The CEO of CryptoQuant, Ki Young Ju, has pointed out that the total capital inflow on-chain for Bitcoin over the last 1.5 years has significantly exceeded the total inflows recorded from 2009 to 2024. What is driving this remarkable increase?

In a recent analysis, it was revealed that Bitcoin’s on-chain inflows from 2024 to 2025 have surpassed those accumulated between 2009 and 2024 by nearly $200 billion. This surge can largely be attributed to institutional investors who are increasingly acquiring BTC.

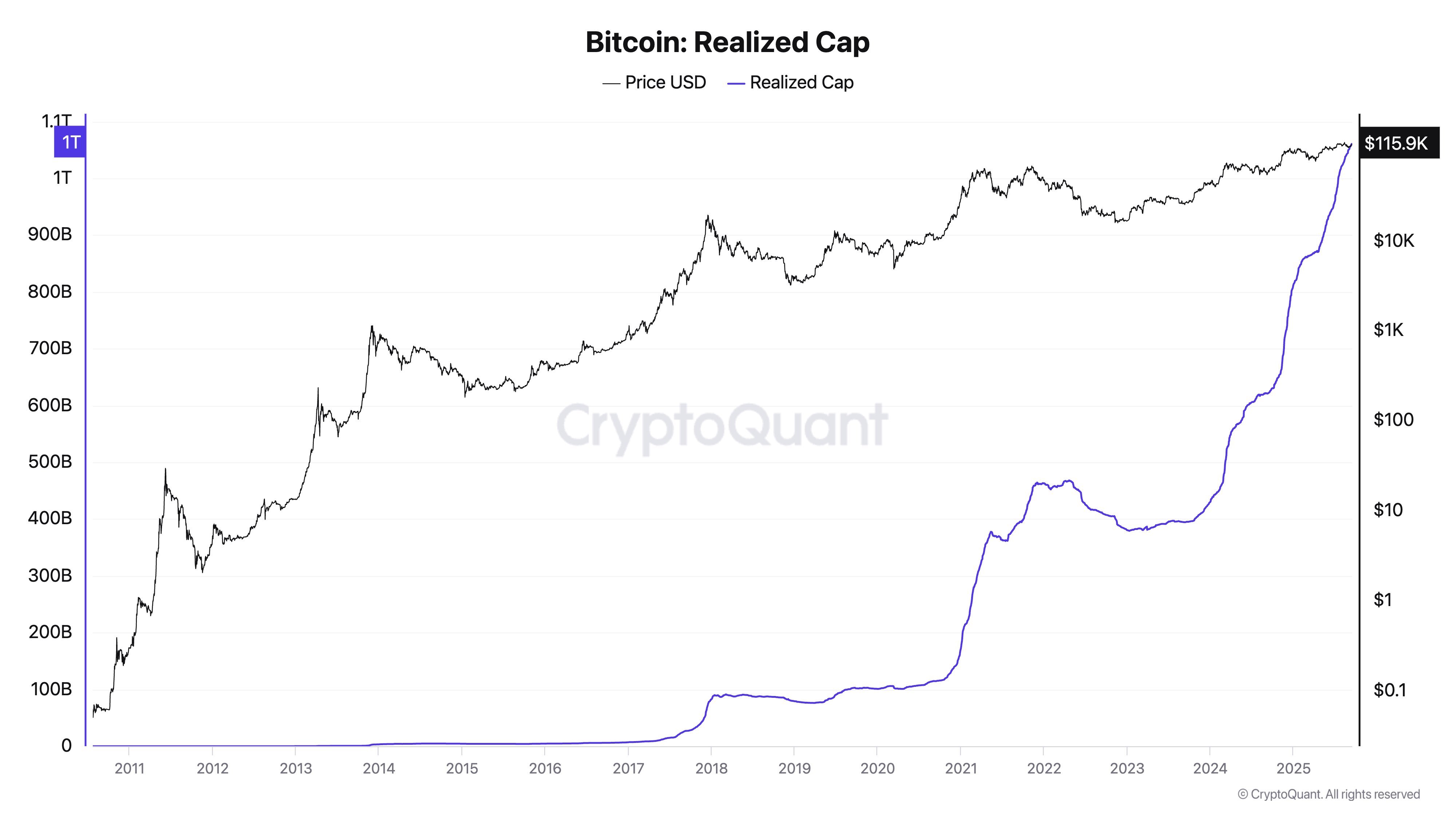

Ju shared a comparison chart illustrating the substantial growth in realized capital associated with Bitcoin. The data indicates that BTC on-chain inflows have surged dramatically in just over a year and a half, reaching an unprecedented $625 billion in realized funds.

This figure not only eclipses the total amount generated from on-chain activities over the past fifteen years but also highlights how quickly this new influx of capital has materialized.

According to CryptoQuant’s Ki Young Ju, during the period from 2009 to 2024, BTC capital inflows totaled approximately $435 billion across fifteen years. In stark contrast, it took less than two years for current market conditions to exceed that figure by almost $200 billion.

What Factors Are Driving High Inflows into Bitcoin?

A significant factor contributing to this dramatic rise in on-chain capital is an influx of institutional investors engaging with Bitcoin through various avenues such as spot ETFs or corporate treasury allocations.

Data sourced from Bitcoin Treasuries indicates there are currently around 3.71 million BTC held within treasuries across approximately 325 entities; notably dominated by publicly traded companies totaling about190 entities. Michael Saylor’s firm remains at the forefront as the largest corporate holder with an impressive stash of around 638,460 BTC.

Additonally, favorable macroeconomic conditions—such as easing inflation rates and anticipated Federal Reserve interest rate cuts—have further fueled this shift in investment strategy among long-term holders who are accumulating assets while illiquid supply reaches record levels. Many investors appear poised for potential impacts stemming from Fed rate adjustments as they transition their funds onto blockchain networks using BTC as their preferred investment medium.

The increasing price of BTC may also attract additional investments due to traders fearing they might miss out on potential gains; at present value reflects a staggering increase of about93.3% within just one year—a clear indication of rising confidence reflected through heightened levels of on-chain activity resulting in multiple all-time highs achieved throughout recent rallies this year alone!

From a technical perspective,BTC appears close toward historically high buying pressure—with its monthly Relative Strength Index nearing70—which signals robust bullish momentum yet raises concerns regarding possible consolidations or pullbacks should traders decide take profits off table sooner rather than later! Nevertheless,the overarching trend remains strong,and given magnitude fresh influxes observed any retracement could be interpreted positively rather than indicating end cycle altogether!

You might also like:

RWA on-chain hits record-high surpassing$29b value