Despite Bitcoin (BTC) facing challenges in establishing the critical $115,000 level as a support point, it has experienced an increase of over two percent within the last week. However, when looking at the past month, Bitcoin has seen a decline of 2.58%, fluctuating between $107,000 and $119,000.

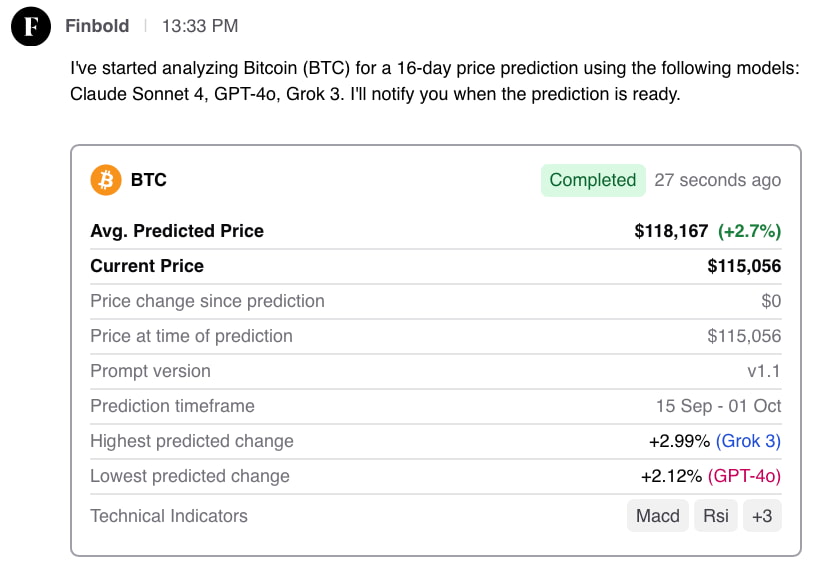

According to Finbold’s AI forecasting tool, Bitcoin is expected to reach a trading price of $118,167 by October 1, 2025. This projection indicates a potential rise of 2.7% from its current value of $115,056. Currently, BTC is trading just above three thousand dollars lower than this anticipated figure.

To arrive at this forecasted price point, Finbold’s AI utilized various advanced language models such as GPT-4o and Claude Sonnet 4 along with Grok 3. By integrating outputs from these diverse models into an averaged prediction system, it aims to minimize discrepancies and offer a more accurate market outlook.

The analysis also took into account momentum indicators like MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), Stochastic oscillator values alongside both the 50-day and 200-day simple moving averages. Within this analytical framework, Grok 3 presented the most optimistic scenario with an expected rise of up to 2.99%, while GPT-4o adopted a more cautious stance predicting only a gain of around 2.12%.

BTC Market Dynamics

The market activity remains vigorous in conjunction with these forecasts; trading volume over the last twenty-four hours hit approximately $46.66 billion—a notable increase by nearly half compared to previous figures. The fully diluted valuation for Bitcoin currently stands at about $2.4 trillion with its volume-to-market cap ratio resting at around 2.02%.

This environment is further influenced by trends across other digital assets; notably the Altcoin Index has surged to reach levels near seventy-two out of one hundred—indicating growing interest in alternative cryptocurrencies even as Bitcoin’s dominance dips close to its lowest mark in seven months.

Market analysts are closely monitoring these evolving dynamics; prominent analyst Michaël van de Poppe characterized current conditions as “very classic price action prior to FOMC meetings.” He pointed out that it’s typical for both Bitcoin and altcoins to undergo corrections leading up to such events—highlighting that downturns during this period can represent opportunities rather than reasons for alarm.

Michaël van de Poppe expressed his perspective on Twitter stating that “Bitcoin now faces its final resistance before we could see another breakout.” He emphasized that breaking through the range between $117K–$118K could lead towards achieving new all-time highs (ATH).

#Bitcoin encounters final resistance before we anticipate seeing new all-time highs.

If we break through between $117K-$118K then we’re headed toward new ATH.

This week is crucial—I’m eager for what volatility lies ahead! pic.twitter.com/4U9Gr0guS0

— Michaël van de Poppe (@CryptoMichNL) September15th2025

The combination of AI-driven predictions alongside traditional technical metrics and trader sentiment underscores significant focus on the zone ranging from $117500-$118000 for BTC prices moving forward; should Bitcoin successfully breach this threshold decisively—it would not only confirm Finbold’s target but also pave way towards potentially reaching record high values once again.

As market momentum continues building coupled with heightened volatility leading up toward FOMC meetings—the forthcoming weeks may prove pivotal in determining which direction will define future phases within Bitcoin’s journey ahead!