On September 13, 2025, Bitcoin was valued at $115,975, boasting a market cap of $2.31 trillion and a trading volume of $43.07 billion over the past day. The cryptocurrency’s price experienced fluctuations between $114,838 and $116,705 as it continued to solidify its recent gains.

Bitcoin

Bitcoin maintained its position near the upper end of its range while consolidating gains from a recent upward breakout. This indicates signs of a developing rally characterized by cautious yet firm momentum. The prevailing trend across various timeframes exhibits a bullish inclination; however, some oscillators suggest potential overextension and short-term fatigue.

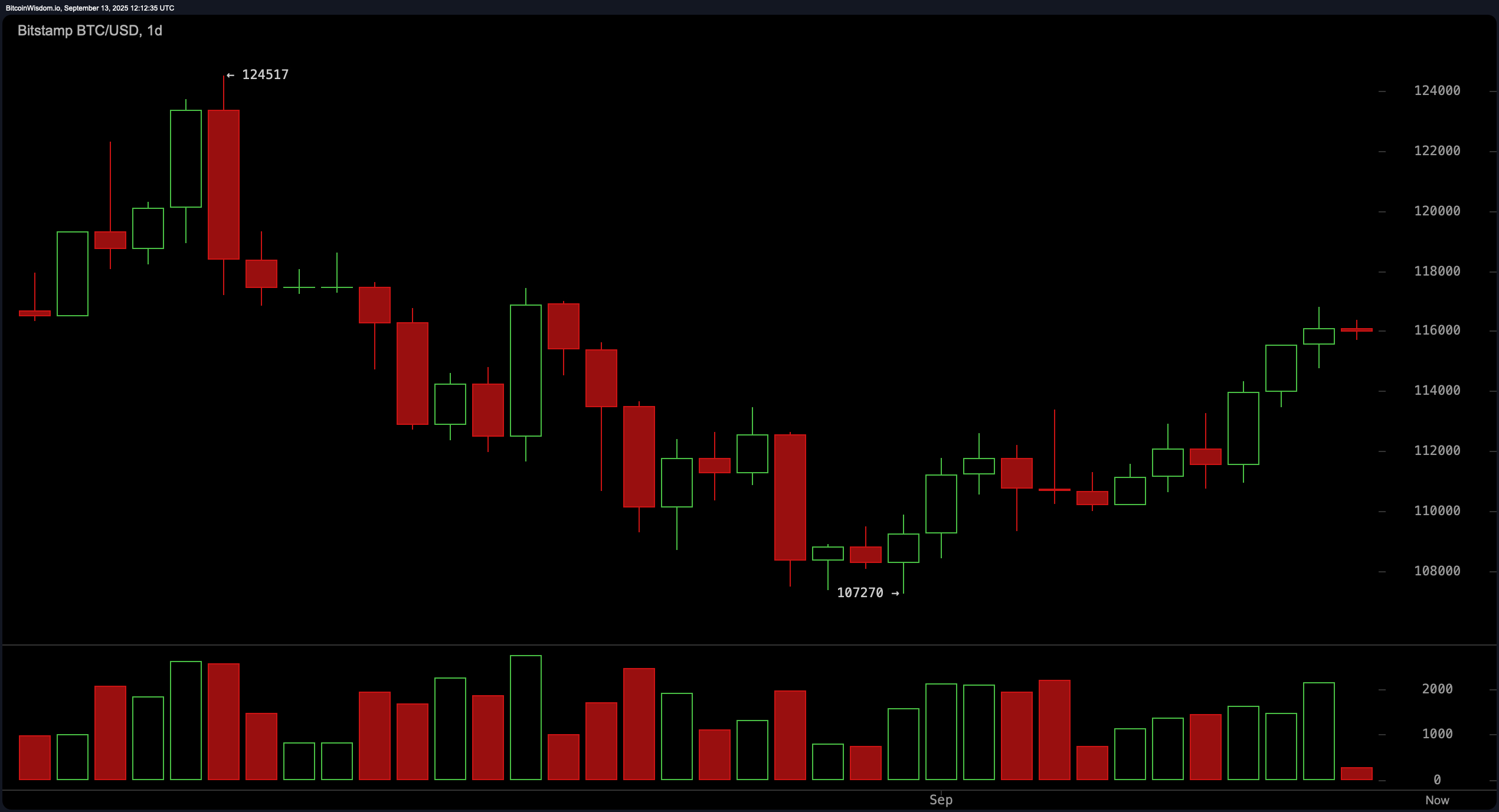

The daily chart illustrates that Bitcoin is undergoing a bullish reversal after experiencing a significant downtrend that reached lows around $107,270. Since then, the price action has established an evident pattern of higher highs and higher lows with gradually increasing volume—an encouraging indicator of conviction in this movement. Currently testing critical resistance near the $116,000 mark requires a strong close above this area to confirm further upward movement. Entry points were more advantageous during the reversal phase; nonetheless, employing trailing stop strategies around $113,500 could safeguard profits for those already holding long positions. Price targets are projected between $117,500 and $120,000 based on identified resistance clusters.

BTC/USD 1-day chart via Bitstamp on Sept. 12, 2025.

The four-hour Bitcoin chart reveals an impressive bullish continuation pattern stemming from an initial breakout at approximately $110,624 and reaching up to about $116,805. While this rally remains intact for now; recent candles have displayed smaller bodies indicating potential momentum pauses ahead. Buyers seem to be taking some time off as support establishes itself within the range of approximately between $114500-$115000 area.

A confirmed breakout surpassing the level at around$117000 could lead to accelerated gains towards$118000 or beyond if accompanied by adequate volume levels.

Cautious bulls might contemplate entries upon retests against support or during breakouts validated by robust volume confirmation.

BTC/USD 4-hour chart via Bitstamp on Sept. 12 ,2025.

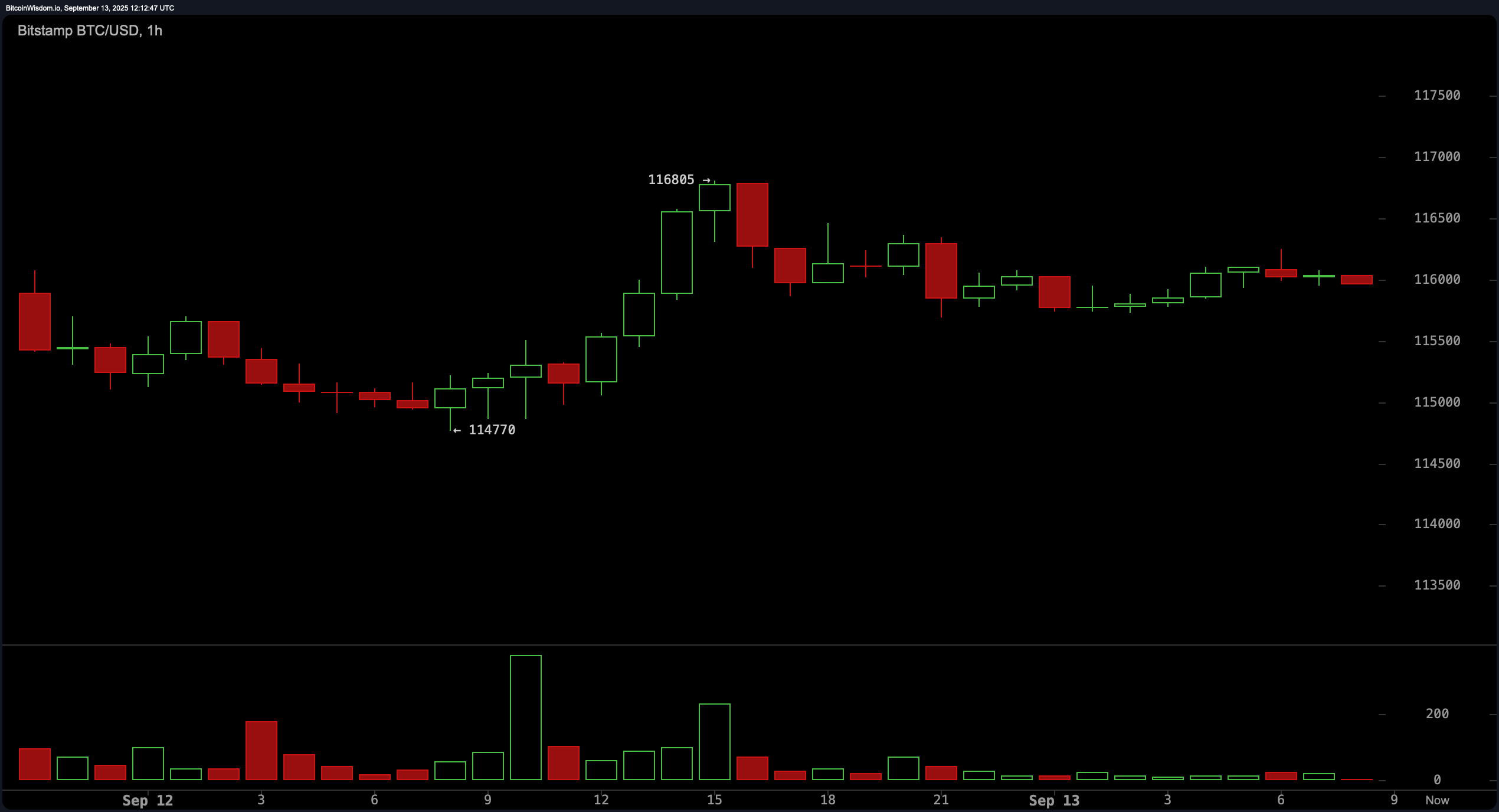

On the hourly chart for Bitcoin consolidation occurs beneath its peak value at$116805 forming what resembles either—a bullish flag formation or perhaps just bound-range setup.Momentum appears subdued but not reversed which often foreshadows continuation moves ahead .Short-term supports hover closely near$114770 where buyers maintain control provided prices stay above roughly$115500.Scalpers may spot opportunities in case there’s any breakout exceeding values nearing.$116800 or bounces occurring close enough toward levels around.$115000 ;however stops should remain tight below respective levels due possible pullbacks shortly thereafter .

BTC/USD 1-hour chart via Bitstamp on Sept .12 ,2025.

From an analytical standpoint concerning technical indicators—the moving averages consistently signal positive momentum.All essential exponential moving average (EMA) & simple moving average(SMA)—including those spanning periods such as10 ,20 ,30 ,50 ,100&200—all indicate favorable buying conditions confirming BTC trades well above crucial trend markers.The EMA(10) rests nearby113586 while SMA(10) stands closer112799 offering immediate trend support alongside longer term SMA(200) positioned significantly lower than102349 establishing solid foundations beneath current valuations

The oscillators provide mixed signals with relative strength index (RSI )at59 suggesting neutral dynamics without triggering over-bought scenarios.On another hand stochastic oscillator reads high up95 hinting towards possible over-extensions occurring commodity channel index(CCI )hovering195 coupled with momentum registering4219 both suggest sell indications pointing out diminishing upward thrusts meanwhilst awesome oscillator measuring475 along MACD figures hitting202 reveal buy signals thereby suggesting broader trends persist undeterred .This divergence among indicators necessitates careful optimism focused primarily upon movements backed by substantial volumes

Bull Verdict:

If bitcoin maintains positioning above vital support zones alongside all major moving averages aligning positively—the overarching technical framework retains its optimistic outlook.Should buyers manage pushing through resistances situated around117k mark exhibiting robust volumes—the pathway leading toward120k seems plausible within upcoming timeframe

Bear Verdict:

Despite overall positive structure—overstretched oscillators combined waning intraday dynamics call forth caution.A breakdown dipping below114770 accompanied volumetric shifts could potentially sway short-term sentiments bearish prompting deeper retracements back towards prior consolidation areas hovering closer113500 </P