimentandcontributingtobitcoin’srecentdownturn。

Arethereanypositivetrendsforbitcoinamidcurrentchallenges?

Despite t he downturn , majordigitalassettreasuriescontinuetopurchasebitcoin,andregulatoryadvancements suggestongoingadoptionthatcouldpositivelyinfluencefutureprices。