This weekend marks a significant milestone in Bitcoin’s journey with the anticipated launch of Bitcoin Core version 30 (v30), sparking heated debates within the community.

Despite circulating rumors about potential plans for a hard fork, the likelihood of Bitcoin undergoing a blockchain split remains extremely low, though technically feasible.

If an unexpected chain fork were to occur, the influence of spot exchange-traded fund (ETF) sponsors in determining which chain retains the “Bitcoin” name and BTC ticker is often overlooked and misunderstood.

Documents filed for US-based BTC spot ETFs indicate that their sponsors have the authority to decide which Bitcoin fork they consider legitimate if a hard fork takes place.

This approach challenges traditional practices where miners or node operators typically select the valid Bitcoin chain based on processing power dominance.

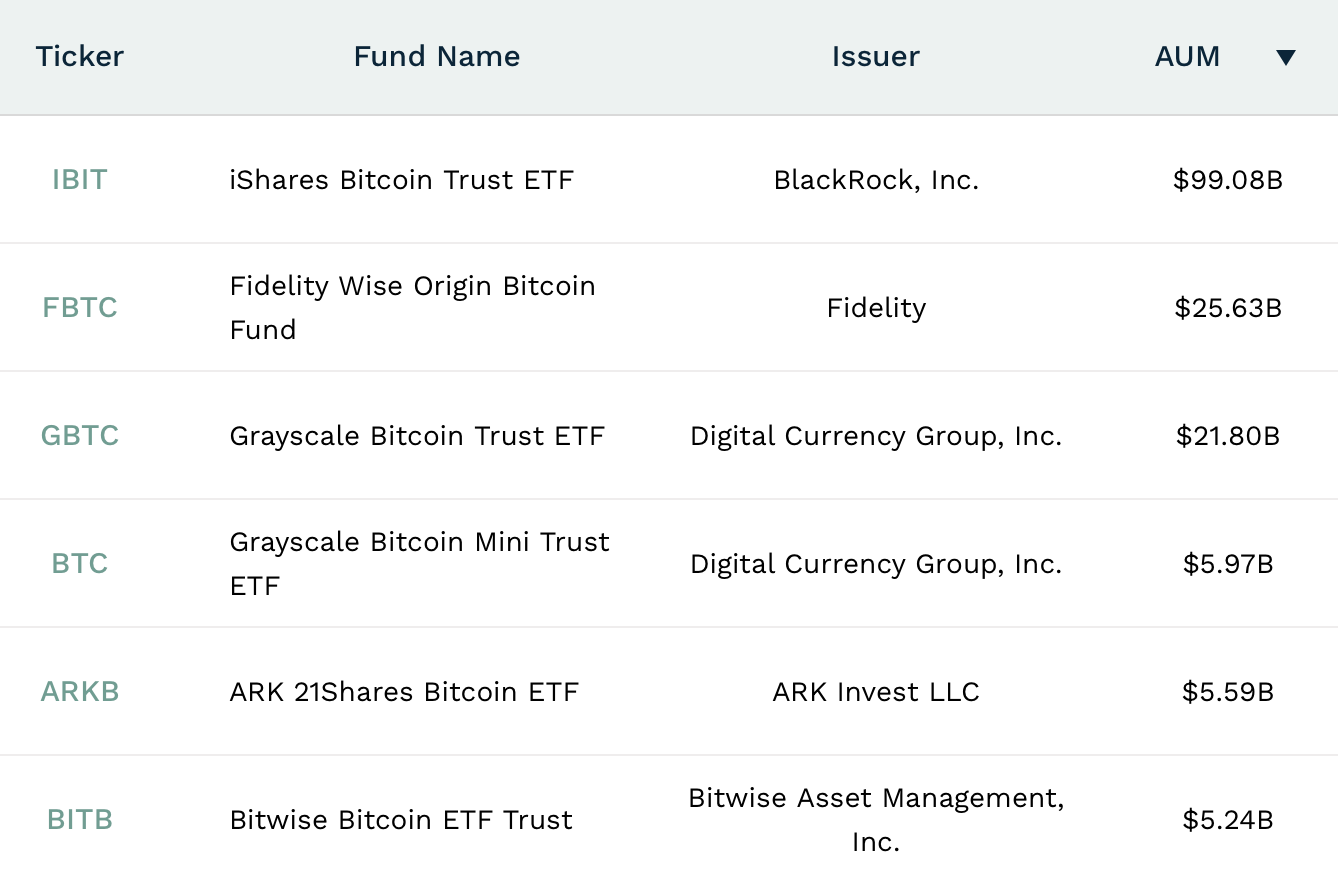

The largest spot bitcoin ETFs. (Source: ETF.com)

The Authority to Define ‘Bitcoin’

BlackRock’s $87 billion IBIT prospectus clearly states that in case of a hard fork, “the Sponsor shall determine which network shall constitute the Bitcoin network and which asset shall constitute bitcoin according to the Trust Agreement.”

Moreover, Blackrock acknowledges it might not choose what appears as most valuable. Their legal disclaimer notes there is no assurance that they will select what seems like “the most valuable” BTC network.

The Bitwise spot bitcoin ETF prospectus echoes this sentiment. It states that “the sponsor will promptly make an informed decision regarding which digital asset network is recognized by the community as ‘Bitcoin’ and identify any ‘forked’ networks.”

ARK Investment Management advises investors not to assume support for newly-forked assets unless explicitly announced by them as eligible for inclusion in their Trust holdings.

Sponsors’ Discretion Over Forks