While Bitcoin’s price continues to capture media attention, a subtle shift is occurring among analysts and institutional strategists who are turning their focus elsewhere.

Rather than debating Bitcoin’s potential for short-term gains, experts are now probing a more fundamental issue: whether the structural patterns that have historically governed Bitcoin’s four-year cycles are starting to break down.

Analysts Shift Focus as Demand Signals for Bitcoin Weaken

This change in perspective arises amid declining demand indicators, increased exchange activity, and growing disagreement among market watchers.

Some experts view the current phase as a typical post-peak correction for Bitcoin. Conversely, others suggest that this pioneering cryptocurrency might be diverging from its traditional cyclical behavior entirely.

Daan Crypto Trades highlights how recent price trends have already challenged one of Bitcoin’s most reliable seasonal expectations.

“Looking ahead, Q1 has usually been favorable for Bitcoin just like Q4 was — yet this past quarter didn’t follow suit. The year 2025 has been turbulent with large inflows and treasury accumulation balanced by significant selling from long-time holders aligned with the four-year cycle. The first quarter of 2026 will be crucial in determining if this cycle remains intact,” he explained.

This underperformance does not necessarily indicate a complete breakdown but rather suggests resistance within the market. ETF inflows and corporate buying appear offset by distribution from long-term holders, diminishing their influence on BTC prices.

The tension is also evident in U.S. spot market data where Kyle Doops notes that Coinbase’s premium on Bitcoin—a common gauge of U.S. institutional interest—has stayed negative over an extended period.

The Coinbase $BTC premium has remained below zero for seven consecutive days at approximately -0.04%, according to Coinglass.

This typically indicates weaker U.S.-based spot demand compared to other markets.

It reflects less aggressive institutional purchases, reduced risk appetite, and cautious capital deployment.

Not panic—but hesitation… pic.twitter.com/HtjNSorO1I

The takeaway here isn’t capitulation but rather uncertainty—capital exists but investors hesitate to aggressively pursue positions at current levels.

Exchange Data Suggests Distribution Rather Than Accumulation

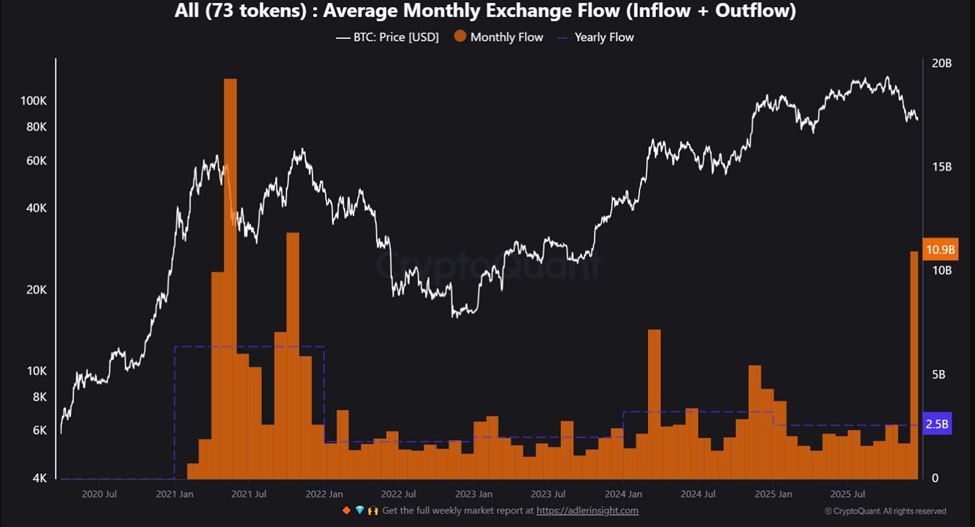

On-chain metrics call for careful interpretation as exchange inflows surge to heights often linked with late-cycle selling pressure rather than early-stage accumulation phases.

“Monthly exchange flows have climbed sharply to $10.9 billion—the highest since May 2021—which signals increased selling activity as investors move assets onto exchanges aiming to liquidate holdings or hedge risks amidst volatility,” stated analyst Jacob King.

This pattern historically aligns with profit-taking periods marking market tops rather than bottoms or accumulation phases.”

If History Repeats Itself: Cycle Patterns Point Downward Amid Institutional Divergence Yet Discipline

Ali Charts emphasizes that despite some structural shifts within the ecosystem, Bitcoin’s historical timing patterns remain remarkably consistent over time:

“Bitcoin's price cycles exhibit striking regularity both in duration and scale—approximately 1,064 days elapse between bottom-to-top phases while around 364 days separate peaks back down to troughs,” he noted referencing previous cycles’ adherence.

If these rhythms hold true once again, it implies we may currently be inside a corrective phase requiring further downside before establishing solid foundations for recovery.

Institutional opinions vary without descending into chaos.

“Bitcoin presently resides in valuation ‘no man’s land’,” says Fundstrat's Head of Crypto Strategy Sean Farrell who points out pressures such as ETF redemptions along with miner sales plus macroeconomic uncertainties.

“Nonetheless I anticipate both BTC and ETH will reach new all-time highs before year-end thereby concluding the classic four-year cycle albeit following a shorter bear market,”””The Debate Over Cycles Has Become an Institutional Conversation

Tom Lee echoes similar sentiments widely discussed across crypto circles suggesting imminent disruption of bitcoin's established four-year rhythm:

TOM LEE THINKS BITCOIN WILL BREAK THE 4-YEAR CYCLE SOON! pic.twitter.com/eWZdW7xkgW

Conversely,Fidelity's Jurrien Timmer adopts an opposing viewpoint.AccordingtoLarkDavis,TimmerseesOctoberasbothapriceandtimemaximumwiththeyear2026forecastedasadeclineandsupportexpectedbetween$65Kand$75K:

&ldquoThe bearmarketishereandBitcoinisheadingdownto$65K”

Thatátát Fidelity&;#39s directorofglobalmacroJurrienTimmerthinks.

WhileJurrienisbullishon$BTCinthelongterm,hobelievesthatBitcoinisonceagainfollowingitshistorical4-yearcycledrivenbyits…pic.twitter.com/KFPcBWTcZP

Togetherthesecontrastingviewsillustratethatanalytsaremovingbeyondjustpriceaction.Thefuturedirectionofbitcoinmaynotonlydecidebullorbearpositionsbutalsowhetheritslongstandingmarketframeworkremainsvalidaftermorethanadecadeofexistence.

ThepostAnalystsLookBeyondBitcoinsPriceAsTomLeeFlagsAStructuralShiftappearedfirstonBeInCrypto.