This month, Bitcoin’s underwhelming price movement has stirred a wave of pessimism among institutional investors, raising concerns that the digital currency might end September on a negative note.

Additionally, data from blockchain analysis shows a reduction in miner accumulation, adding further pressure to the already struggling cryptocurrency.

ETF Withdrawals and Miner Liquidation May Drive Bitcoin Down

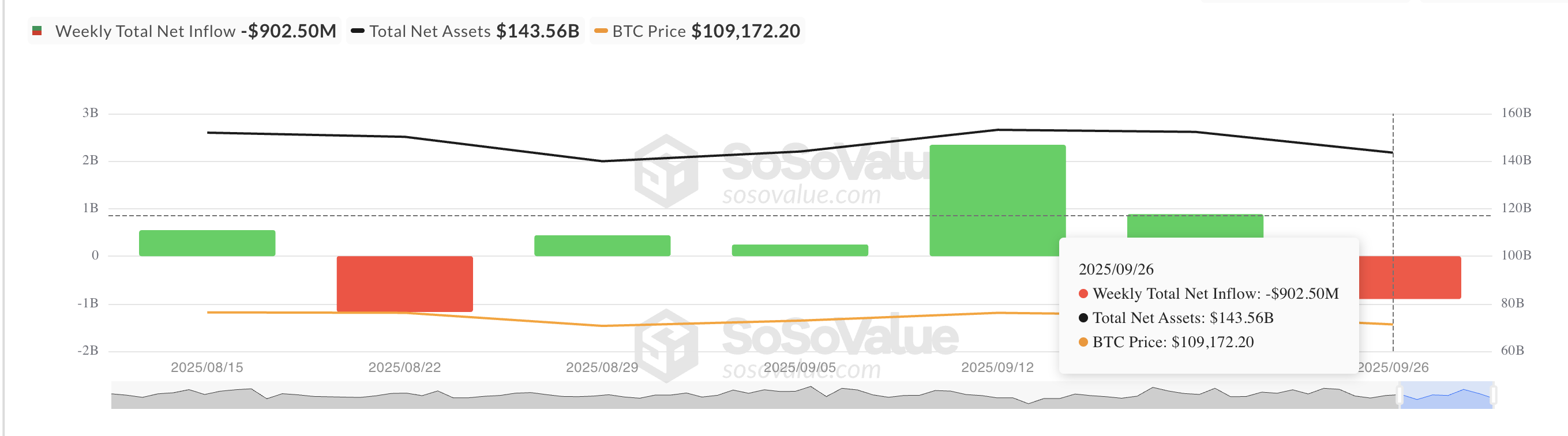

The continuous withdrawal of funds from spot BTC exchange-traded funds (ETFs) indicates diminishing interest from institutional players. As reported by Sosovalue, capital outflows from these ETFs between September 22 and 26 amounted to $903 million, highlighting a significant retreat of investment.

For more insights into token trends and market updates: Interested in receiving similar insights? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

The historical relationship between ETF movements and BTC prices has been strong. Back in July, the cryptocurrency soared past $120,000 due to monthly inflows surpassing $5 billion into ETFs. The current trend of outflows presents a stark contrast and suggests that mid-year institutional enthusiasm may be waning. This scenario places Bitcoin at risk for further declines if large-scale investors continue withdrawing their funds.

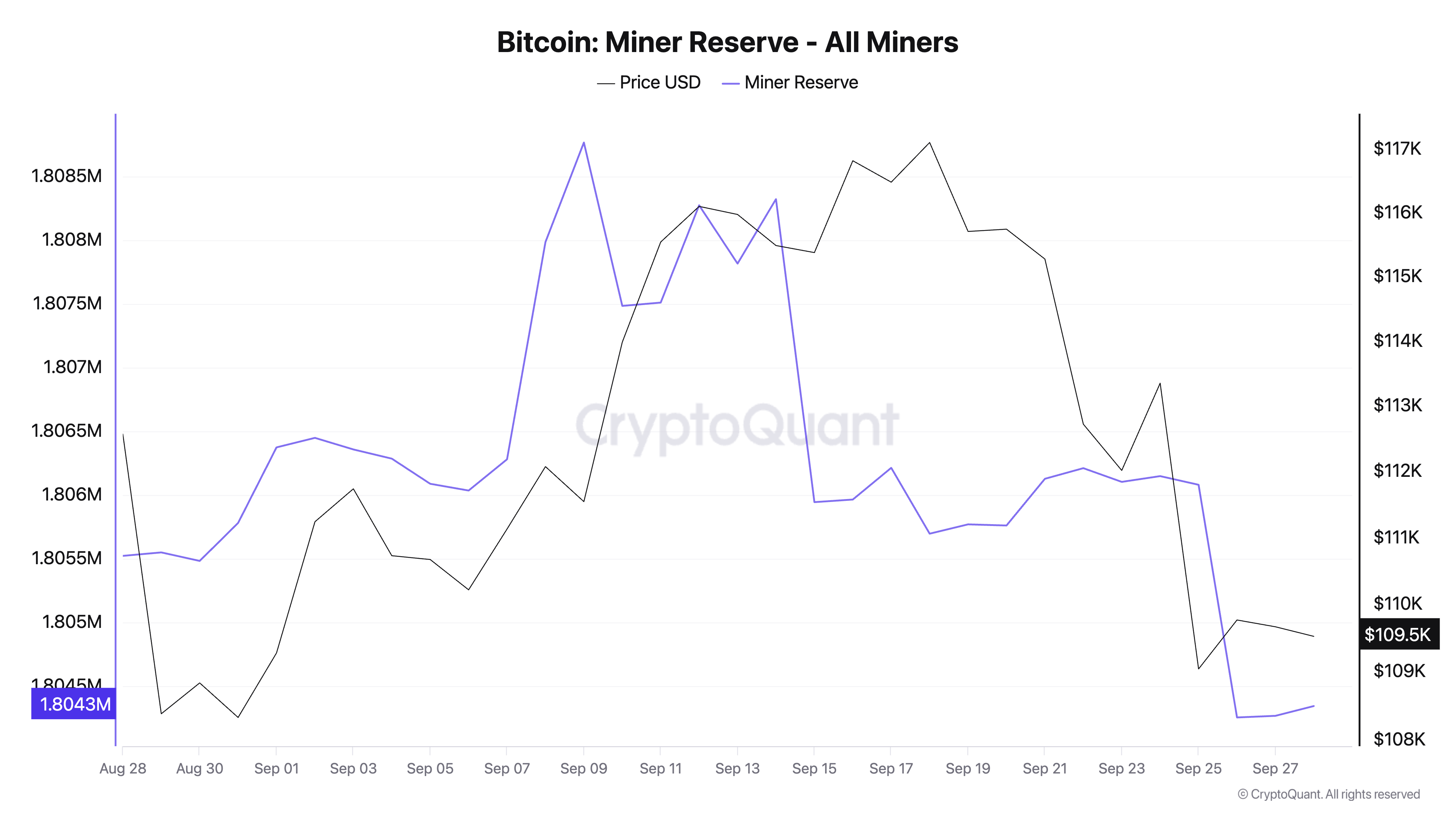

Moreover, blockchain data reveals decreasing miner reserves as miners opt to sell rather than hold onto their BTC holdings—contributing further to the bearish sentiment surrounding the coin. According to CryptoQuant’s figures, this reserve holds 1.8 million BTC but has seen its value decrease by 0.24% since September 9.

Bitcoin Miner Reserve Source: CryptoQuant

Miner reserves reflect how much BTC miners retain before selling it on exchanges. A decline signals they are liquidating assets either for profit or operational expenses.

This behavior typically increases market supply which can exert downward pressure on Bitcoin’s price.

Sustained Selling Could Lead To New Lows

BTC Price Prediction Source: TradingView

If spot BTC ETFs persist with withdrawals while network miners continue offloading coins then prices could slide towards $107557 ;

However should demand surge alongside improved market sentiment then values might rise above $110034 reaching up towards $111961 instead

The article titled ‘Bitcoin Price Stalls Amidst ETF Outflows And Miners Pullback’ was first published on BeInCrypto