Amidst a significant decline in the US dollar, both precious metals and Bitcoin (BTC) are reaching unprecedented levels, paralleling the rise of risk assets such as stocks. This trend is indicative of a substantial macroeconomic transformation, as highlighted by market experts from The Kobeissi Letter.

The S&P 500 index has surged over 40% in the past half-year. Meanwhile, BTC recently soared to an all-time high exceeding $125,000 on Saturday. Gold is also experiencing record highs at $3,880 per ounce as of this writing and approaching $4,000.

Analysts noted that the correlation coefficient between gold and the S&P 500 hit an unprecedented 0.91 in 2024. This unusual alignment between traditionally safe assets and riskier ones suggests markets are adapting to a “new monetary policy.” They further explained:

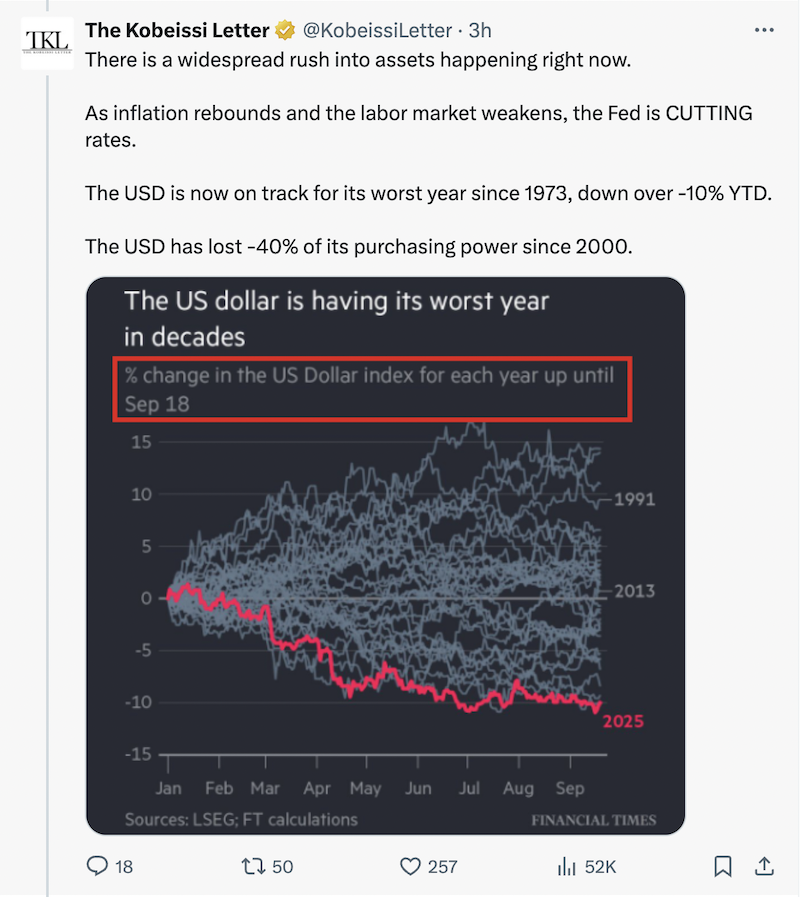

“There’s currently a widespread shift towards asset acquisition. With inflation rebounding and labor markets weakening, interest rates are being reduced by the Federal Reserve. The USD is poised for its worst performance since 1973 with over a 10% drop year-to-date. Since 2000, it has lost around 40% of its purchasing power.”

Source: The Kobeissi Letter

This analysis coincides with several factors: a US government shutdown leading to major downward revisions in job statistics indicating labor market weakness, interest rate reductions, and mounting concerns about dollar depreciation—all serving as positive price drivers for BTC.

Related: Bitcoin corrects from $125K all-time high: Where will BTC price bottom?

Experts attribute new BTC peak to economic conditions

The recent surge of BTC can be attributed largely to macroeconomic influences like the recent US government shutdown according to Fabian Dori from global digital asset bank Sygnum.

This shutdown began on Wednesday resulting in either complete closure or minimal operation budgets/staffing at regulatory bodies due entirely political dysfunction which has reignited investor confidence towards using cryptocurrencies like Bitcoin as reliable stores-of-value amidst waning trust within traditional institutions he shared with Cointelegraph.

Bitcoin continues hitting new peaks entering bull territory. Source: ••TradingView