The value of Bitcoin has experienced a significant decline, plummeting from approximately $69,000 to below $66,500 within a mere hour. This abrupt drop in $BTC has resulted in the liquidation of over $79 million in long positions, as reported by Coinglass. Simultaneously, the overall cryptocurrency market capitalization saw a reduction of around $90 billion during this period, even while US stock markets remained positive.

Source: X

During the same timeframe, Ethereum also faced a downturn and fell below the $2,000 mark. The liquidation map indicated that substantial long positions were clustered beneath the $66,000 level which intensified selling pressure as prices neared critical support areas. Although there was a minor recovery today, Bitcoin is currently fluctuating between $66,000 and $68,000 if this support holds firm.

Crypto analysts at IT Tech have observed that the SuperTrend indicator has turned red—an indication of bearish momentum for $BTC. They cautioned that if Bitcoin fails to reclaim the level of $68,000 promptly it could lead to further declines with increased liquidation risks emerging below the threshold of $65,500.

The Impact of US Debt Projections on Market Sentiment

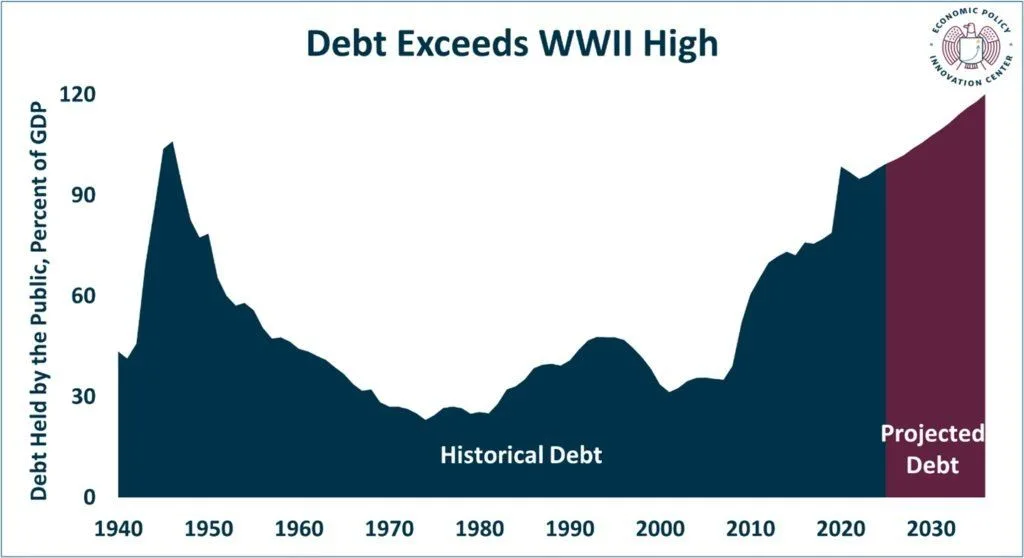

This selloff occurred shortly after new economic forecasts were released by the Congressional Budget Office (CBO), raising alarms about America’s fiscal health moving forward. The CBO projected that national debt will exceed its World War II peak by 2030—reaching 106% of GDP—and could escalate to 175% by 2056.

Source: X

This revised outlook indicates an increase in projected deficits over ten years by an additional $1.4 trillion compared to last year’s figures. Net interest payments are anticipated to double from one trillion dollars in 2026 to approximately two point one trillion dollars by 2036 due to rising interest rates and increasing borrowing demands.

CBO Director Phillip Swagel stated that “Our budget projections continue to indicate that our fiscal path is unsustainable.” Furthermore, they forecasted that reserves for Social Security will be depleted by 2032—one year earlier than previously estimated.

The Fiscal Burden Linked To Trump Administration Policies

A significant portion of this debt increase can be attributed to legislation enacted during President Donald Trump’s tenure starting in 2025. The permanent extension of tax cuts and business incentives from 2017 is expected to inflate deficits by about four point seven trillion dollars through until 2035.

Nevertheless,the CBO estimates suggest these expanded tariffs may generate roughly three trillion dollars in federal revenue through till about 2036; however,the overall financial landscape remains strained with warnings regarding potential inflation spikes due higher tariffs between now and late decade。

The budget office also pointed out how reduced immigration levels might shrink America’s population count significantly —by five point three million people —by year-end twenty thirty-five。This demographic shift could decrease working-age individuals available for employment numbers down two point four million while average monthly job growth slows considerably averaging just forty-four thousand jobs per month between twenty twenty-eight through twenty thirty-six。

Could A Recovery In Bitcoin Prices Be On The Horizon? Insights From Santiment Analysis

As traders reactively monitor broader economic indicators impacting crypto markets closely watching key support near sixty-five thousand alongside resistance around sixty-eight thousand marks。

Additionally social sentiment data reveals retail investors remain largely pessimistic despite recent recoveries following drops beneath sixty-thousand dollar thresholds last week。Santiment’s analysis shows prevalent fear-driven posts dominating major platforms when compared against bullish commentary indicating reluctance among many retail participants re-entering markets even amidst price stabilization efforts occurring lately。

Source : Santiment

This degree crowd pessimism suggests many retail players hesitate re-entering despite ongoing stabilization seen recently . Historically elevated fear levels often precede rebounds especially when larger holders accumulate reducing resistance points .

At time writing , bitcoin trades at around sixty-six thousand six hundred fifty-five after brief recovery yet still down three point five percent within past day .