The cryptocurrency market experienced significant downturns on Tuesday, yet some optimism emerged as the Federal Reserve’s actions provided a cushion for prices. A late-day post by President Trump on Truth Social served as a reminder to investors that he holds the ability to influence asset prices positively at any moment.

Bitcoin saw its value drop to $109,800 during early trading hours in the U.S., following an overnight descent from nearly $116,000. It later recovered slightly to $112,600, marking a 2.8% decrease over 24 hours. Ether faced a 4% decline while BNB, XRP, and Dogecoin fell between 4% and 6%. The CoinDesk 20 Index also registered a fall of 3.2%.

Stability returned somewhat after Fed Chair Jerome Powell indicated that the central bank is approaching the conclusion of its quantitative tightening (QT) phase—an effort aimed at reducing bond holdings. He highlighted signs of cooling in both employment markets and money markets’ liquidity constraints which could signal another interest rate cut soon.

U.S. stock indices reacted sharply with Nasdaq and S&P 500 reversing initial losses briefly before closing down by about 0.75% and just under half-a-percent respectively.

A portion of gains made earlier was wiped out when President Trump suggested imposing restrictions on Chinese cooking oil imports unless China increases soybean purchases from America via Truth Social late into trading sessions causing ripples across both crypto assets & equitiy sectors alike.

Continued Interest in Crypto Mining Stocks

The surge continued for crypto mining companies as they remain attractive investments due largely because rising demand driven through artificial intelligence (AI). Companies like Bitfarms (BITF), Cleanspark (CLSK), Iren (IREN), Marathon Digital Holdings Inc.(MARA) along with TeraWulf Inc.(WULF) all saw their shares jump more than ten percent throughout Tuesday’s trade period.

A Shift Towards Bitcoin Accumulation Amid Leverage Reset

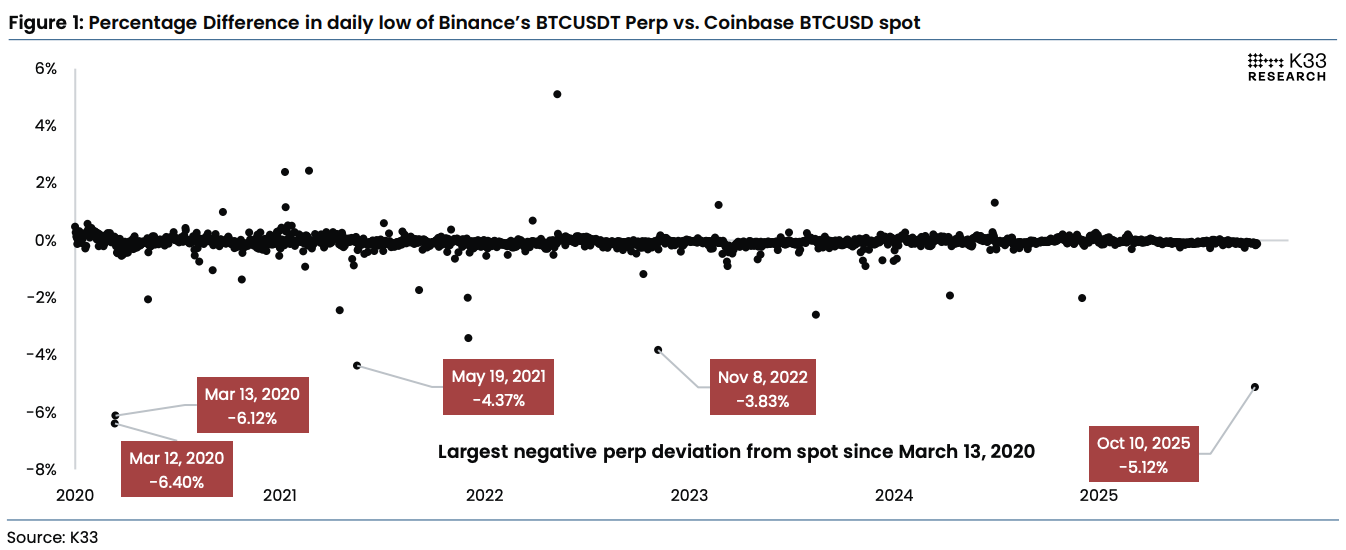

The recovery following last week’s abrupt market crash seemed less robust come Tuesday but according Vetle Lunde who heads research at K33 believes this dip presents opportunity given how bitcoin has found stability post-major leverage adjustment.

“Post-recent leverage clear-out we are cautiously optimistic regarding BTC albeit patience remains crucial,” Lunde wrote noting thin liquidity persists short-term due trader recuperation efforts however historically similar scenarios have often signaled bottoming out within markets.

Price deviation between Binance’s BTC perpetual swaps and Coinbase spot prices K33)

Price deviation between Binance’s BTC perpetual swaps and Coinbase spot prices K33)

“This current level appears enticing enough now consider increasing exposure towards spot BTC since excessive leveraging cleared dramatically,” Lunde stated further citing supportive macroeconomic environment including expectations around expansionary policies coupled alongside heightened institutional interest pending ETF catalysts favor gradual accumulation strategies going forward.”