Local news outlets report that Argentina’s central bank is exploring new regulations that would enable banks to participate in the cryptocurrency sector. Experts believe this initiative could significantly broaden access to digital currencies and stablecoins for the general public.

Argentina’s Central Bank Considers Allowing Banks to Engage in Crypto Activities

The Situation

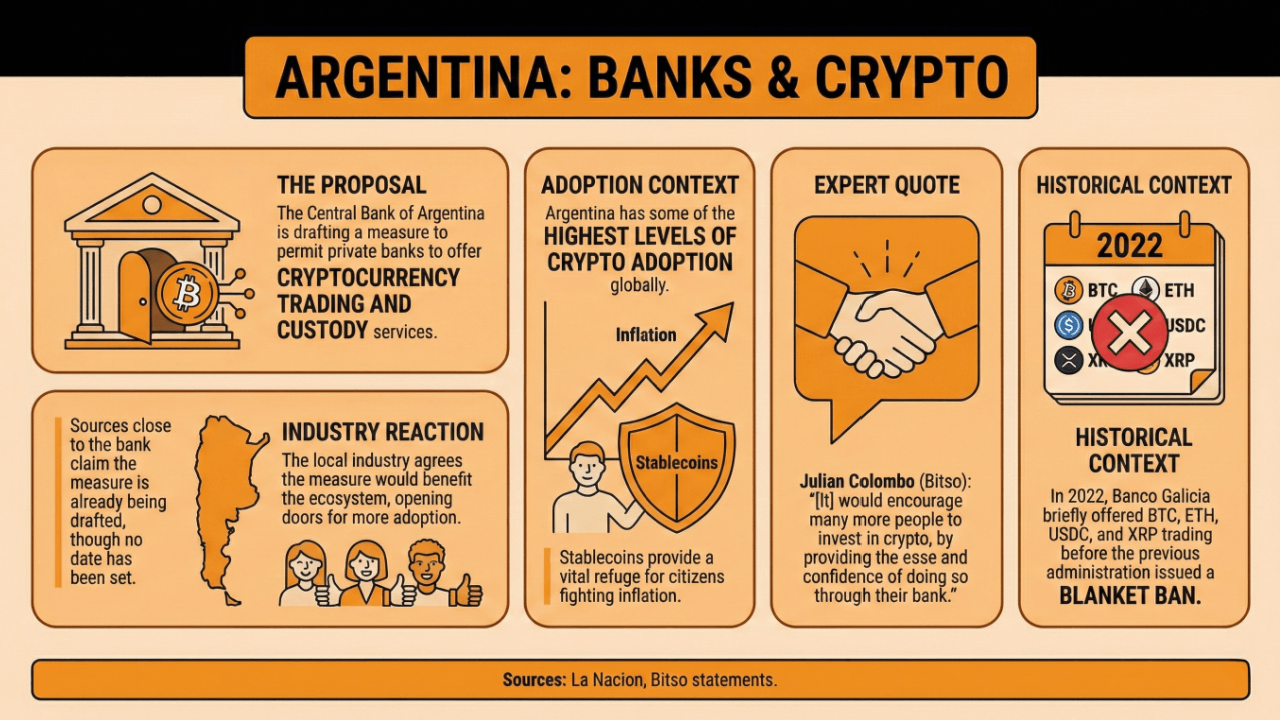

The Central Bank of Argentina is reportedly preparing a framework that would authorize financial institutions to provide services related to cryptocurrency trading and custody.

According to La Nacion, insiders close to the central bank revealed that a proposal is currently being drafted, aiming to grant private banks permission for crypto-related operations. However, no specific timeline or detailed information has been disclosed yet.

Industry participants within Argentina’s crypto community have expressed optimism about this potential policy change, suggesting it could enhance the country’s digital asset ecosystem by enabling more individuals to explore options like bitcoin and stablecoins.

Argentina ranks among the top nations globally for cryptocurrency adoption, largely because stablecoins offer citizens protection against inflation and currency depreciation. Julian Colombo, South America manager at Bitso, commented that such regulation “would motivate many more people to invest in cryptocurrencies by providing convenience and trust through their banking institutions.”

Back in 2022, Banco Galicia introduced crypto services allowing customers access to BTC, ETH, USDC, and XRP trading on its platform. Nevertheless, under previous leadership at the central bank, a comprehensive ban was imposed preventing banks from offering these products.

Related read: Central Bank of Argentina Prohibits Private Banks From Providing Cryptocurrency Services

The Importance of This Development

If implemented successfully, this policy would position Argentina as a trailblazer for crypto integration within Latin America—countries like Bolivia and Venezuela have considered similar steps but have yet to act decisively.

Experts highlight how legitimizing cryptocurrencies through official banking channels could accelerate adoption by presenting them as viable alternatives alongside traditional financial instruments. This shift may empower everyday Argentinians with easier access toward saving or investing via digital assets directly from their trusted banks.

Caution remains necessary; regulators must carefully evaluate how introducing these novel financial products might impact economic stability amid ongoing challenges faced by Argentina’s economy.

The Road Ahead

No definitive launch date has been announced so far; however industry sources anticipate implementation around April 2026 according to La Nacion’s coverage.

Frequently Asked Questions (FAQ)

- What proposal is being considered by Argentina's central bank?

The institution plans on drafting rules permitting private banks to facilitate cryptocurrency trading along with custody services. - How might this affect crypto usage across Argentina?

Such regulation could strengthen local blockchain ecosystems while encouraging broader public participation in assets like bitcoin & stablecoins through familiar banking platforms. - Please explain past involvement of Argentinean banks with cryptocurrencies?

In 2022 Banco Galicia briefly offered multiple cryptos including BTC & ETH before regulatory restrictions halted those offerings under former administration policies.” - When can we expect these changes take effect?

Industry insiders estimate an effective rollout sometime near April 2026 which may establish Argentina as one of Latin America's foremost advocates for regulated crypto finance solutions .