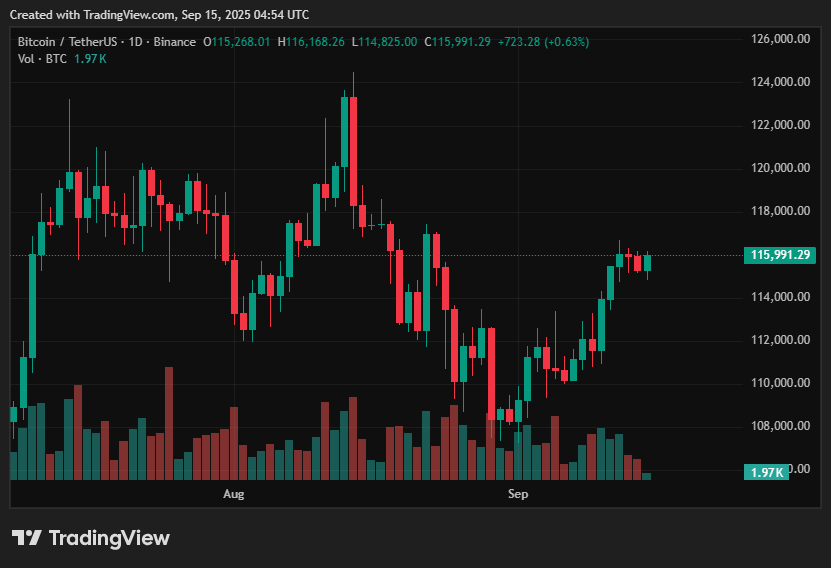

Bitcoin has been experiencing a limited trading range, oscillating between $114,000 and $116,000. Recent data indicates an uptick in institutional interest and significant purchases by large investors, commonly referred to as whales.

The ongoing struggle around the resistance level of $115,000 is pivotal for determining the next major market movement. Analysts are closely monitoring this situation as it could signal a critical shift.

Various forecasts suggest that Bitcoin may undergo a substantial breakout in the coming weeks based on technical analysis, inflows from exchange-traded funds (ETFs), and macroeconomic indicators. This potential price movement could significantly influence market trends through Q4 2025.

Table of Contents

Current BTC Price Scenario

The value of Bitcoin recently surpassed the $114,000 mark and is stabilizing around this figure while facing resistance between approximately $116,000 and $117,500. Indicators suggest growing demand from institutional investors along with new ETF inflows supporting this upward trend.

Traders regard the support range of $110,000 to $112,000 as essential for maintaining stability. Given the shallow market depth near upper resistance levels, any significant sell orders or profit-taking actions could lead to increased volatility.

Market participants are vigilantly observing whale activities alongside futures open interest to detect signs of distribution rather than fresh accumulation.

You might also like:

Will Fed interest rate cuts propel Bitcoin prices?

Upside Outlook

If Bitcoin manages to break through and sustain its position above the cluster of resistances at approximately $116,000–$117,500 successfully—most analysts predict a bullish trajectory toward values ranging from $122,000 to potentially even up to $130,000. This optimistic outlook is supported by stablecoin liquidity enhancements alongside steady ETF inflows coupled with favorable macroeconomic predictions such as anticipated US rate reductions.

Certain forecasts indicate that if these positive factors align effectively while momentum accelerates further upwards; prices might extend towards ranges between about $135k-$140k. The necessary backing for such an upward scenario may stem from whales or large holders continuing their accumulation strategies.

Downside Risks

Despite these positive projections existing risks remain considerable; hence price expectations should not be overly rigidly defined. Should Bitcoin fail to uphold its position within support levels at around 110k-112k; it risks falling back towards ranges near 100k-105k due primarily either due reduced exposure among whales or sizable sell orders appearing close enough proximity relative towards current resistances levels inhibiting growth prospects further downwards respectively .

Additionally , weaknesses observed across macroeconomic data points , unexpected hawkish Federal Reserve policy shifts , or diminishing liquidity conditions may exacerbate downside risks . The tightening range seen within derivatives markets combined with rising leverage can heighten chances regarding abrupt movements occurring either direction should sentiment shift unexpectedly too .

BTC Price Prediction Based on Current Levels

BTC support and resistance levels

Currently ,the pricing structure surrounding bitcoin (BTC) fluctuates between supportive thresholds set roughly at about$110K whilst encountering resistive barriers positioned nearby around$116K-$117K respectively.The bullish narrative targeting objectives spanning roughly toward areas marked off closer together within bounds ranging perhaps up until reaching values nearing$122K-$130 K would require clear breakout confirmations backed strongly via volume indications possibly leading higher depending upon prevailing macro forces impacting overall sentiment likewise moving forward into future periods ahead too.

On another note however,a decline downward trajectory pushing back nearer towards lower end targets identified previously somewhere close approximating areas lying just beneath threshold limits touching down approaching figures hovering below roughly estimated costs averaging out anywhere situated nearby hitting benchmarks closing off underneath likely falling back again closer nearing regions dropping eventually settling somewhere returning ultimately finding themselves resting firmly placed upon those established supports mentioned earlier standing tall awaiting revival attempts reemerging thereafter following subsequent recoveries taking place soon afterwards instead later on altogether too!

You might also like:

Smarter Web eyes distressed rivals as UK Bitcoin treasury race tightens