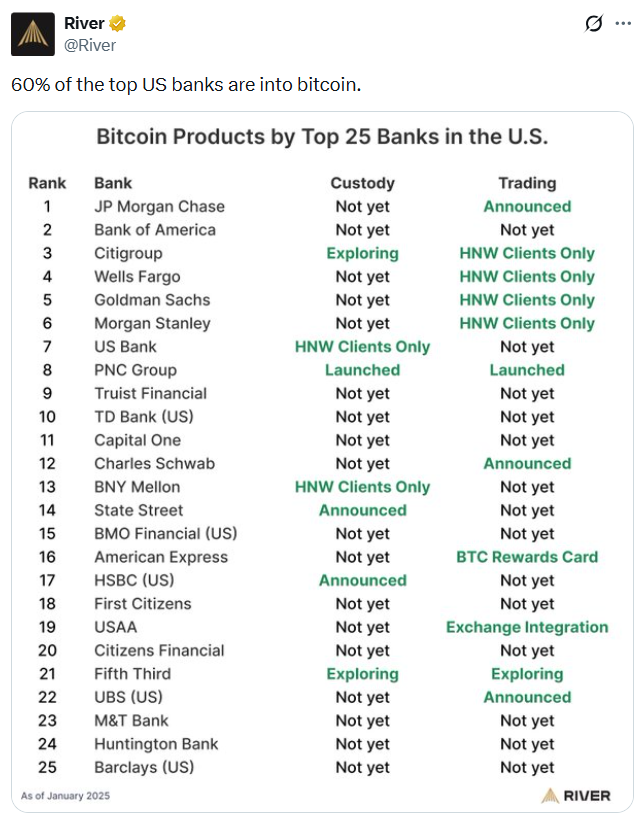

According to River, a company specializing in Bitcoin financial services, more than half of the leading banks in the United States have either begun providing or announced intentions to offer Bitcoin-related products such as trading and custody solutions.

In a post on X this past Monday, River revealed that out of the top 25 US banking institutions, approximately 60% are now engaged with Bitcoin initiatives.

Brian Armstrong, CEO of crypto exchange Coinbase, shared insights from his attendance at the Davos World Economic Forum held in Switzerland from January 19 to January 23. He noted a growing openness among banking executives toward cryptocurrencies.

Armstrong mentioned that while some banking leaders remain cautious, many are highly supportive of crypto and view it as an important opportunity. One CEO from a top ten global bank even described cryptocurrency as their primary focus and an existential priority for their institution.

Source: River

Historically, certain US banks faced criticism for being anti-crypto and were allegedly involved in efforts like Operation Chokepoint 2.0—a government initiative aimed at restricting financial services to cryptocurrency businesses.

The Big Four Banks: Three Embracing Crypto

The latest addition to River’s roster is Swiss banking powerhouse UBS, which also operates within the US market. Bloomberg reported on Friday that UBS is considering offering Bitcoin (BTC) and Ether (ETH) trading options exclusively for its wealthiest clientele.

Among America’s “Big Four” banks: JPMorgan Chase has expressed interest in launching crypto trading platforms; Wells Fargo currently provides institutional clients with services including loans backed by Bitcoin holdings; Citigroup is exploring custody solutions tailored for institutional investors holding cryptocurrencies.

Together these three institutions manage assets exceeding $7.3 trillion according to Forbes data.

Despite these advancements though, skepticism remains prevalent regarding certain aspects of digital assets—particularly yield-generating stablecoins—which many bankers fear could introduce systemic risks into traditional finance systems.

A Number Of Major Banks Remain Hesitant

The fourth member of the Big Four group—Bank of America—and ranked second largest bank nationwide by asset size ($ over 2.67 trillion), has yet to declare any concrete plans related to Bitcoin offerings per River’s report.

Additionally, other sizable players such as Capital One ($694 billion assets) and Truist Bank ($536 billion assets) have not publicly shown interest towards integrating cryptocurrency services so far either according to Forbes rankings data available today.