Following the significant crash on October 10, Bitcoin (BTC) is experiencing increased volatility. An AI tool now forecasts that the cryptocurrency might soar to an unprecedented high of nearly $200,000 by late 2025.

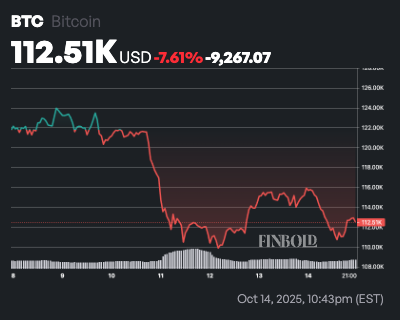

Currently, Bitcoin is valued at $112,474, marking a decrease of 2.7% over the past day and more than 7% throughout the week.

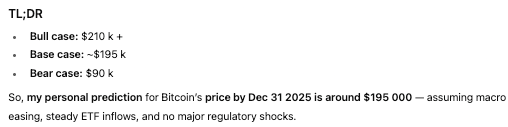

For insights into its end-of-2025 potential, Finbold consulted OpenAI’s ChatGPT. The AI predicts Bitcoin could reach around $195,000 due to favorable macroeconomic trends, steady institutional investments, and robust blockchain activity.

The forecast hinges on four main elements: monetary policy shifts, institutional engagement levels, blockchain robustness metrics, and overall market sentiment.

The model anticipates moderate interest rate reductions by the Federal Reserve towards late 2025 to enhance liquidity and reignite interest in riskier assets. Additionally consistent demand from spot Bitcoin ETFs could drive prices higher given its finite supply.

On-chain analytics suggest a stable mid-cycle stage with strong participation from long-term investors and active wallet users.

Despite cautious market sentiment post-correction ChatGPT observes signs of recovery which often precedes new upward trends once leverage stabilizes again.

Bitcoin Price Forecast

The December 31 price projection starts with an estimated closing value for Bitcoin at about $95K in late-2024 rising towards approximately $113K by mid-October next year according to ChatGPT’s analysis model based on historical data cycles suggesting possible gains ranging between sixty percent up-to one hundred ten percent over subsequent twelve months targeting anywhere between one hundred eighty-five thousand dollars through two hundred ten thousand dollars come December twenty-twenty-five centered around base expectation close near nineteen five K mark specifically speaking here today now…

This prediction assumes ongoing adoption among institutions alongside supportive macroeconomic conditions but cautions against potential downturns if investor confidence wanes or regulatory challenges increase substantially under bearish circumstances values may drop back toward eighty-five grand up till reaching max ceiling point closer round even number mark say one-hundred-thousand aligning roughly speaking previous peak cycle highs historically observed earlier periods before present moment currently underway right now all things considered overall though generally optimistic outlook maintained looking ahead further future prospects seem bright indeed provided sufficient capital flows remain intact whilst major players continue expanding involvement within broader ecosystem contextually speaking naturally enough as expected logically follows henceforth without doubt whatsoever beyond shadow question posed hereinabove thus far stated accordingly thereof forthwith thereafter conclusively finally ultimately so there you have it folks!

Main image courtesy Shutterstock