Germany’s highly publicized campaign to seize Bitcoin has recently come under renewed examination after blockchain analysts disclosed that nearly $5 billion worth of BTC remains untouched. This revelation has sparked curiosity within the cryptocurrency community, leading to questions about whether these funds are lost, frozen, or simply being held in reserve.

Reasons for the Inactivity of the Coins

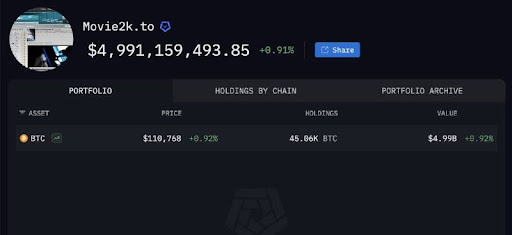

In a post on X, prominent crypto influencer Crypto Patel—who is affiliated with CoinMarketCap and Binance—pointed out that Germany’s Bitcoin seizure initiative appears to have encountered significant challenges. According to blockchain analytics firm Arkham, a substantial amount of dormant BTC linked to the now-defunct Movie2K piracy platform suggests that German authorities may be struggling in their efforts.

The report indicates that around 45,000 BTC, valued at approximately $5 billion, has remained inactive across more than 100 wallets since 2019. It is believed these coins are still under the control of the original operators from Movie2K.

Earlier in 2024, German officials successfully confiscated nearly 50,000 BTC which were subsequently liquidated for about $2.9 billion. However, despite this notable action, this new information reveals that a considerable portion of Movie2K’s assets remains inaccessible.

Bitcoin continues its ascent into mainstream acceptance among influential individuals and institutions worldwide. Crypto specialist Hashley Giles noted that Bitcoin serves as an ideal asset for balance sheets across various profitable businesses regardless of their size or industry.

In the UK context specifically, establishing an e-money account provides companies with straightforward access to Bitcoin without jeopardizing existing banking relationships. By focusing on accumulation rather than trading activities during accounting processes businesses can avoid complications related to constant market fluctuations.

Apart from seamless integration capabilities offered by Bitcoin it also provides unparalleled liquidity; companies can convert BTC into pounds almost instantaneously whenever necessary—even during weekends when traditional banks are closed.

This flexibility stands in stark contrast with business bank deposit savings accounts in the UK where ultra-low interest rates often require lengthy notice periods before accessing slightly better yields; however there’s no such waiting period associated with Bitcoin making it both adaptable and efficient as an asset class.

Enhancing Security While Unlocking Liquidity

Bitcoin has consistently been regarded as one of the most reliable digital assets available today; yet fulfilling its full potential requires establishing itself as a stable unit of account according to BSquaredNetwork who highlighted U2—a USD-pegged stablecoin backed by BTC—as essential for maintaining security while facilitating global liquidity access through cryptocurrencies’ ecosystem enhancements .

The vision presented by BSquaredNetwork goes beyond mere transactions; positioning U2 as a dependable unit allows BTC not only function effectively within payment systems but also serve pivotal roles across decentralized finance (DeFi) platforms along with AI-driven microtransactions bridging connections between its attributes resembling digital gold alongside emerging intelligent economic frameworks built upon them .

Featured image from Pixabay chart sourced via Tradingview.com