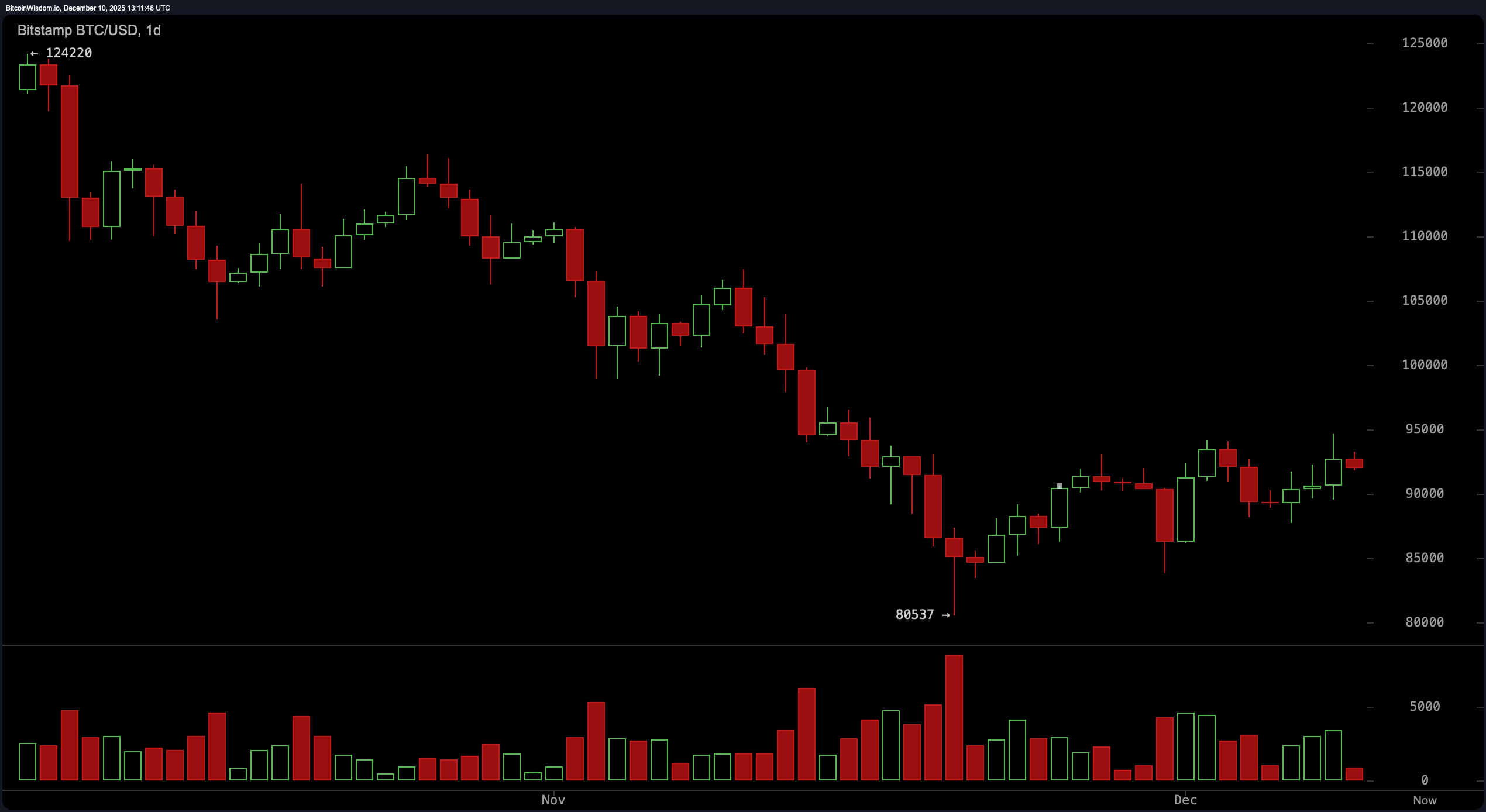

Bitcoin recently paused just under the $95,000 threshold following a dramatic surge from its earlier low of $80,537 this month. The cryptocurrency has been oscillating tightly between $90,000 and $94,000, leaving investors anxious and closely analyzing every market movement. With trading volumes diminishing and technical signals offering conflicting messages, the immediate future looks anything but predictable.

Technical Analysis of Bitcoin’s Price Movement

The 1-hour chart on Wednesday reveals a mix of enthusiasm and weariness. After an explosive climb that reached as high as $94,652, Bitcoin’s price has settled into a consolidation phase between $92,000 and $93,000. Trading volume has notably decreased after the initial excitement subsided—suggesting traders are taking a moment to regroup.

Chart analysts might identify patterns such as a bullish flag or an ascending triangle forming. A decisive move above $93,500 accompanied by increased volume could trigger another upward push. Conversely, if prices fall below the support level near $91,000, this optimistic outlook may falter temporarily.

Examining the 4-hour timeframe shows Bitcoin’s rebound from approximately $83,814 to recent highs resembling a double bottom pattern in formation. Currently trapped within the range of roughly $91K to just under $94K levels—it appears to be digesting gains cautiously like an athlete replenishing energy mid-race. Initial surges saw significant volume spikes indicating strong interest; however since then trading activity has tapered off suggesting momentum is being carefully reassessed by participants.

A convincing break above around$94{,&}500 would reinforce bullish sentiment strongly while dropping below about$90{,&}500 could send momentum seekers back into reevaluation mode.

On daily charts looking at broader trends: Bitcoin seems to be recovering slowly after falling sharply from highs near$124{,&}000 down toward lows close to$80{,&}537 earlier this year/month (depending on context). Current price action displays classic signs of uncertainty with small-bodied candles featuring indecisive wicks signaling bearish-to-neutral sentiment among traders.

The rally brought heightened volumes initially but now these numbers are tapering off hinting at either pause or mild retracement ahead; attention remains fixed firmly upon resistance near$95{,&}000—breaking through decisively here might renew buying confidence whereas slipping beneath around$90{,&}000 risks further declines possibly targeting levels closer toward$85{,&}000 or lower still.

Diving into oscillator readings provides additional nuance: The Relative Strength Index (RSI) hovers neutrally at about48 while Stochastic Oscillator stands modestly elevated near75—both implying no extreme conditions currently dominate market psychology.

The Commodity Channel Index (CCI) rests around92 straddling neutral territory.

Average Directional Index (ADX) measures29 confirming indecision in trend strength.

Meanwhile Awesome Oscillator dips slightly negative (-2052), Momentum indicator signals caution (+1658), and MACD lingers marginally below zero (-1529), subtly hinting potential for upward moves despite mixed overall signals.

Moving averages paint divided perspectives reminiscent of spirited holiday debates:

Short-term averages like EMA(10) positioned at roughly91,{&}035 & SMA(10) near90,{&}755 lend support for current pricing action.

EMA(20)/SMA(20) continue encouraging optimism.

However longer-term indicators including EMA/SMA50 plus especially100 &200-day moving averages trend downward reflecting residual bearish pressure lingering from previous downturns—the200-day SMA notably distant at108,{&}939 serving as reminder that recovery isn’t fully secured yet.

Taken together these factors suggest bitcoin is precariously balanced in short term —oscillators along with shorter moving averages whisper promise but extended trendlines remain skeptical.

The crucial resistance level sitting just shy of95,{&}000 acts like velvet rope separating tentative rallies from sustained advances.

Traders must vigilantly monitor price behavior alongside sudden shifts in volume plus any unforeseen macroeconomic developments because volatility reigns supreme not only over prices but also opinions within crypto markets alike.

Bullish Perspective:

If bitcoin manages to break convincingly beyond95,{&}000 supported by strong trading volumes technical indicators align favorably for continued upside potential.

Short-term formations lean positive while supportive moving average structures imply foundation already laid out —this breakout scenario could mark more than mere noise potentially ushering next phase in bitcoin’s resurgence story.

Bearish Perspective:

A decline beneath90,{&}000 coupled with weakening volumes might signal early exhaustion warning flags flashing across market landscape.

Given mid-to-long term averages remain well above current valuations combined with faltering momentum metrics deeper pullbacks cannot be ruled out yet.—Bears have not exited stage merely biding time awaiting opportunity triggered by missteps ahead.

Frequently Asked Questions ❓

Where is bitcoin currently trading? Bitcoin is priced around92,{&;}026 fluctuating narrowly within intraday ranges presently available on exchanges.

Is bitcoin breaking out or consolidating? Technical analysis indicates consolidation occurring just beneath critical resistance level set close to95,{&;}000 dollars .

Which indicators do traders focus on? Key tools include Relative Strength Index(RSI), Moving Average Convergence Divergence(MACD), alongside monitoring trade volume trends closely .

What's global sentiment surrounding bitcoin?   ; Market mood remains cautiously optimistic featuring robust short-term momentum tempered against persistent long-range hurdles .