The narrative is becoming all too common for cryptocurrency enthusiasts: while gold and silver continue to set new records, digital currencies are experiencing a sharp decline this Thursday.

Bitcoin has plummeted approximately 2% in the last hour, settling at $108,800. This drop essentially erases its recovery from last Friday’s downturn. Other cryptocurrencies are facing even steeper declines; Ethereum, XRP, and Solana have each fallen around 3% within the past sixty minutes.

In contrast, precious metals remain highly sought after. Gold has climbed another 2%, reaching just below $4,300 per ounce—a new record high. Silver is also up by 3.6%, marking its own record peak.

What’s Happening?

You might be wondering why Bitcoin and other major tokens are under pressure following last week’s much-needed reduction of excess leverage.

The likely reason is the tightening liquidity in financial markets that appears to be dampening investors’ willingness to take risks.

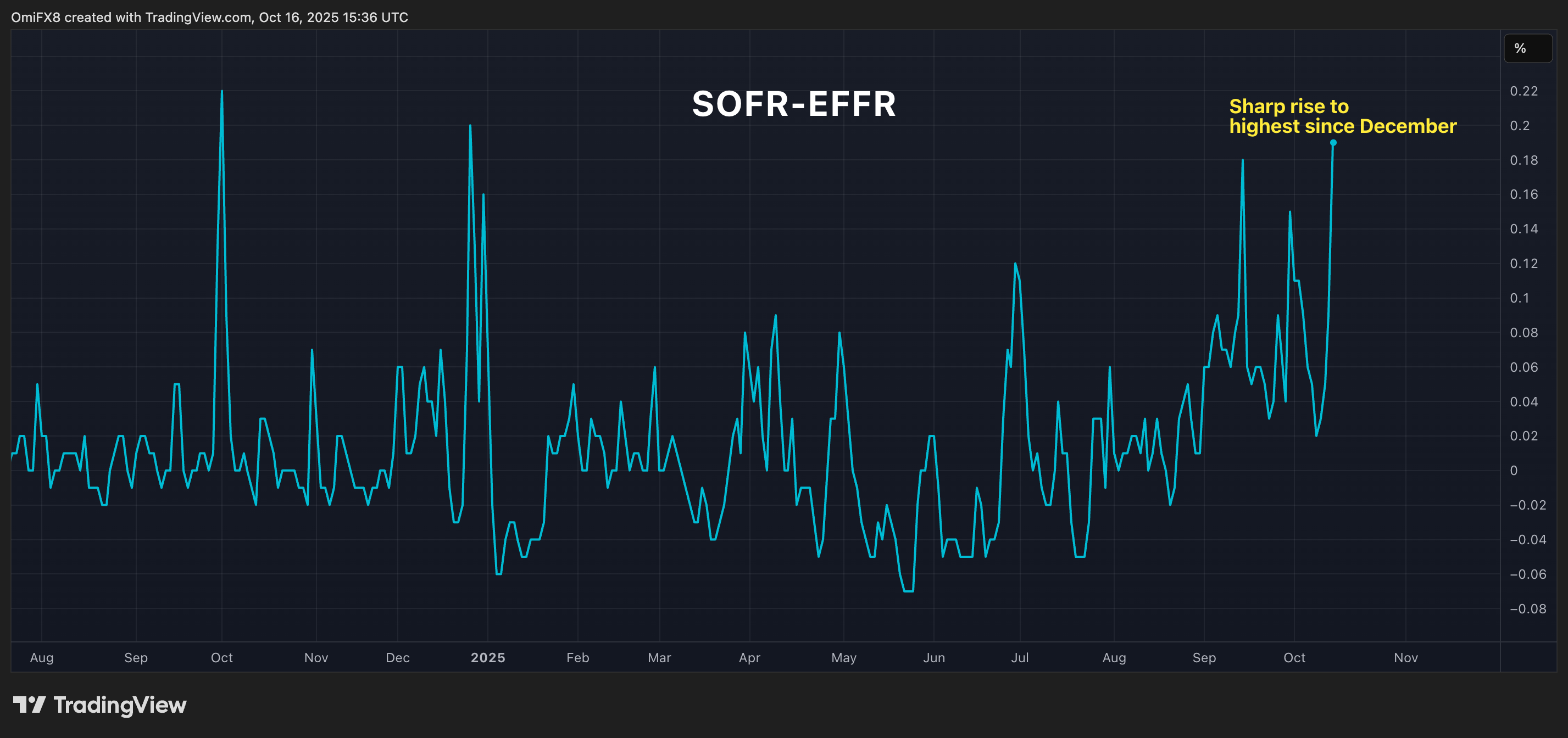

This tightening can be observed through the widening gap between the Secured Overnight Financing Rate (SOFR) and the Effective Federal Funds Rate (EFFR). Over one week, this spread has increased from 0.02 to 0.19—the highest level since December 2024—according to TradingView data.

SOFR reflects the cost of borrowing cash overnight using U.S. Treasury securities as collateral in repurchase agreements (repos). Typically utilized by banks, broker-dealers, asset managers, money market funds, and insurance companies; SOFR is considered an almost risk-free rate based on actual transaction data.

Conversely,EFFR represents an average interest rate at which banks lend excess reserves overnight within federal funds markets without collateral or security—primarily influenced by Federal Reserve monetary policy decisions.

SOFR-EFFR spread.

When SOFR surpasses EFFR levels,it indicates lenders demand higher returns even for secured loans backed by U.S.Treasury securities—a signifier indicating tight liquidity conditions resulting in more expensive short-term borrowing costs.

The recent surge within spreads may limit gains seen with BTC—which many consider purely reliant upon available liquid assets.

It’s worth noting that current spreads remain significantly lower than those witnessed during September’s repo crisis back when rates hit highs nearing three percent.

However,further indications point towards additional funding stressors present today.On Wednesday alone,banks accessed over six billion dollars via standing repo facilities(SRF)—marking their largest drawdown since COVID-19 pandemic excluding quarter-end periods.

Introduced during early stages throughout year twenty-one,this facility offers crucial backstops amidst potential fund shortages providing twice-daily overnight cash advances against US Treasuries.All these signs indicate central bank intervention might soon alleviate pressures potentially reigniting bullish sentiment among crypto enthusiasts hoping renewed rallies will propel BTC prices higher once again.Yet,whether such expectations materialize remains uncertain amid evolving economic landscapes worldwide…