Summary

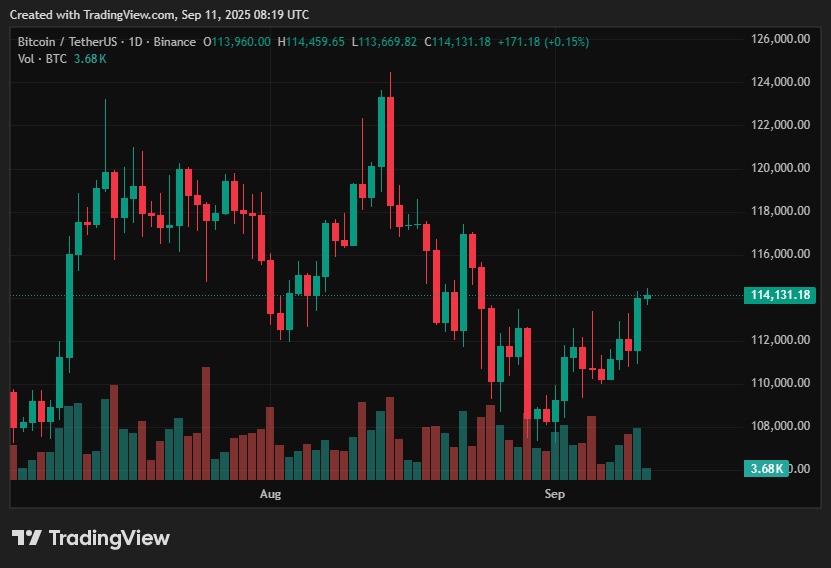

Currently, Bitcoin is trading around $114,000, positioned between the support level of $110K and the resistance at $115K. Analysts suggest that if Bitcoin surpasses the $115K mark, it could potentially rise to a range of $118K to $130K. Conversely, failure to break through this resistance may lead prices downwards towards the levels of $100K to $108K. The bullish sentiment is bolstered by stablecoin liquidity and ETF inflows; however, selling pressure from large holders (whales) adds downside risks. The market appears primed for significant volatility with potential swings of up to $20K.

As Bitcoin remains above the crucial threshold of $114,000 while contending with overhead resistance and an increase in bullish momentum, analysts are once again focusing on BTC as a central player in market dynamics.

The indicators for volatility are signaling an imminent breakout as traders remain cautious while cryptocurrency prices fluctuate within a tightening range after several weeks of stability.

The interplay between whale activities, seasonal trends, and institutional investments creates a high-stakes environment where any forthcoming decision could result in substantial financial shifts. This situation has led analysts to differing opinions regarding Bitcoin’s price trajectory—some predict an upward surge while others prepare for possible corrections.

Table of Contents

Bitcoin Price Prediction: What You Need To Know Today

At present levels near approximately $114,000, Bitcoin is consolidating within a narrow band above essential support at around $110k. The 50-day moving average continues exerting pressure on immediate resistance now situated closer to about 114500 dollars. Given this tight range between support and resistance points ($110k-$114500), traders are keenly watching for any decisive breakout.

The rising open interest in futures contracts suggests that leverage within the system is building up further; this increases chances for severe liquidations once a clear direction emerges from current market conditions. Volatility metrics indicate that participants anticipate significant movements ahead due both tightening conditions across markets along with heightened speculative interest among players involved.

You might also like:

Bitcoin faces challenges around 115k as ETFs experience outflows — can whale accumulation lead toward reversal?

Positive Outlook For Bitcoin Price

If BTC manages decisively breaks past its current barriers ($114500-$115000), it may witness swift short-term gains reaching upwards toward ranges between approximately 118000-122000 dollars soon thereafter—a strong bullish signal would be generated upon clearing these thresholds paving pathways leading potentially higher towards targets around 125 thousand -130 thousand dollars later on too!

This optimistic outlook finds additional backing through recent substantial inflows into spot bitcoin ETFs over last week which indicates robust institutional demand driving prices upward! Notably BlackRock increased their exposure by roughly169 million via their fund recently alongside total ETF inflows exceeding246 million earlier this month alone!

Additionally strong stablecoin liquidity persists ensuring resilience against selling pressures whilst supporting further upside should momentum continue accelerating positively going forward!

POTENTIAL DOWNSIDE RISKS

If unable overcome resistances noted previously then we might see declines back retesting key level surrounding$110 k zone again soon enough! If breached here downward moves become likely targeting zones nearer$108 k first followed possibly even lower ranging anywhere below$100-104 K thereafter depending how swiftly sentiments shift amongst traders involved overall ! Cascade liquidations caused when over-leveraged longs get forced out could exacerbate such downturns significantly .

The uptick seen lately regarding whale selling activity poses additional concerns since large holders have offloaded more than 115 ,00 btc just last month alone raising downside risk probabilities substantially too . Furthermore September’s historical seasonality often brings weakness compounding fears rapid mood shifts may spark flash crashes unexpectedly !

BTC PRICE FORECAST BASED ON CURRENT TRENDS

BTC daily chart showing critical support/resistance levels

Trading currently occurs within boundaries set forth previously($110 k -$114 ,500 ) representing vital territory overall ! Positive scenarios projecting movement upwards into areas spanning anywhere from(approximately)118 K-130 K would gain strength following successful breakouts beyond upper limits established thus far!

A breakdown occurring beneath marks surrounding108 K would signal bearish trend developments pushing values downward approaching ranges near105-K-100-K instead possibly triggering sell-offs amidst growing panic among investors fearing losses incurred rapidly escalating fears concerning broader implications associated therein overall landscape shifting drastically post-breakdowns experienced historically before …

You might also like:

Crypto rally under threat as risky patterns emerge despite hopes linked Fed cuts looming ahead!

EMERGING MARKET TRIGGERS TO MONITOR

ETF flows remain pivotal forces propelling ongoing rallies presently observed reflecting strong institutional demand right now still intact across various sectors driven largely macroeconomic improvements creating favorable environments conducive risk assets gaining traction amid weakening dollar prospects combined expectations rate cuts coming down pipeline eventually soon enough too…

Stablecoin liquidity continues providing necessary supports ensuring adequate funds available withstand selling pressures encouraging growth opportunities manifesting subsequently later stages henceforth onward looking closely monitoring technical structures including moving averages tests head-and shoulders formations evaluating accurate perspectives forecasting future trajectories evolving dynamically week-to-week basis subsequently arising triggers shaping next significant breakthroughs or breakdowns anticipated forthcoming periods respectively…

( DISCLOSURE : THIS ARTICLE DOES NOT CONSTITUTE INVESTMENT ADVICE . CONTENT MATERIALS FEATURED HEREIN INTENDED EDUCATIONAL PURPOSES ONLY )