Bitcoin has recently dipped beneath a significant Fibonacci threshold, yet the emergence of a Golden Cross hints at a possible upward turnaround.

Over the past day, Bitcoin (BTC) has declined by 2.3%, currently valued around $90,230. During this timeframe, its price oscillated between $89,623.50 and $94,177.16. The leading cryptocurrency has also experienced a 3.5% drop over the last seven days. When looking at its monthly performance, Bitcoin shows a decrease of 14.1%, while on an annual scale it remains down by approximately 8%.

Considering recent market movements and overall sentiment, Bitcoin encounters strong resistance near the $94,000 level; meanwhile, immediate support appears to be around $89,600.

The market’s response to the Federal Reserve’s latest interest rate reduction indicates that investors remain cautious—Bitcoin and other digital assets have struggled to gain momentum despite accommodative macroeconomic policies. As BTC continues trading within this range-bound environment, it is uncertain whether it will hold firm or face additional downward pressure.

Can Bitcoin Hold Its Ground?

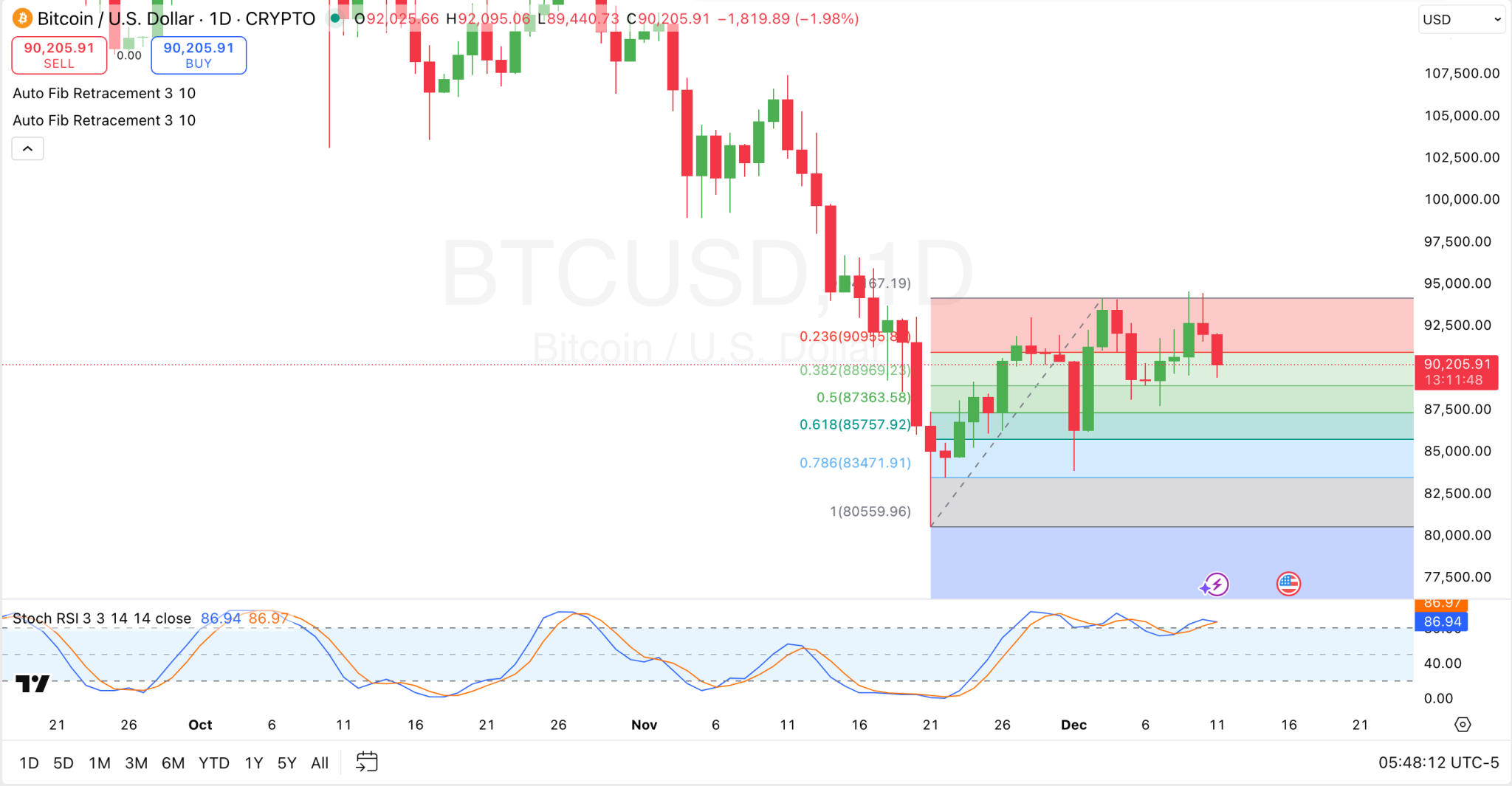

Currently testing crucial Fibonacci retracement points that previously acted as support or resistance zones,

Bitcoin recently slipped below the 0.236 retracement level set at about $90,960—a key short-term support area.

The next potential safety net lies near the 0.382 Fibonacci mark at roughly $88,969.

If these levels fail to sustain BTC’s price action further declines could push prices toward the half-way point on this scale—around $87,364—which serves as another critical floor.

The Stochastic RSI indicator reading close to 86.94 suggests waning bullish momentum for Bitcoin,

implying that consolidation or cooling off may precede any meaningful rally upward.

If BTC closes below that initial retracement zone (0.236), then attention shifts toward stronger support near $85,758 (the 0.618 level). Conversely, breaking back above this threshold could propel prices higher beyond resistance around $94,000.

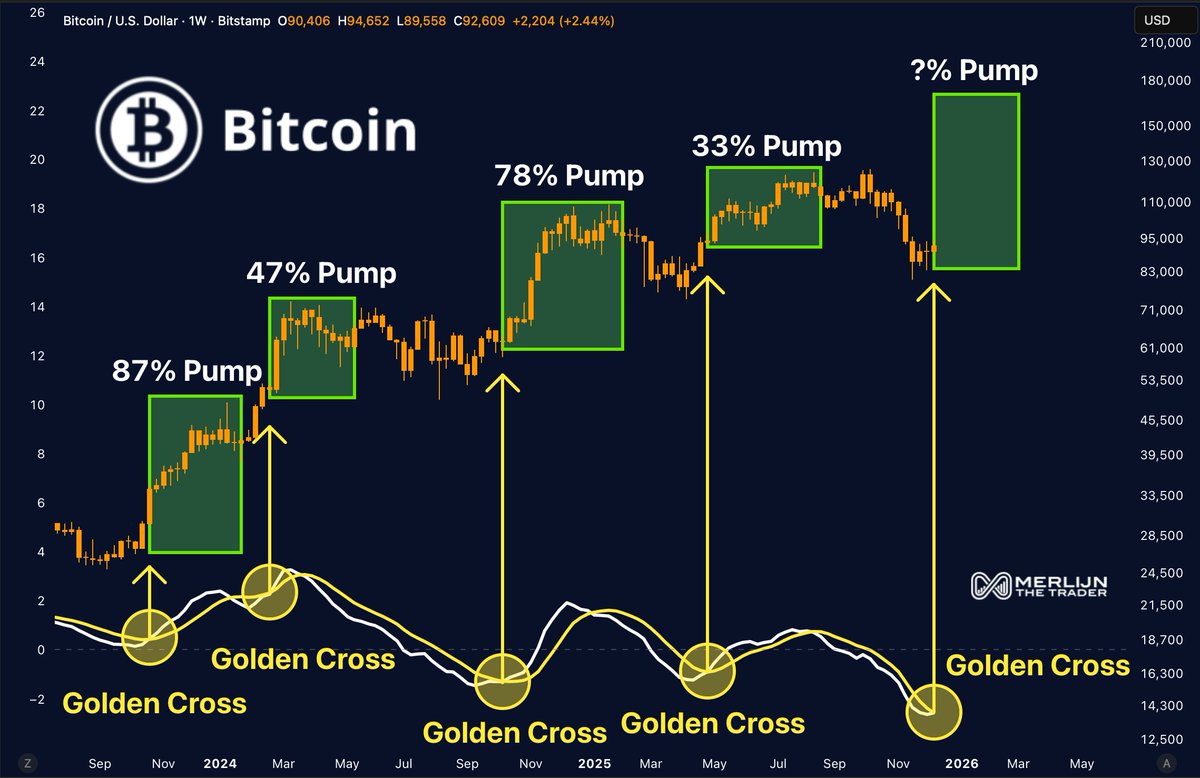

A Fifth Golden Cross Signals Potential Surge

In related news, analyst Merlijn The Trader has pointed out that Bitcoin just triggered its fifth Golden Cross event.

Historically, each previous occurrence led to substantial rallies, with gains recorded at approximately +87%, +47%, +78%, and +33% respectively following those signals.

The analyst describes this current formation as “louder than ever”, suggesting an imminent breakout scenario.

Despite skepticism among some investors, This technical pattern strongly indicates further upside potential for BTC, towards targets exceeding $170,000. A rise from today’s ~$90,230 valuation would represent an approximate increase of ∞∞∞%.88.3%;