Bitcoin remains in a consolidation phase following its significant recovery from the $107K level. Although there are indications of bullish momentum, the future direction will heavily rely on whether the price can surpass nearby liquidity levels or if it will encounter resistance and retreat for further accumulation.

Technical Insights

By Shayan

Daily Overview

On the daily chart, Bitcoin is trading within a clearly defined range between support at $107K and resistance at $123K. The recent surge in buyers at this lower boundary has led to a sharp rebound, enabling Bitcoin to reclaim its 100-day moving average and move towards the upper limit of this range.

This pattern indicates renewed interest from market participants who are defending critical support levels. The key point to watch now is the upper boundary at $123K. A breakout above this threshold would not only establish a new all-time high but also confirm an ongoing bullish trend across broader markets.

4-Hour Analysis

Diving into the 4-hour chart, Bitcoin has approached near its swing high around $117K, where significant buy-side liquidity exists just above that level. While the bullish structure appears stable, a minor pullback into the demand zone ranging from $110.7K to $113.1K cannot be dismissed.

This region has previously drawn considerable buying activity; thus, a successful retest here could bolster bullish sentiment further. Should buyers defend this area effectively and regain momentum, it may attract liquidity above that swing high—potentially igniting another upward movement toward higher price levels.

On-Chain Insights

By Shayan

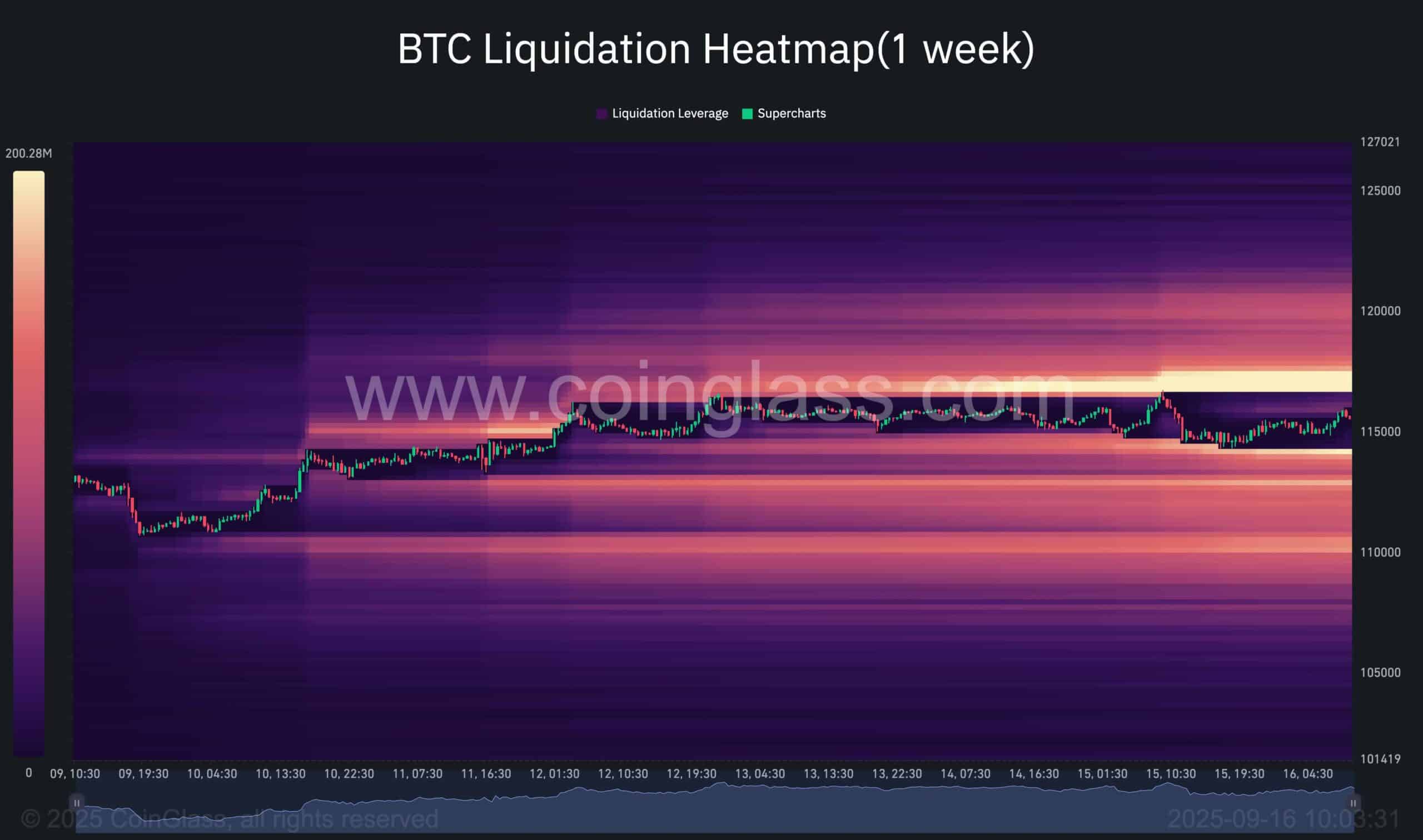

The weekly liquidation heatmap for Bitcoin reveals a concentrated cluster of liquidations positioned just above recent swing highs—aligning with liquidity points noted on our 4-hour analysis.

The market often accelerates as it approaches these zones since stop orders and forced liquidations can enhance momentum significantly. A decisive push past these swing highs could trigger such cascades—prompting short positions to cover their losses while driving prices upward.

This supports our previous scenario: although some retracement into demand zones might occur briefly, overall conditions increasingly favor absorption of liquidity above those swing highs—a setup that could act as fuel for continued growth toward new peaks.