Anthony Pompliano contends that while gold has demonstrated notable gains in dollar terms since the start of 2020, it has actually depreciated by 84% when evaluated against Bitcoin over the same timeframe.

Pompliano, who leads Professional Capital Management (PCM), shared this perspective during a recent interview on FOX Business. He portrayed Bitcoin as a reliable asset for preserving value.

Gold and S&P Performance in Relation to Bitcoin Since 2020

The American entrepreneur highlighted that although investors often celebrate nominal increases in gold or the S&P 500 when valued in dollars, these assets tell a different story when compared to Bitcoin.

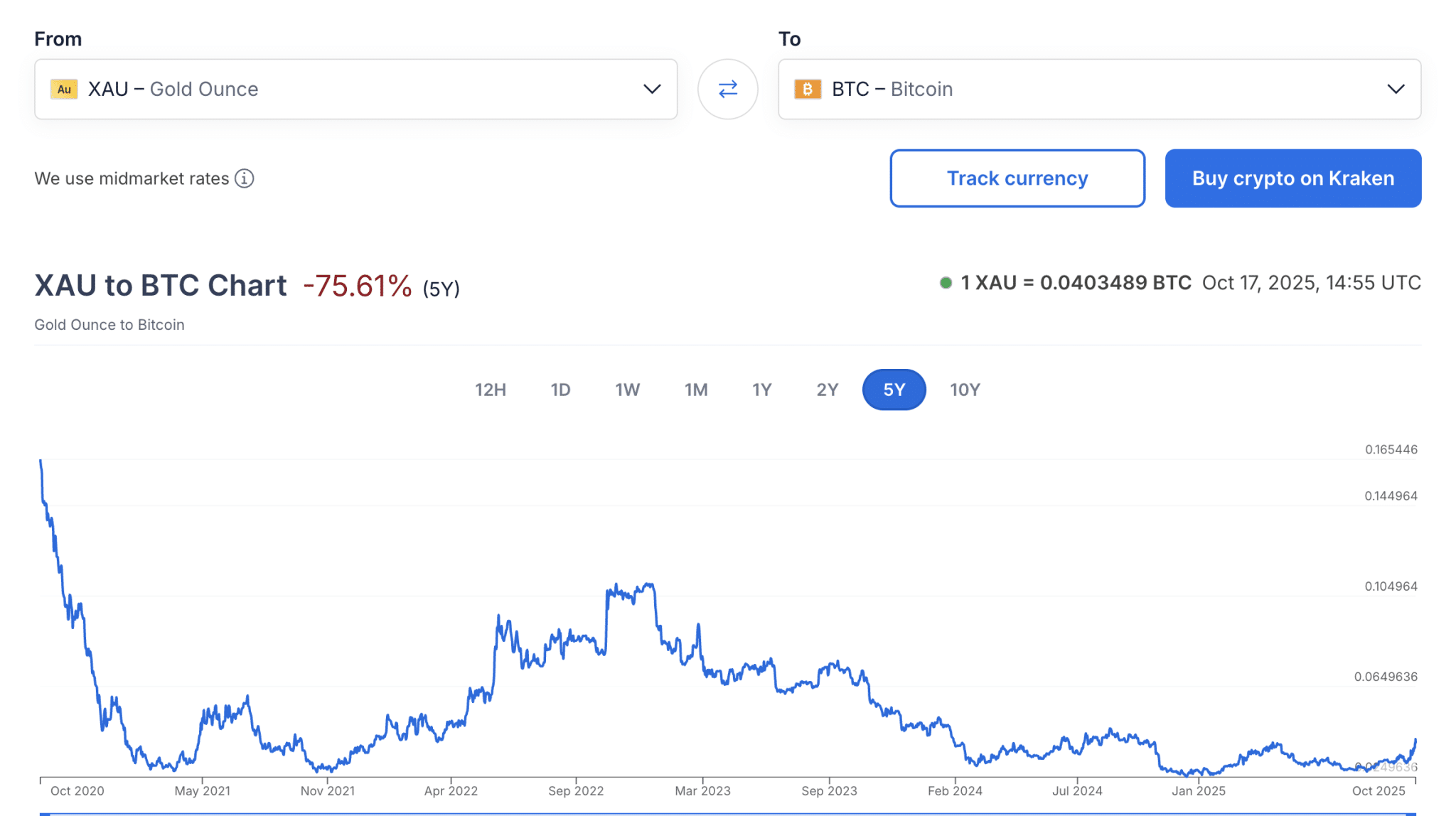

This argument is supported by data from platforms like XE.com. The chart comparing gold to BTC reveals a significant loss of 75.55% over five years, whereas BTC’s performance relative to gold shows an impressive rise of 310%.

Bitcoin as a Benchmark for Performance

Praising Bitcoin’s extraordinary growth during this period, Pompliano pointed out that BTC has increased approximately by 1,500% since January 2020.

He suggests using Bitcoin as a benchmark for evaluating performance instead of relying solely on the dollar. His analysis indicates that stocks and gold may appear successful in dollar terms but are actually declining compared to Bitcoin’s value.

Pompliano’s comments arise amidst ongoing criticism from supporters of gold despite its current rally.

The precious metal recently achieved an unprecedented high at $4,376 due to rising economic uncertainties and intensifying trade tensions between the U.S. and China.

Conversely, macroeconomic pressures have negatively impacted Bitcoin. The leading cryptocurrency dropped below $104,000 today. Following this downturn, Peter Schiff advised investors to sell their BTC holdings and invest in gold instead.

Schiff also asserted that reaching $1 million is more plausible for gold than it is for Bitcoin. Despite such critiques, Pompliano remains firm: even though fiat currency metrics suggest otherwise regarding its performance against inflationary pressures globally—gold loses ground against bitcoin continually—he advises those unable outperforming bitcoin should consider purchasing it outrightly without hesitation!