Derivatives trading desks are in full swing this weekend, with Bitcoin’s options market urging traders to make decisive moves as futures approach cycle peaks.

Robust Liquidity and Strategic Wagers: Bitcoin Options Market Targets $110K Levels

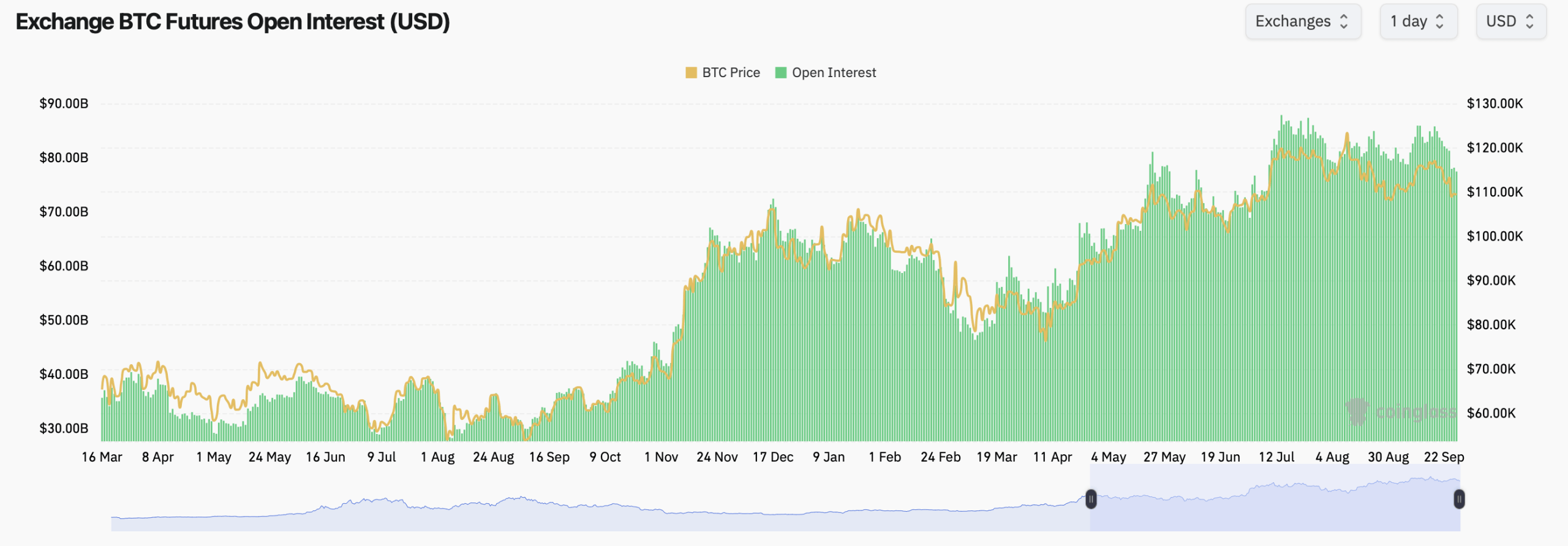

This Saturday, Bitcoin is valued at $109,449, and the futures market is bustling. The total open interest (OI) stands at 707.59K BTC or approximately $77.45 billion, showcasing a vibrant two-way trading environment.

The CME leads with 138.82K BTC ($15.19 billion), capturing a 19.6% share and experiencing a slight daily increase of 0.32%. Binance follows closely with 123.30K BTC ($13.50 billion), holding a 17.42% share despite seeing its OI dip by 0.90% over the day.

Source: Coinglass.com on Sept.27,2025.

Bybit reports an OI of 84.39K BTC ($9.23 billion), down by .87% within the last day, while OKX registers an increase of 1.31% to reach 37.78K BTC ($4&dot13 billion). Gate shows &#&x20AC;;8&dot56;billion) after dropping −#&period07%;

The secondary flow varies: Bitget holds steady at &#.72billion),a modest gain of .45%, whereas Kucoin’s position shrinks by .88%, settling at ;669&dot49million). WhiteBIT decreases slightly by .55%, holding ;2&.29billion). MEXC surges upward by +;87%billion)&comma while BingX plummets sharply to show only ;1&billion).

This weekend sees bullish sentiment among bitcoin options traders based on positioning rather than transaction data.  Calls account for %60%ofoiwith19910216BTC&comma comparedto %39&period34 percentforputsat12914911BTC.</P

YetinthelastdayonDeribit&comma putsbarelyledthevolumeat1624721BTC(50andpercentofcallsare1569448BTC(4913%)periodTradershedgefortheweekendratherthanjustcheerleading></P

Themostactivecontractsareclusteredaroundbitcoin’scurrenttradingrangeOnSept28theDeribit$110000putoptionhad13119BTCinvolumeTheOct10$100000putadded8533BTCTowardstheendofthemonthanOct31$116000callrecorded8125BTCOthercontractsrelatedtothe$110000strikealsosawsubstantialactivitykeepingthemarketlively></P

LooKingfurtheroutDecember’scallsdominatetheopeninterestleaderboardTheDec26$140000callholds98045BTCfollowedbythe200kcalwith85272BtcStrongpositionsalsoexistatthe120kand150kstrikesindicatingtraders’interestinpotentialupsidebeforeyear-end> </P

Maxpain—thelevelwhereoptionbuyersfeelitthemost—showsasmoothbandaround110kt116kacrossnear-termexpirieswithashallowdip105klatedecemberrolls >

Insummary,futuresliquidityisabundantoptionsOIfavorscallsneartermvolumeshiftstoputs,andmax-painmapcentersaround11okBitcointradershavetheirplaygroundnowpricdetermineswhopaysforthride >