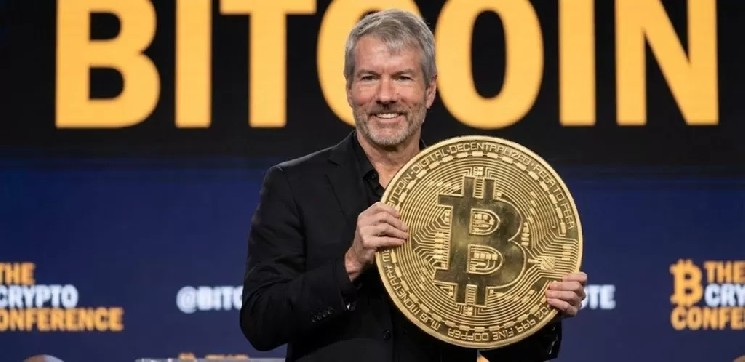

Michael Saylor, the founder of Strategy, has once again made headlines by sharing insights about Bitcoin with his followers.

In a recent update on X, Saylor referred to “the continuously advancing orange wave,” which many in the market interpreted as a signal that Strategy might be gearing up for another increase in its Bitcoin investments.

The company has a history of announcing its latest Bitcoin acquisitions shortly after such posts. In these communications, the term “orange” is often associated with BTC purchases.

Current figures reveal that Strategy’s Bitcoin holdings are valued at approximately $62.88 billion. The firm possesses 709,715 BTC, acquired at an average price of $75,980 each. Given current market prices, this position reflects a profit margin of 16.6%, translating to unrealized gains estimated around $8.95 billion.

A comparative analysis over the past year positions Strategy and BTC against established players in traditional markets. Alphabet tops this comparison with an impressive growth rate of 71% over the last year; NVIDIA follows closely at 58.5%. The NASDAQ-100 index saw an increase of 21.1%, while the S&P 500 rose by 15%. Tesla’s stock climbed by only 13%, whereas Bitcoin experienced a decline of 13.6% during this timeframe—Strategy shares suffered even more significantly with a drop of 53.9%. This data underscores how much more volatile company stocks can be compared to fluctuations in Bitcoin prices.

Conversely, when looking at volatility rankings from the past month, Strategy shares lead with an astonishing rate of volatility at 49%. In contrast, Bitcoin’s volatility was recorded at just 31.5%, while other major tech stocks like Tesla (29.4%) and Meta (24%) also exhibited considerable fluctuations during this period.

*This content does not constitute investment advice.