Story Highlights

Bank of Japan rate hike to 1% may trigger major Bitcoin price volatility globally.

Japan holds $1.2 trillion US Treasuries, making policy changes globally impactful for Bitcoin prices.

Bitcoin dropped 3% previously after Bank of Japan raised rates to 0.75% in January.

The global crypto market is back under pressure as expectations grow that the Bank of Japan could raise interest rates to 1% in April 2026. Bank of America warns that tighter policy in Japan may reduce global liquidity and trigger another sharp Bitcoin sell-off, similar to the 3% drop seen after January’s hike.

Bank of Japan Rate Hike to 1% in April 2026

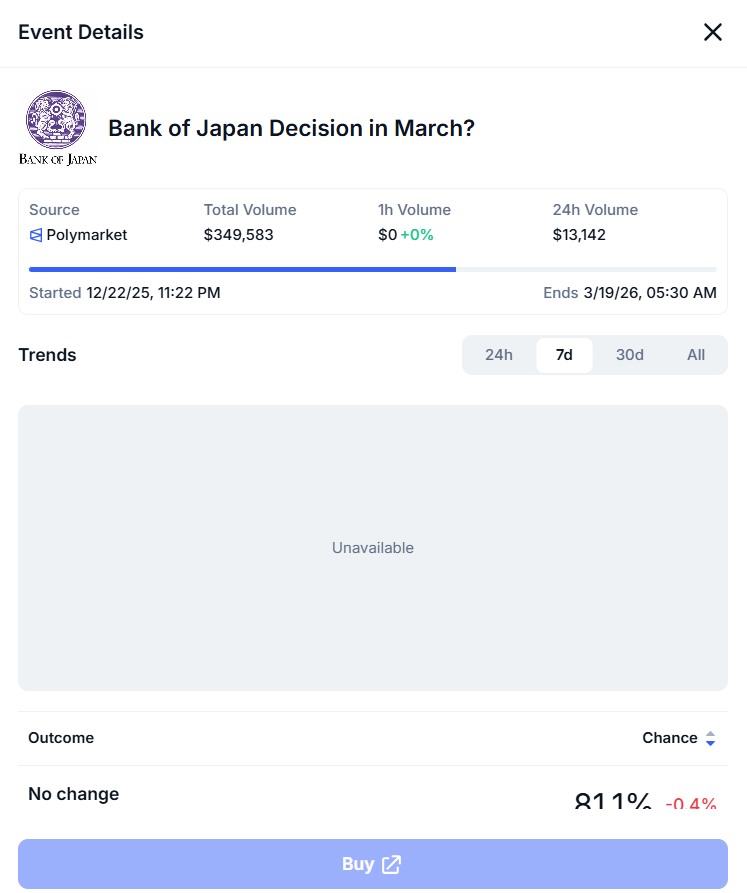

According to Bank of America Global Research, the Bank of Japan (BOJ) is expected to increase interest rates by 25 basis points, which could push the interest rate to 1% in April 2026.

The Bank of Japan is expected to implement a 25 basis point interest rate increase, which will bring interest rates to 1% in April 2026, according to Bank of America Global Research

This would mean that interest rates in Japan would reach their highest interest rate level since the 1990s because Japan maintained its interest rates close to zero for an extended period.

Bitcoin Price After BOJ Rate Hike

Looking at the earlier BOJ rate hike data shows strong sensitivity to Japan’s interest rate changes. The Bitcoin price after BOJ rate hike in January 2026 reflected this clearly, as Bitcoin fell nearly 3% shortly after the Bank of Japan raised rates to 0.75%. This showed how quickly crypto markets react when global liquidity conditions change.

When interest rates increase, borrowing becomes more expensive, which reduces the flow of capital into risk assets like Bitcoin.

If the Bank of Japan raises rates again toward 1%, analysts warn Bitcoin could face more downside pressure. Some estimates suggest a possible 4% to 5% decline, which may push the Bitcoin price closer to the $60,000 level.