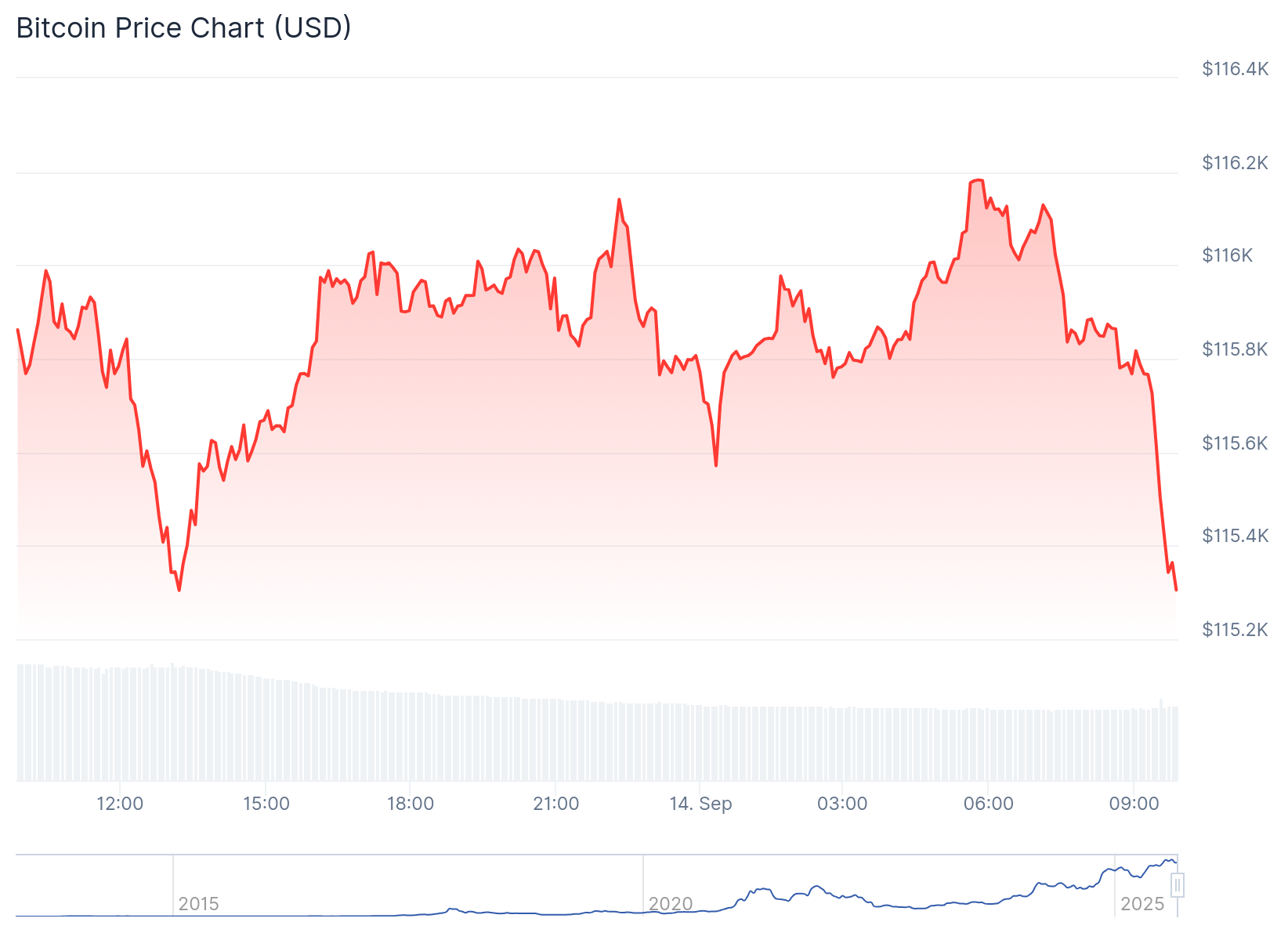

Last week, Bitcoin experienced a significant surge, surpassing the $115,000 mark as market expectations for interest rate reductions by the Federal Reserve increased. Additionally, there was a notable influx of over $2.3 billion into exchange-traded products.

As of Sunday, September 14th, the leading cryptocurrency had dipped by 0.5% on that day. More details are provided below.

Source: CoinGecko

Overview

The price of Bitcoin has surged in anticipation of an interest rate decision from the Federal Reserve.

Analysts predict that the bank will implement a reduction of 25 basis points.

While this could lead to an increase in BTC’s value, technical indicators suggest potential downward movement ahead.

You may also find interesting: The delay in Dogecoin ETF does not significantly hinder major breakout potential

The Federal Reserve’s Upcoming Interest Rate Cut

This week’s most impactful macroeconomic event will be Wednesday’s decision regarding interest rates from the Federal Open Market Committee (FOMC).

The odds presented by Kalshi and Polymarket indicate nearly complete certainty for a cut of 25 basis points. The CME FedWatch Tool corroborates this perspective as well.

Typically, when the Federal Reserve begins to lower interest rates, it is seen as favorable for Bitcoin (BTC) and other cryptocurrencies. Historically speaking, these assets have thrived during periods characterized by loose monetary policies but tend to falter when tightening occurs.

A case in point is how Bitcoin reached its all-time high during the pandemic due to aggressive rate cuts from the Fed but subsequently plummeted below $16,000 following hikes in 2022.

An additional bullish factor is that this anticipated rate cut coincides with Q4—a period known for strong performance historically; data from CoinGlass indicates an average return exceeding 84% for Bitcoin during Q4 since 2013.

Nonetheless, there are concerns that any positive impact on Bitcoin may be limited due to two primary factors. Firstly, much of this cut might already be factored into current prices—creating a scenario where traders sell upon receiving news about it if it aligns with expectations or appears hawkish instead.

Potential Risks Associated with Current Price Patterns

BTC price chart | Source: crypto.news

A significant risk lies in how Bitcoin has developed what resembles a rising wedge pattern on its weekly chart—characterized by two upward-sloping and converging trendlines which raise concerns about an imminent breakdown possibility given their convergence angle.

Additonally ,technical indicators such as oscillators like Relative Strength Index (RSI) and MACD show signs of bearish divergence; indicating asset prices declining despite upward trends observed previously .

Therefore ,while many view impending Fed cuts positively towards bitcoin & crypto markets overall , caution should still prevail considering possible pullbacks occurring simultaneously .

For further reading:The sudden rise in Pepe Coin price follows massive withdrawals totaling approximately 1.1 trillion from exchanges.