This week, US Representative Byron Donalds made headlines by announcing a purchase of Bitcoin valued at up to $100,000. This action has sparked interest, particularly since he serves on the House Subcommittee on Digital Assets.

The timing of this transaction coincides with heightened scrutiny surrounding stock trading among members of Congress. It also fuels speculation that a legislative framework for cryptocurrency could soon be approved, potentially acting as a positive influence on Bitcoin’s market value.

Implications of Congressional Investment in Bitcoin

The Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee is responsible for creating and evaluating laws that regulate the digital economy.

As the cryptocurrency sector continues to grow rapidly, this committee plays an essential role in establishing comprehensive regulatory guidelines for crypto assets and related financial technologies.

Given Donalds’ position within this subcommittee, his recent investment in Bitcoin raises questions about the potential advantages lawmakers may have regarding information access prior to public disclosure.

BREAKING: Representative Byron Donalds has filed a purchase of up to $100K in Bitcoin ($BTC).

Donalds sits on the House Subcommittee on Digital Assets. pic.twitter.com/n7Xe7ePdY5

— Quiver Quantitative (@QuiverQuant) January 8, 2026

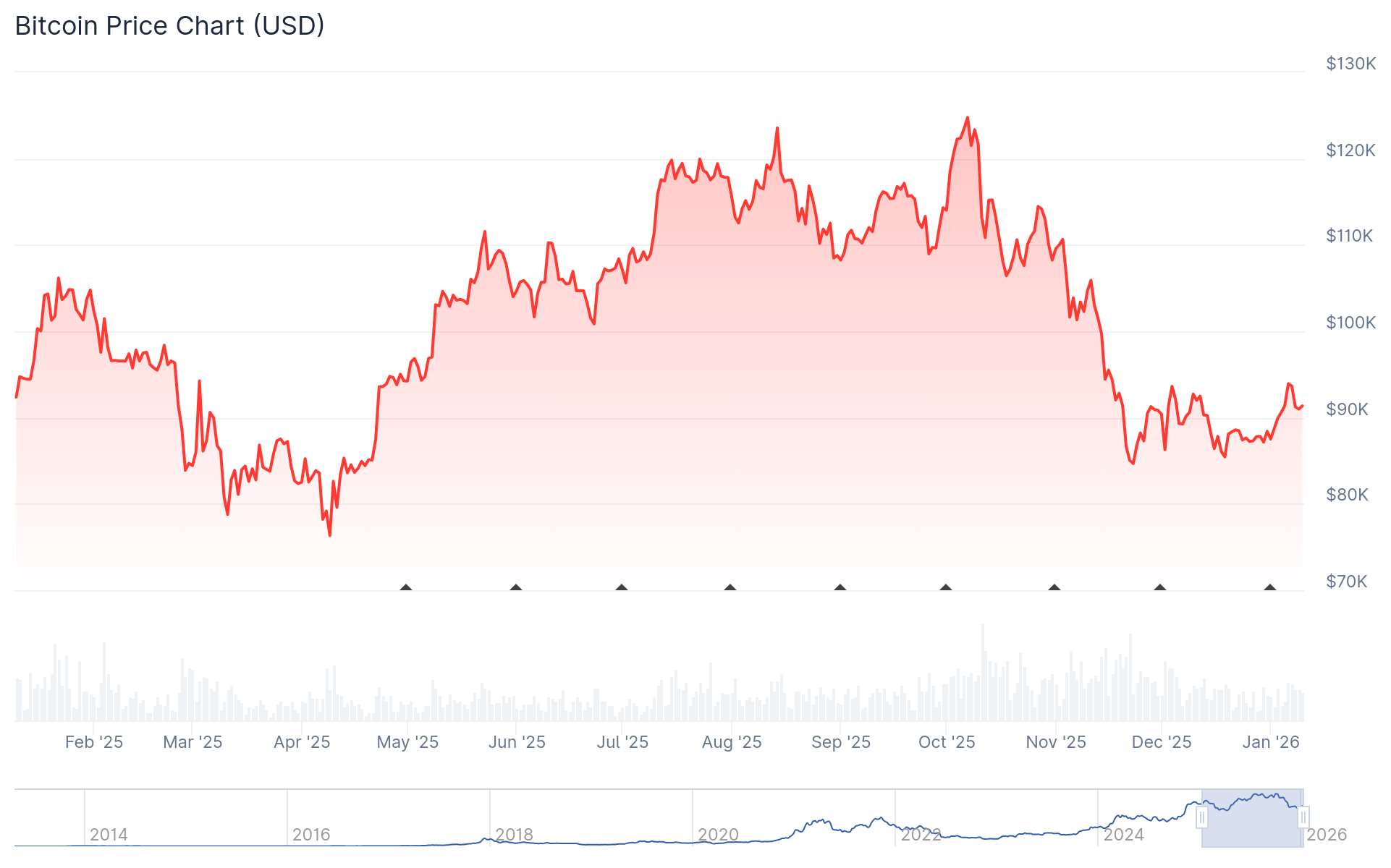

This acquisition also stirs discussions about what lies ahead for Bitcoin as we enter a new year. Currently priced at $91,370 after experiencing fluctuations that saw it dip as low as $84,000 while struggling to regain the $100k mark over several months.

Market analysts express concerns that waning demand might indicate that Bitcoin is entering bear territory. In an interview with BeInCrypto recently conducted by CryptoQuant analyst Julio Moreno predicted a potential bottom price around $56k sometime in 2026.

Nevertheless, there are glimmers of hope for Bitcoin’s future performance. A significant investment from an influential congressional figure may signal expectations for recovery before external market pressures escalate further.

The ongoing discussions regarding crypto market structure legislation could provide just what is needed for another surge in Bitcoin’s value.

The Importance of The Clarity Act For Cryptocurrency

This past July saw the passage of The Clarity Act through the House—a bill designed specifically to regulate cryptocurrency markets effectively. Since then, efforts have been underway within the Senate towards drafting its version known as The Responsible Financial Innovation Act.

This Senate proposal is currently under review by both Senate Agriculture Committee and Senate Banking Committee; while one has already released preliminary drafts discussing its contents yet no similar document exists from its counterpart just yet

A vote will only take place once these reviews are completed; should it secure sufficient support during voting procedures—it would return back down through channels leading toward final approval from President Trump before becoming law officially

Despite facing numerous political hurdles lately reports suggest passage could occur early March—if successful such developments might significantly affect pricing trends associated with bitcoin .

CLARITY ACT Timeline Per @EleanorTerrett :

After talking with my close friend @EleanorTerrett regarding her thoughts on when she personally thinks CLARITY act will get Trump’s desk , she stated ” It’s slated pass out senate banking committee next week , then get …

— Crypto Investment Group (@CryptoIG_) January 8 , 2026

Last July’s enactment GENIUS act exemplifies how regulatory changes can sway markets ; following Trump signing into law BTC soared hitting peak values around119 k – some anticipate similar reactions if clarity act gains approval .

Historically speaking crypto space endured persistent uncertainty concerning regulations thus clear policies serve vital confidence boosters consumers investors alike ; sizable bills like these often catalyze shifts across sectors .

Meanwhile Donald’s recent bitcoin buy reignites discourse surrounding congressional stock trading bans .

Tackling Insider Trading Among Lawmakers

As part several congress members whose investments have come under fire due their privileged positions – including Louisiana Rep Cleo Fields who profited immensely off well-timed trades involving IREN (a mining company ) seeing returns upwards233%.

Later Jonathan Jackson member house agriculture sub-committees purchased Robinhood stocks first time same month.

The discussion extends beyond cryptocurrencies encompassing all types stock transactions occurring amongst lawmakers.

A long-standing issue finally gaining traction again over past year where legislators aim introduce measures preventing officials utilizing non-public data trade actively.

On Saturday Ritchie Torres confirmed intentions submit bill prohibiting federal employees & executive branch officials engaging prediction contracts having access confidential info likewise alongside others sitting upon digital asset committees like himself & Jackson.

An earlier proposal was introduced October Ro Khanna aiming restrict president family members congresspersons from participating either crypto stocks accepting foreign funds altogether!

The post A Key US Lawmaker Made A $100K Bitcoin Buy – Is The CLARITY Act Close To Passing? appeared first On BeInCrypto.