The U.S. government faces a potential shutdown at midnight if Republicans and Democrats fail to reach a budget agreement.

Bitcoin Declines Amidst U.S. Political Standoff

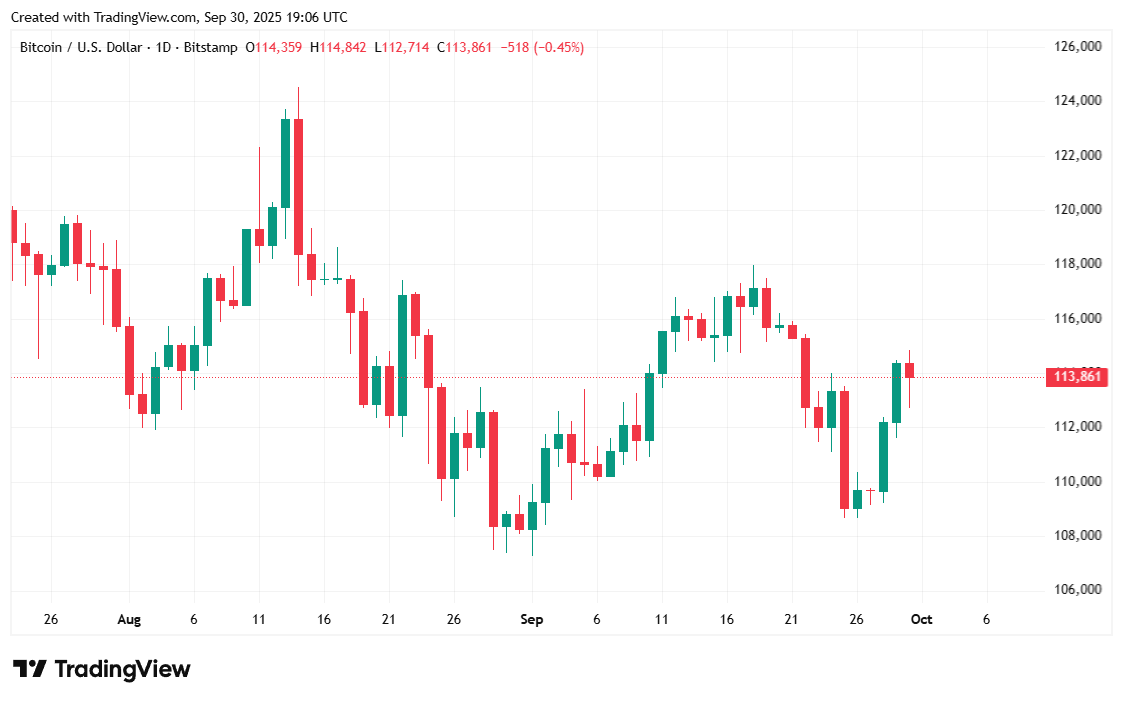

On Tuesday, the fiscal future of the United States became a battleground as Republicans and Democrats clashed with no resolution in sight. With only hours left before the deadline to approve a spending bill, financial markets took a hit, leading to bitcoin’s drop below $114K following its brief rally on Monday.

Despite holding majorities in both congressional chambers, Republicans could not secure Senate approval for their temporary funding proposal after it passed in the House; it fell short by 60 votes. Meanwhile, Democrats introduced their own legislation seeking an extension of health insurance tax credits and reversing Medicaid cuts made earlier by Trump’s administration. This proposal also failed in the Senate.

The blame game is now underway between both parties over this deadlock which could lead to what would be the fifteenth government shutdown since 1980 if unresolved by midnight. Such an event might leave millions of federal employees unpaid and disrupt numerous governmental services and programs—a scenario reminiscent of 2018’s shutdown during Trump’s presidency that lasted 35 days with $3 billion lost economically—causing bearish trends for bitcoin and stocks alike on Tuesday.

“Senate Democrats have two clear options,” stated John Thune, U.S. Senate Majority Leader on Tuesday afternoon: “They can vote for this straightforward continuing resolution keeping our government operational—as they did thirteen times under Biden—or choose closure.”

Market Metrics Summary

As per Coinmarketcap data at press time, Bitcoin stood at $113,922.15 reflecting a minor decline of -0.13% from yesterday but marking an increase of +1.83% compared to last week. Over past day trading range was between $112740.56-$114836.62

(BTC price / Trading View)

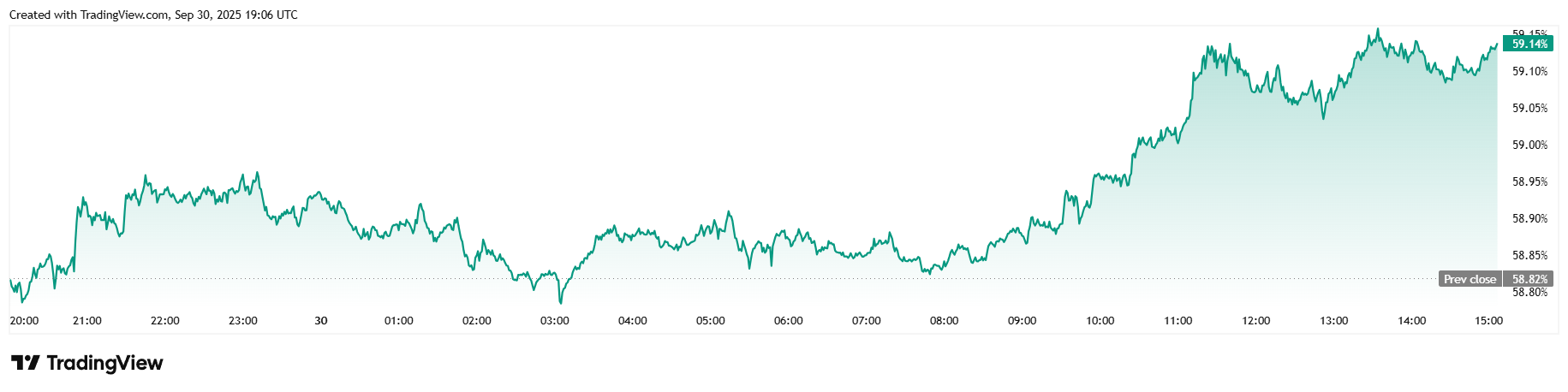

The daily trading volume saw slight reduction down -4.1% totaling $57˙86 billion while market cap experienced marginal dip -0.2&% aligning with pricing trends;, Bitcoin dominance increased + 0.\51% reaching &59.\14%

(BTC dominance / Trading View)

Total open interest concerning Bitcoin futures dropped by −\31\19% standing at \80\25 billion today according Coinglass figures;. Liquidations summed up \47\65 million within twenty-four hour period including shorts amounting \29\43 million leaving longs covering remaining \18\.22 million