The significant Bitcoin price drop of 50% from its record high in October 2025 continues to dominate discussions across financial circles.

Gold supporter Peter Schiff has issued a warning, suggesting that the best move now is to exit the market. “The true chance lies in selling Bitcoin before it loses another half of its value,” Schiff posted on X.

He criticized what he perceives as biased coverage by mainstream media, which portrays the recent crash as a buying opportunity. These remarks come amid Bitcoin’s fall toward the $60,000 mark, erasing nearly half of its peak value above $126,000.

Main Highlights

Peter Schiff advises selling Bitcoin now to avoid further declines.

Bitcoin has fallen to around $66K, almost 50% below its October 2025 peak.

Saylor refers to market volatility as a “gift for believers” and continues purchasing $BTC.

Gary Vee views prices under $70K as an “unexpected buying opportunity.”

Bitcoin Approaches $60K Threshold

Last Friday saw Bitcoin dip near $60,000 without fully rebounding since then. The leading cryptocurrency briefly surged by 20% reaching approximately $72,200 but bearish forces have regained control once again.

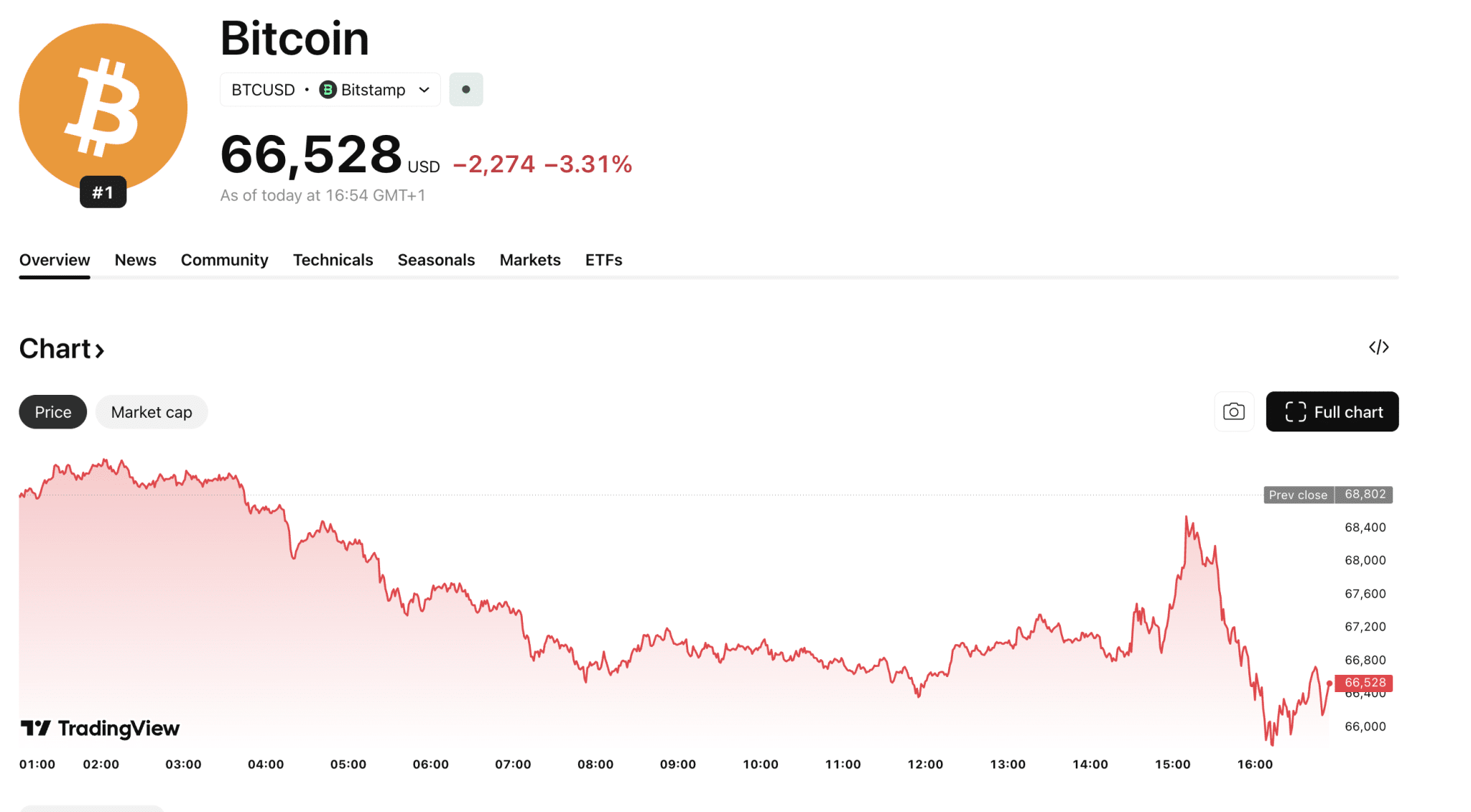

The current trading price stands at about $66,100 — down over 4% today and more than 11% during the past week — placing it roughly 47.5% below all-time highs.

Source: TradingView

The selloff is attributed by analysts to profit-taking among early investors combined with reduced ETF inflows and broader risk aversion in global markets.

A number of industry leaders consider these levels a rare generational entry point. However, Schiff remains skeptical about this optimistic outlook.

Schiff Questions Bitcoin’s Historical Strength

A user named Fenak responded on X pointing out that historically Bitcoin has bounced back from similar steep declines and argued buying at around $66K is preferable compared with entering near all-time highs close to $125K. Nevertheless, Schiff rejected this argument stating past performance does not guarantee future results:

Bitcoin’s history is too short to conclude that it will always do anything.

— Peter Schiff (@PeterSchiff) February 11, 2026

Schiff consistently emphasizes that Bitcoin lacks intrinsic worth and often contrasts it unfavorably against gold—a traditional store of value he trusts more.

Another commentator questioned why his focus remains so heavily fixed on criticizing Bitcoin rather than promoting gold exclusively—implying he might fear digital currency could eventually rival gold’s monetary status.

X user Bull Brezza suggested viewing the current drop not as failure but typical behavior for scarce assets like cryptocurrencies or precious metals alike—highlighting how gold itself declined roughly 45% between years 2011–2015 before rebounding strongly afterward.

Meanwhile Michael Saylor—the Executive Chairman at Strategy—has described volatility as “a gift for those who believe”. Despite suffering multi-billion-dollar paper losses due to ongoing purchases during dips,$BTC, Saylor urges continued accumulation.

'''''

Gary Vaynerchuk (aka Gary Vee), CEO of VaynerMedia recently shared via The Crypto Basic platform his strategy: accumulating bitcoin while prices remain below seventy thousand dollars—which he calls an “unexpected opportunity”. Analyst Ali Martinez pinpointed approximately fifty-two thousand forty dollars ($52, 040) based on MVRV pricing bands indicating potential bottom support levels.

Bernstein analysts maintain their bullish stance forecasting bitcoin could reach one hundred fifty thousand dollars ($150, 000) by end-2026 citing weak sentiment behind correction rather than fundamental structural damage within crypto markets.