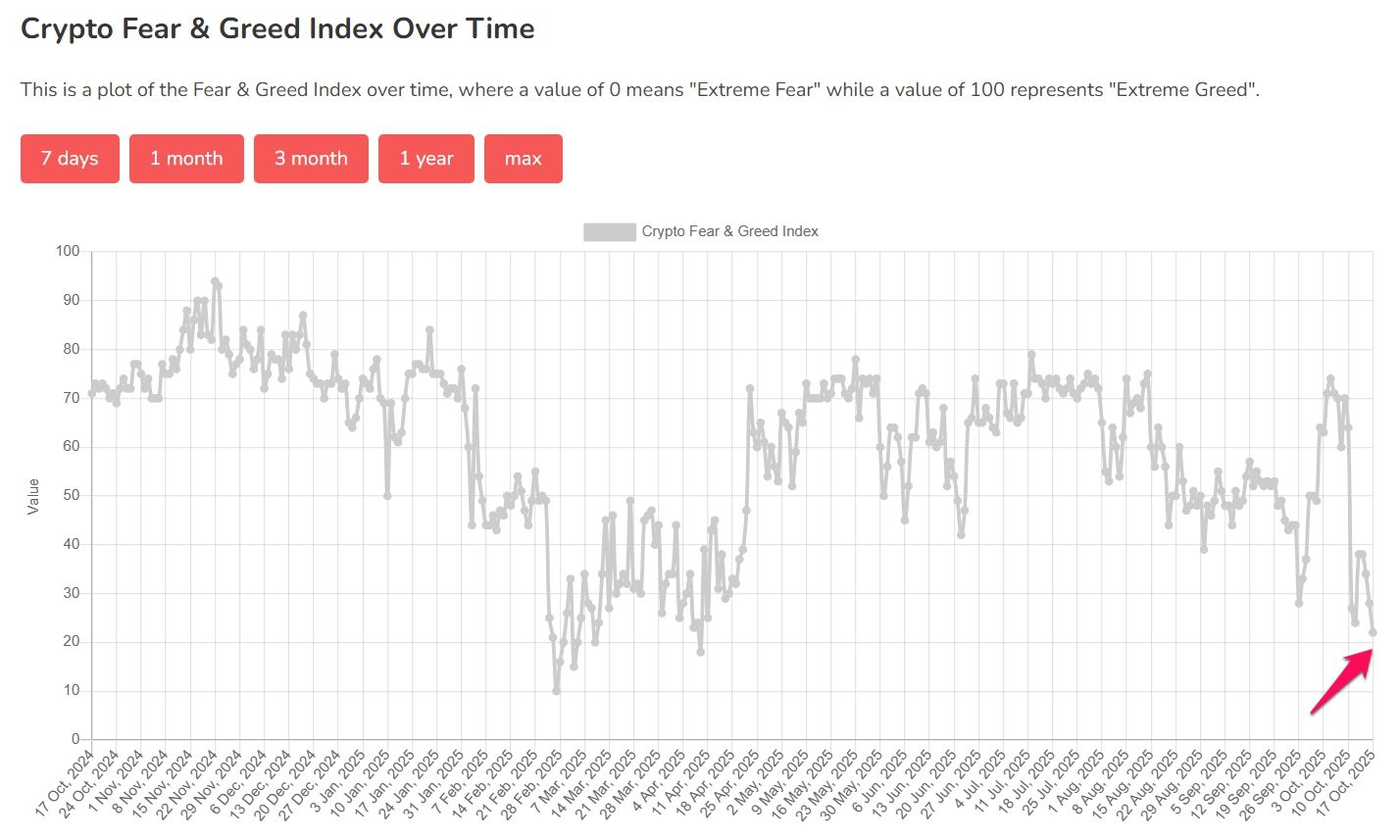

On October 17, 2025, the Crypto Fear & Greed Index dropped dramatically to a mere 22 points, indicating a phase of “extreme fear”—the lowest point since April.

What implications does this have for the market? Historical trends and expert opinions may provide some insight.

Is October an Opportunity to Be Bold Amidst Others’ Anxiety?

The Fear & Greed Index is derived from various elements: price volatility (25%), market momentum/trading volume (25%), social media sentiment (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends data (10%).

A score below 25 often signifies heightened fear, potentially presenting buying opportunities. However, it also cautions about possible further declines.

According to alternative.me’s data, the index nosedived from a previous high of 71 just days before—a rapid change in investor outlook within such a short period.

Crypto Fear & Greed Index. Source: alternative.me

The last occurrence of such low levels was in April when it aligned with a significant market trough. That downturn was succeeded by an impressive recovery where Bitcoin surged over 70% during the following six months.

Analyst Ted observed that Binance’s funding rate for Bitcoin recently turned negative—indicating that traders with short positions are now paying fees to those holding long positions.

Bitcoin Funding Rate on Binance. Source: CryptoQuant

This signal has historically marked market bottoms followed by robust rallies—a pattern evident in mid-2025 as well.

“Historically speaking, this often leads to bottoming out and subsequent rallies,” remarked Ted. “Will history repeat itself?”

This October Seems Unusual

The prevailing fear isn’t confined solely to crypto markets but has permeated into broader stock markets too.

JUST IN 🚨 Extreme Fear hits Stock Market after six months 👻😱🫂 Brace yourselves!!! pic.twitter.com/EoJzhxcxMz

&mdash Barchart (@Barchart) October16,

&mdash Barchart (@Barchart)October16,

This pessimistic sentiment likely mirrors larger macroeconomic concerns including geopolitical tensions arising from President Trump’s trade policies towards China alongside recessionary fears linked with recent Federal Reserve interest rate decisions.This pessimistic sentiment likely mirrors larger macroeconomic concerns including geopolitical tensions arising from President Trump’s trade policies towards China alongside recessionary fears linked with recent Federal Reserve interest rate decisions.

Despite these challenges Dr André Dragosch PhD Head Research Bitwise expressed optimism regarding Bitcoin’s resilience:”Remember we’ve already witnessed substantial capitulation within cryptoasset sentiments it’s TradFi sentiments catching up downside hence why bitcoin remains relatively resilient amidst turmoil once again serving canary macro coalmine.” Dr André Dragosch noted.Dr André Dragosch noted.

Historical patterns coupled comments underscore potential store value during periods anxiety suggesting opportunity investors establish positions attractive levels however strategy being bold amidst others’ anxiety might backfire should persist deepen overtime despite hopes “Uptober” month historically yields strong returns analysts caution shaping fourth-worst year creation gains under19% thus far.