A co-founder of Babylon Labs, a company focused on Bitcoin infrastructure, has announced the development of a groundbreaking system that enables the use of native Bitcoin as collateral for borrowing on the Ethereum blockchain without requiring trust.

In a post made on Wednesday via X, David Tse, who is both a co-founder of Babylon Labs and a professor at Stanford University, revealed that they have created a proof-of-concept which allows users to utilize native Bitcoin (BTC) as collateral in an entirely trustless manner for borrowing purposes on Ethereum.

This announcement follows the release of Babylon’s white paper earlier in August detailing their innovative Bitcoin trustless vault system. This system employs BitVM3—a smart contract verification framework—to secure BTC within individual user vaults. Withdrawals from these vaults are controlled by cryptographic proofs that verify external smart contract states recorded on the Bitcoin network.

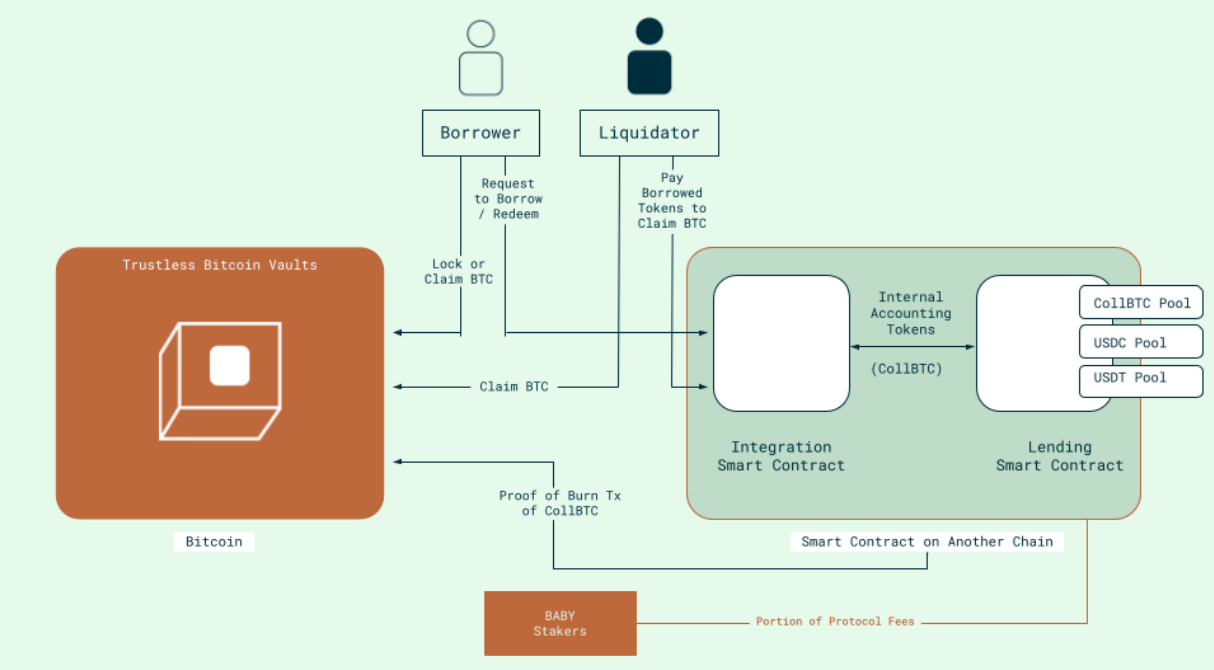

The technology facilitates locking up Bitcoin and bridging it over to Ethereum without needing to depend on any centralized custodian or bridging mechanism. On Ethereum’s side, there exists a smart contract that confirms the BTC vault through an integrated light client before acknowledging it as collateral.

An experimental version of this new token is currently being tested within Morpho’s lending protocol; however, it remains in its early stages with only $14 worth of liquidity available in USDC (USD Coin). Tse described VaultBTC as “an intermediate non-fungible asset designed to connect the vault with Morpho while allowing depositors and liquidators to withdraw BTC without any need for trust.”

A schematic representation illustrating the lending system based on Bitcoin vaults. Source: Babylon Labs

As per publication time, neither Babylon Labs nor Tse had provided comments requested by Cointelegraph.

Related: Kraken introduces Bitcoin staking featuring integration with Babylon

The Trust Factor

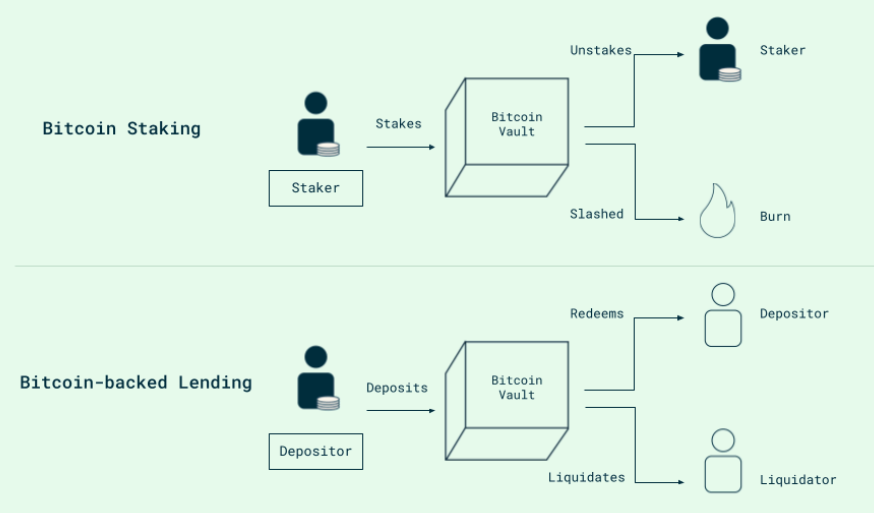

While certain aspects outlined previously are indeed trustless, other components introduce elements lacking complete trustlessness. According to their white paper, liquidations within Babylon’s bitcoin vault rely upon whitelisted liquidators who oversee price movements and monitor state changes within each vault—this results in a liquidation process that lacks permissioning and thus carries inherent trust assumptions.

The model still presumes that enough liquidators—and occasionally significant lenders—will act appropriately despite mechanisms intended to prevent censorship. Although theft is mitigated due to design safeguards preventing unauthorized access to Bitcoins themselves; nonetheless this reliance introduces an element requiring some degree of faith into how these participants will behave under pressure.

Schematic diagram illustrating liquidation processes related specifically towards bitcoin vaults. Source: Babylon Labs

The success or failure regarding liquidations heavily depends upon price oracle accuracy—which brings along risks associated with timing delays or potential censorship issues should inaccuracies arise during critical moments when decisions must be made swiftly concerning market fluctuations affecting value assessments involved here . As such , providers like Band Protocol & Pyth Network affiliated closely together have yet responded back after inquiries were sent out seeking clarification surrounding reliability concerns raised during publication timelines .

Related:The future landscape for DeFi isn’t limited just onto one platform – it’s branching out across various chains including those built atop bitcoin itself!

A Shift In Paradigm?

The white paper illustrates its points clearly using an example scenario : “Imagine Bob owns 1 BTC but wants $50k worth stablecoin borrowed from Larry through lending protocols established over at ethereum ” . In order facilitate such transactions effectively , if btc drops below $50k then larry retains rights liquefy said assets otherwise bob retrieves them once loan obligations fulfilled timely mannered!

Currently existing systems necessitate multiple layers involving trusting parties throughout entire process ; Bob could choose handover his btc directly larry while placing faith he’ll return them afterwards safely intact! Alternatively bob might retain ownership promising allow larry access whenever necessary should prices dip too low—but ultimately relies solely good intentions between two individuals involved ! Lastly another option entails bridging btc into wrapped format allowing usage contracts set forth utilizing ethereums ecosystem however again would hinge heavily upon trusting those wrapping mechanisms employed therein .

Wrapped tokens inherently require reliance placed onto centralized custodians holding backing assets securely so users must place confidence they won’t lose funds freeze accounts misuse resources entrusted them instead relying solely honesty solvency rather than cryptographic assurances offered up until now ; this fundamental issue tackled head-on via babylons innovative approach eliminating all prior dependencies associated beforehand !”Trustless Vaults eradicate every single assumption rooted around dependency structures,” claims stated document explicitly outlining methods used achieve desired outcomes efficiently.”

Magazine :< ‘Debasement trade’ will pump bitcoin whilst ethereums dat systems shall prevail according hodlers digest dated oct 5-11!