Bitcoin is currently facing significant structural challenges as it continues to navigate a clearly defined corrective phase. The latest price movements indicate a sense of uncertainty and compression, rather than a continuation of any prevailing trend, implying that the market is awaiting a substantial catalyst for its next directional shift.

Technical Overview

Daily Chart Analysis

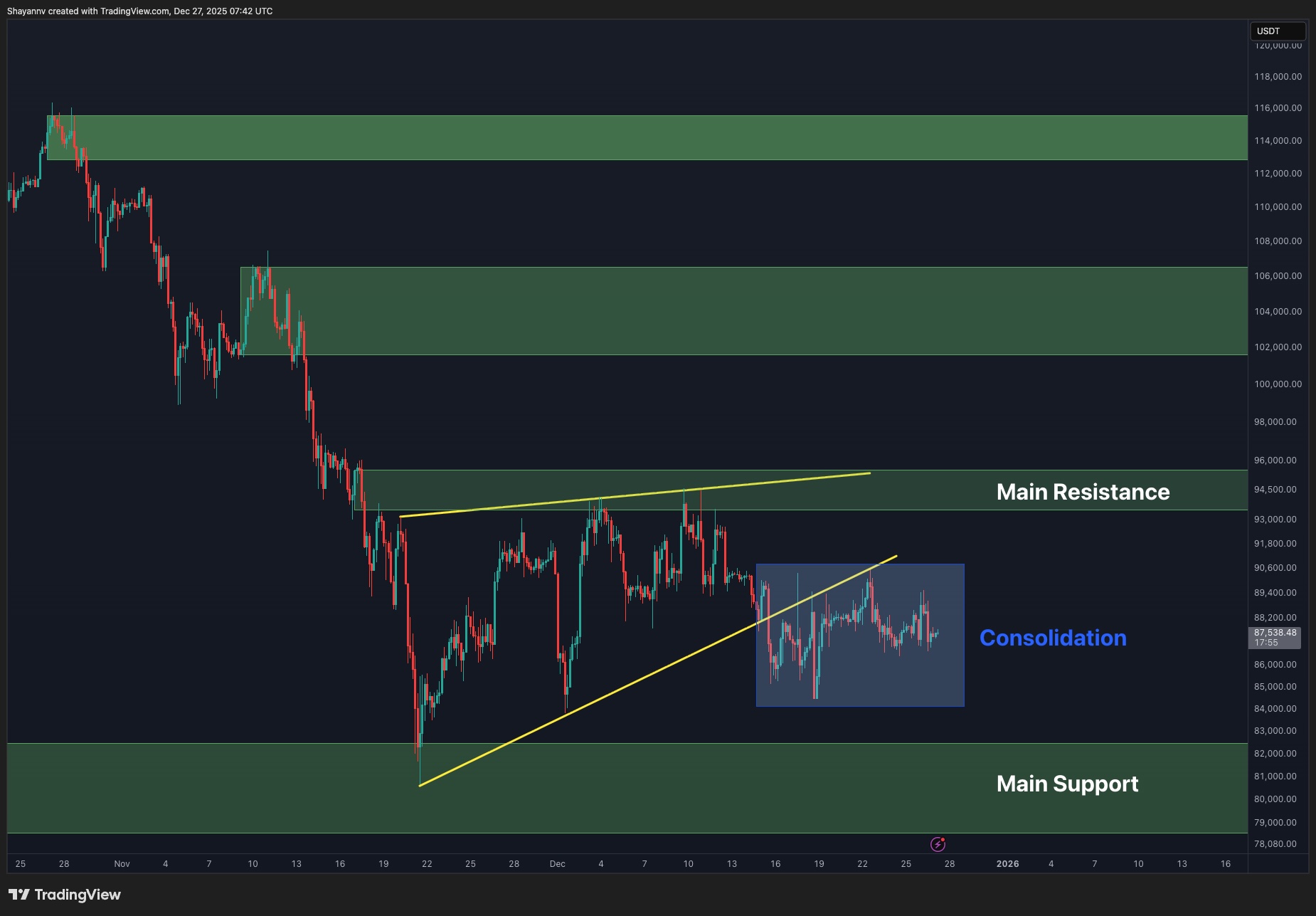

On the daily chart, Bitcoin remains within an overarching descending framework following its recent sharp decline. The price is currently trapped between a clearly marked demand zone ranging from $82K to $80K and major resistance situated around $95K to $96K. The consistent inability to reclaim mid-range resistance underscores ongoing sell-side dominance, while the formation of lower highs indicates that bullish momentum is notably weak.

The market now operates closer to the lower end of this range, where buyers have historically intervened to support prices. However, the lack of robust bullish movement from this area suggests that demand appears reactive rather than driven by initiative. As long as BTC trades below the $95K resistance level and maintains its downward trend structure, the overall bias remains neutral to bearish; consolidation or gradual declines are still anticipated.

4-Hour Chart Insights

The 4-hour chart offers clearer visibility into current market dynamics. Following an extended selloff, Bitcoin has been consolidating within a narrow range beneath an ascending short-term wedge and overhead resistance levels. This price behavior signifies equilibrium between buyers and sellers rather than accumulation since BTC consistently struggles to break higher with conviction.

Recent attempts at upward movement have been swiftly rejected, indicating persistent supply pressure during minor rallies. Conversely, selling pressure has eased near the $85K–$86K zone where short-term demand continues absorbing sell orders. This pattern suggests a range-bound environment where liquidity builds on both sides prior to potential expansion; if there’s a clean breakdown below this consolidation phase, it could lead towards the $82K demand zone while sustained recovery above short-term resistance would be necessary for shifting intraday sentiment toward bullishness.

Until such decisive breakout occurs though, expectations lean towards continued erratic price action driven by liquidity instead of establishing clear trends.

Market Sentiment Analysis

The average order size data in futures trading reveals noticeable changes in market participation patterns—recent activity shows increasing dominance from smaller traders as prices fluctuate below recent peaks. This shift is evidenced by rising retail-sized orders while larger whale activities have significantly diminished; such behavior typically indicates late-stage participation wherein smaller traders become more active after major directional shifts have already occurred.

Durring earlier bullish phases larger order sizes were more prevalent which suggested stronger institutional or whale involvement propelling price increases forward; however today’s landscape reflects an absence of sustained large orders indicating smart money may either be on pause or adopting defensive strategies instead . Without consistent influxes from whale-sized orders , upside momentum tends weaken leaving prices susceptible volatility alongside downward pressures .

The prevalence of retail-sized futures orders at current pricing reinforces concerns regarding whether recent rebounds possess sufficient backing from larger players’ convictions . Historically speaking , imbalances like these often precede prolonged consolidations or further corrections since rallies led predominantly by retail struggle against overhead supply . Unless there’s clear resurgence among large order activities emerging soon , on-chain structures will likely continue aligning with cautious-to-bearish outlooks for Bitcoin in near term future