The price of Bitcoin has plummeted nearly 50% from its peak of $126,000, igniting concerns about a potential further decline.

Historical trends indicate that if a correction of 70% occurs again, Bitcoin could drop to around $40,000.

Market sentiment suggests that Bitcoin is currently in a state of fear, which often precedes the formation of the final price bottom.

The leading cryptocurrency, Bitcoin, has faced significant challenges recently as it attempts to bounce back from its all-time high of $126K down to approximately $67K—a staggering drop nearing 50%.

As crypto enthusiasts eagerly anticipate market recovery, historical analysis points toward a possible decline in Bitcoin’s value to around $40K by the year 2026.

Here’s an exploration into why this might happen!

Reasons Behind Potential Drop to $40K

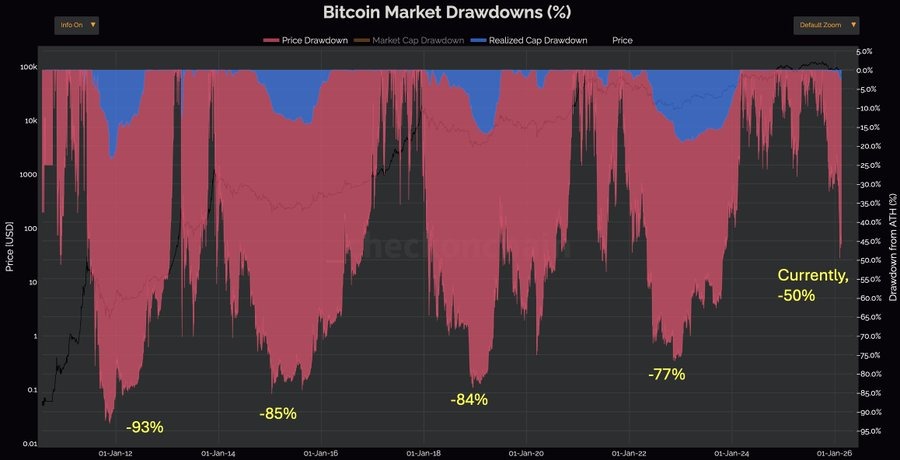

Bitcoin has consistently demonstrated patterns of severe corrections following new peaks. For instance, in 2011,$BTC‘s value surged from just $1 to an impressive $30 before correcting by an astonishing 93%, dropping below the five-dollar mark. In another instance during 2015 after the collapse of Mt. Gox exchange, it fell by as much as 85%, descending from $1,100 down to about $150.

The trend continued in 2018 when investors began taking profits; thus causing Bitcoin’s price to tumble by approximately 84%, moving from its peak at around $20K down towards roughly $3.1K.

A similar scenario unfolded in early-2022 when$BTC‘s value dropped significantly—by about 77%—from its high at around$69K down towards approximately$16k after Tesla ceased accepting$BTC, undermining market confidence.

This current cycle saw Bitcoin reach a new all-time high (ATH) at$126k back in October2025 and now trades at$67k—a notable decrease amounting up-to50%

.

If history repeats itself and follows previous patterns closely,$ BTC is likely set for another downturn—potentially hitting levels near$ BTC at40 ,000 .

Cyclical Market Trends Indicate Possible Drop By November

Market psychology also aligns with this pessimistic outlook regarding future prices.

The Wall Street Cheat Sheet illustrates how cryptocurrencies likeBitcoin navigate through various emotional phases throughout their lifecycle.

During times marked by euphoria,Bitcoin achieved heights reaching up-to$126 ,000 ,where investor excitement peaked alongside expectations for even higher valuations.Eventually entering stages characterizedby complacency followedby anxiety where prices receded slightly but many believed these fluctuations were merely temporary drops settlingaround January2026atabout97 ,620 dollars.

Currently,Bitcoin appears entrenched withinthe angerandearlydepressionstages dominated primarilybyfearfrustrationandintense selling pressure.. Past cycles have shownthat such conditions frequently leadto final bottoms,and there’s speculation surrounding whetherBitcoinwill dipclosertoapproximatelyforty thousand dollarsbeforeNovember twenty-sixthofthisyear..

After reachingits lowest pointhistorically,Bitcoin typically transitionsinto disbeliefandrecoveryphases where gradualprice increases commence signalingnewbullruns ahead!

The Impact Of Halving Cycles On Historical Trends

In contrast,the halving cycle associatedwithBitcoincould potentially alterthese predictions entirely…

Historically speaking,thehalvings have consistently resultedin peakingvalues occurring12to18monthsaftereacheventdueprimarilytoreduced supply coupledwithincreased demandfollowingtheevents themselves!After experiencingits mostrecenthalving eventbackin twenty-twenty-four,it seems likely thatwe may witnessanupcoming surgeforbitcoinsbeginningmidwaythrough twentysixteenwhichcould ultimatelyinvalidatepreviously establishedtrends altogether!