Over the past 24 hours, Bitcoin has fluctuated within a narrow range between $87,418 and $90,307. Although this price movement appears stable on the surface, it conceals increasingly intricate strategies unfolding in the futures and options markets. Beneath this calm trading band, derivative data reveals that traders are actively positioning themselves for developments expected in early 2026.

Insights from Bitcoin Derivatives as Spot Price Remains Steady

While Bitcoin’s spot price remains indecisive, activity in futures and options markets continues unabated despite the holiday season slowdown. These derivatives provide a valuable lens into how professional investors are gearing up for what lies ahead.

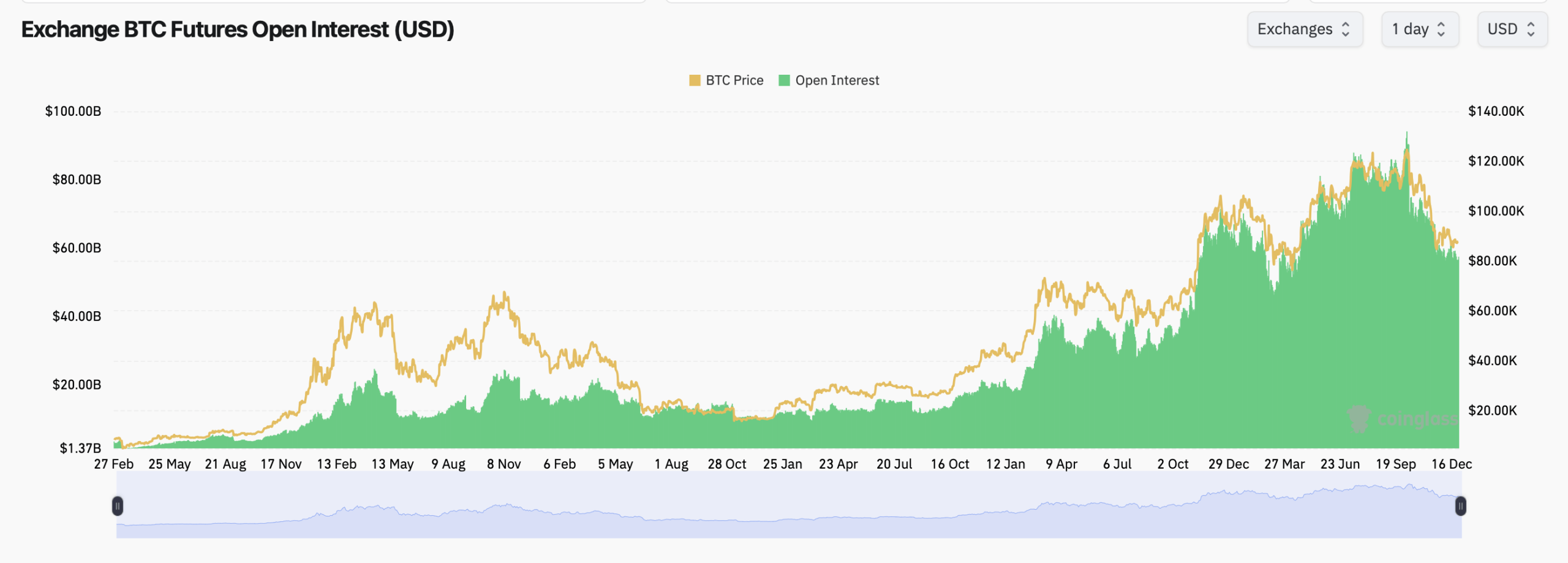

According to coinglass.com data, total open interest (OI) across bitcoin futures contracts stands at approximately $57.45 billion globally. This substantial exposure indicates that many traders retain confidence rather than rushing to liquidate positions. The measured growth of open interest suggests deliberate accumulation heading into year-end rather than frantic repositioning.

The CME exchange continues to be a pivotal hub for institutional bitcoin futures trading with around $9.87 billion in open interest—equivalent to roughly 112,380 BTC—making up about 17.18% of global totals. While alternative crypto exchanges dominate overall volume figures, CME’s significant share underscores ongoing institutional engagement as we approach 2026.

Other major crypto derivatives platforms paint a complementary picture: Binance leads with approximately $11.05 billion OI followed by Bybit at $5.26 billion and OKX near $3.23 billion respectively. Meanwhile, smaller venues like Kucoin and Bitget have experienced sharper percentage gains recently indicating more tactical adjustments over the past week.

The hourly and four-hour changes in open interest across these key exchanges remain moderate — implying prudent management of leverage instead of aggressive expansion — an important factor as liquidity conditions often shift entering a new calendar year.

Bullish Bias Evident in Bitcoin Options Despite Potential Pressure Points

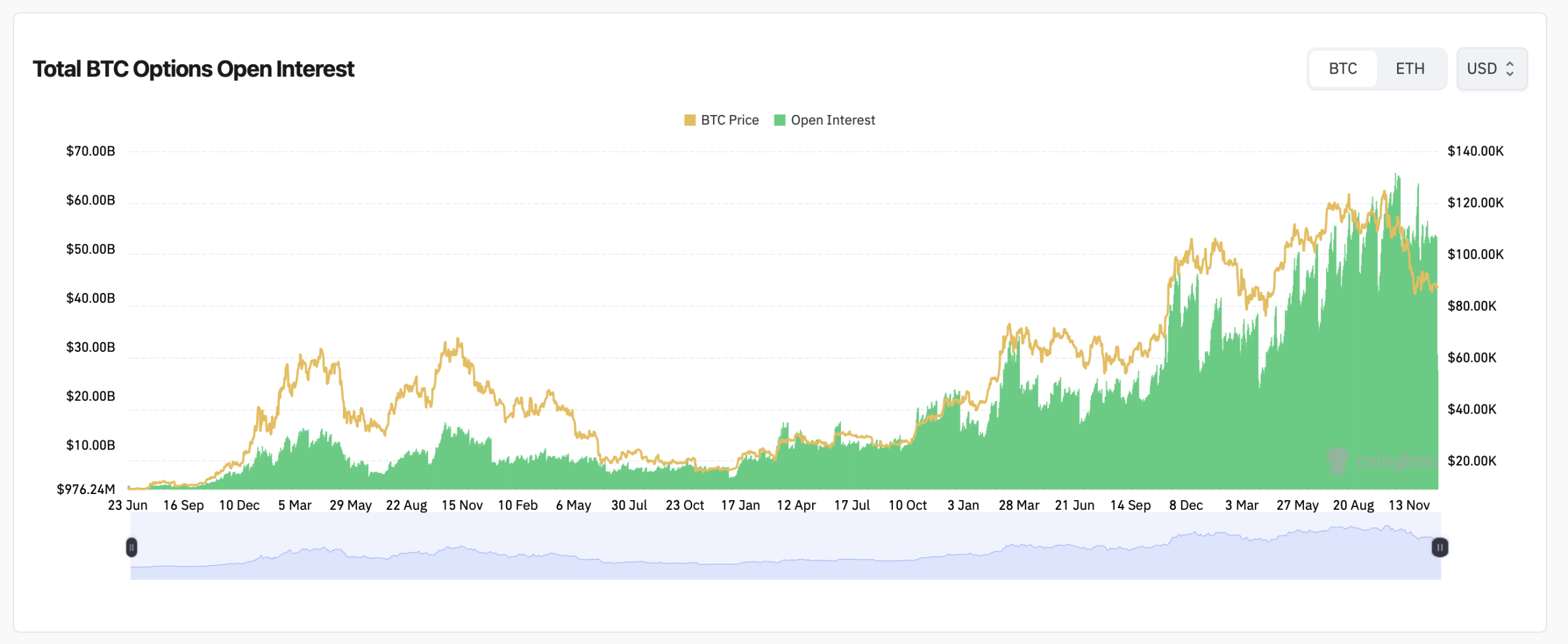

If futures demonstrate commitment levels among traders then options reveal their strategic intentions more clearly: total bitcoin options open interest is climbing steadily with calls outnumbering puts significantly.

Current figures from Coinglass show call contracts comprise about 56.‧83% of total options OI compared to puts at roughly 43.‧17%, signaling market participants favor upside exposure even while spot prices linger sideways.

This optimism extends into recent trading volumes where calls accounted for around 54.‧15% versus puts at approximately 45.‧.85%. Such distribution indicates active hedging but also directional bets leaning toward higher prices going into early next year — further insights emerge from CME’s robust options market data:

- A concentration exists on contracts expiring within one to three months along with meaningful buildup extending through three-to-six month expirations;

- This longer-dated positioning reflects expectations beyond short-term volatility toward macroeconomic shifts anticipated during early-2026;

- CME option positions balance calls against puts fairly evenly suggesting traders combine directional plays alongside structured risk mitigation rather than pursuing purely one-sided wagers;

- “Max pain”, or strike prices where most option holders stand to lose money upon expiry, tend toward ~$90K on Deribit while Binance shows similar zones just below current spot levels.;

The max pain thresholds often act like magnets during consolidation phases because they represent points where maximum option expirations become worthless—thus influencing price behavior around those levels significantly.

Bitcoin currently trades just beneath these critical ranges meaning derivatives markets seem poised either for decisive moves or continued stasis until expiration dates arrive.

Moreover, a long-term taker buy-sell ratio hovering near neutral across all exchanges reinforces an overarching theme: equilibrium prevails between buyers &sellers.

Recent readings suggest neither side dominates aggressively unlike previous bull or bear cycles seen historically—the current landscape features disciplined interaction over desperation-driven action.

This balanced environment aligns well with broader derivative trends showing active yet cautious position building ahead of upcoming milestones.

The Outlook As We Approach The New Year

When considering both bitcoin’s futures & amp ; nbsp ;options metrics collectively , it becomes clear that market participants are preparing strategically instead of reacting impulsively . Open Interest remains elevated , call volumes surpass put activity , & amp ; contract expiries cluster predominantly within Q I – Q II periods next year . Yet Max Pain indicators coupled with neutral trade flow ratios remind investors conviction must coexist alongside prudence .

Though spot pricing consolidates , underlying derivatives dynamics imply groundwork is being laid thoughtfully by professionals anticipating forthcoming opportunities rather than waiting passively .

Frequently Asked Questions ❓

What does Open Interest mean regarding bitcoin Futures ?

It quantifies outstanding unsettled future contracts ’ cumulative value held by market players .

Why do Call Options Outnumber Puts ?

This imbalance suggests bullish sentiment tempered by risk management measures among traders aiming higher but prepared against downside risks .

What Is Meant By Max Pain In Options Trading ?

Max Pain represents strike prices causing maximal loss upon expiry thereby influencing short term pricing tendencies due its gravitational pull effect during consolidation phases .

CME’s Role In Bitcoin Markets?

CME symbolizes regulated institutional participation offering transparency & credibility vital for mature derivative ecosystems involving cryptocurrencies.