In August 2025, corporate and institutional bitcoin reserves saw significant growth as tracked organizations accumulated an additional 47,718 BTC. This increase brought the total reported holdings to approximately 3.68 million BTC, as per data from bitcointreasuries.net. Notably, these net additions were solely attributed to both public and private companies.

New Entities Recorded by Bitcointreasuries.net in August

The newly added bitcoins were valued at $5.2 billion based on the price of $108,695 on August 31st. The entire stack of around 3.68 million BTC was estimated to be worth close to $400 billion by the end of the month. The totals included various categories such as public corporations, private enterprises, government holdings, exchange-traded funds (ETFs), and bitcoins associated with decentralized finance (DeFi) and smart contracts.

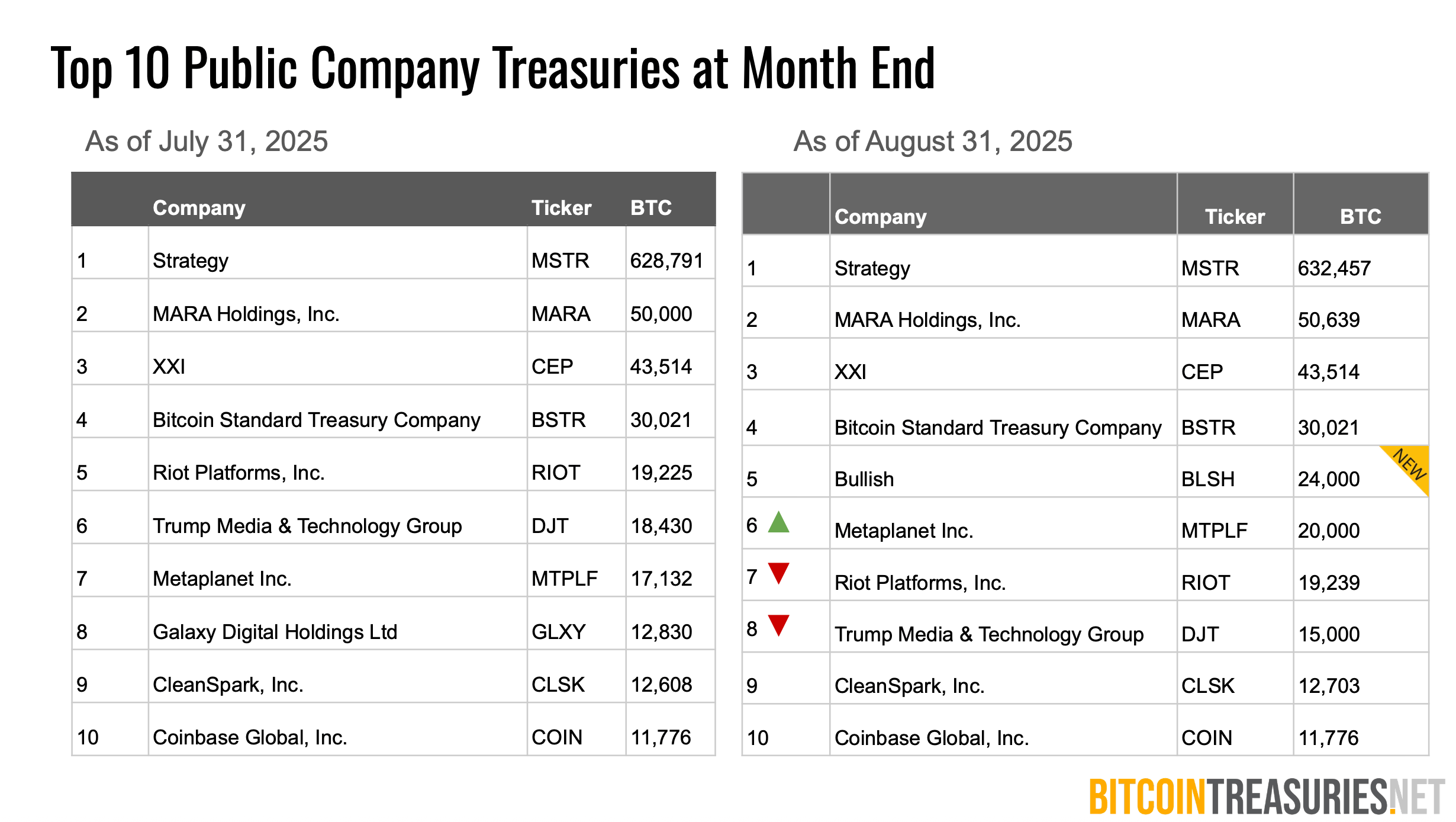

According to Bitcointreasuries.net’s findings, balances held by public companies have nearly doubled since late 2024; early September statistics indicated that public treasuries had surpassed the milestone of one million BTC—valued at about $111 billion on September 4th. Furthermore, corporate listings have seen a near doubling since January due to an increasing number of firms adopting treasury strategies.

Source: Bitcointreasuries.net report August 2025.

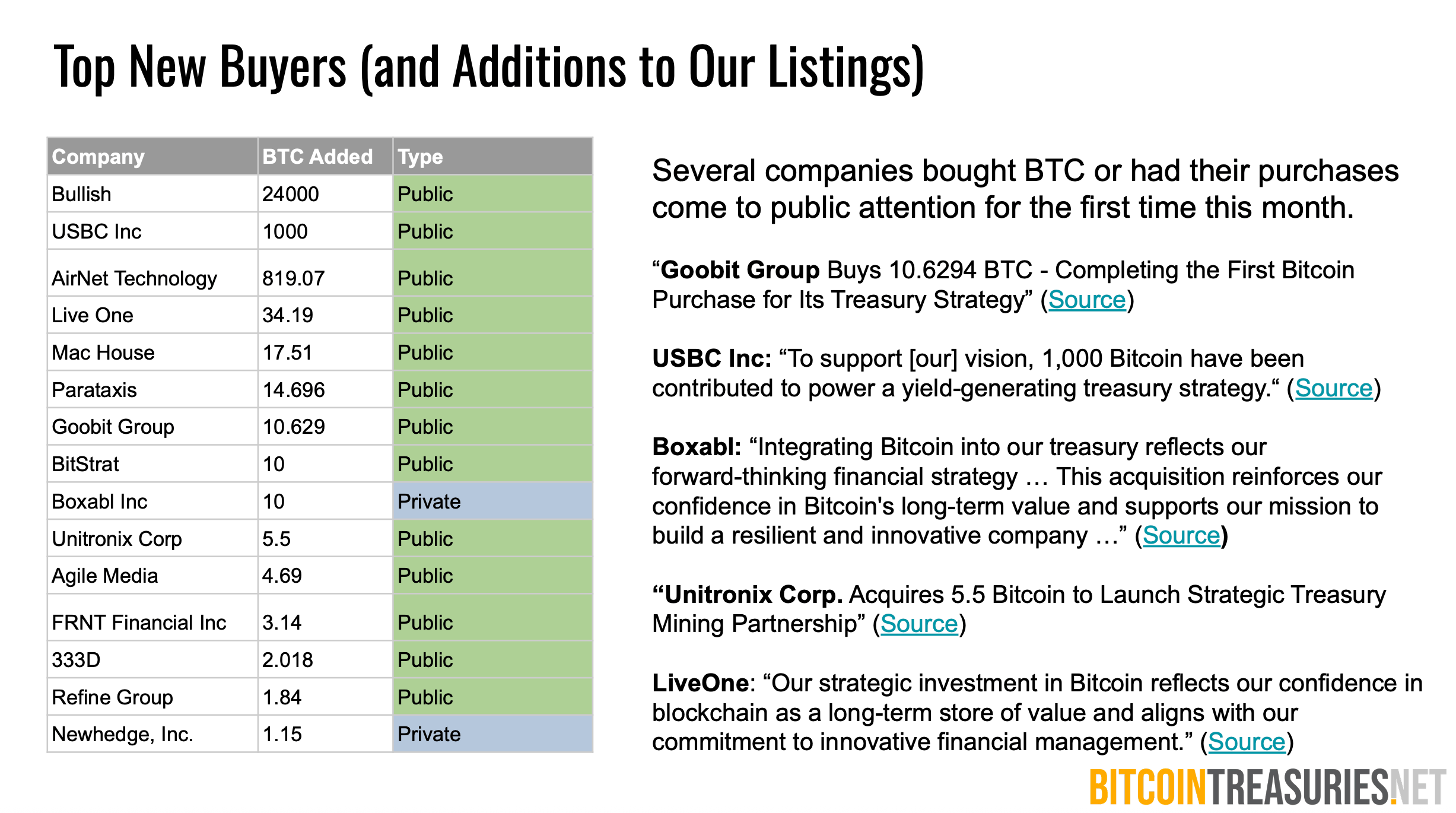

The most substantial single addition for the month came from crypto exchange Bullish following its successful initial public offering (IPO) in August when it acquired an impressive total of 24,000 BTC. Other noteworthy acquisitions included KindlyMD with its purchase of 5,744 BTC; Strategy acquiring another 3,666 BTC; Galaxy Digital adding up with their acquisition of 2,894 BTC; and Metaplanet securing an additional amount totaling up to 1,859 BTC.

Metaplanet from Japan completed four transactions throughout August that increased its holdings to reach a total of approximately18 ,991BTC by month-end—ranking it sixth among publicly listed treasuries overall. The company has outlined financing plans involving perpetual preferred stock issuance amounting to JPY555 billion (around $3 .7 billion) along with an international share offering projected at roughly $880 million.

Source: Bitcointreasuries.net report August 2025.

The fundraising initiatives gained momentum during this period—with programs surpassing over $15 billion according to researchers at bitcointreasuries.net . Strategy announced a market program valued at $4 .2 billion while KindlyMD revealed plans for raising equity worth around $5 billion linked directly towards treasury expansion efforts ; Metaplanet also detailed their JPY issuance alongside share sales , whereas Parataxis pursued a SPAC arrangement potentially yielding about $640 million.

Throughout this month alone , bitcointreasuries.net documented roughly seventeen new entities joining their ranks —most being publicly traded firms . Their estimates suggest that outof174 trackedpubliccompanies95 originated outsideofcryptocurrency space ; however crypto-native businesses still maintain approximately three times more bitcoin than these newer entrants into this domain .

Around ten additions recorded inAugustwere either basedin or listed within United States territory.The report highlighted recent regulatory changes including new Nasdaq stipulations introducedinearlySeptember requiring shareholder approvalforcrypto-treasure funding activities althoughStrategy statedthatits capital-market operations remained unaffectedbythese developments