As of 12 p.m. EST on January 24, 2026, Bitcoin is valued at $89,166 per coin. The derivatives market reveals a complex landscape beneath the surface, with futures leverage easing and options traders showing selective optimism. Meanwhile, liquidation figures indicate that excessive positions are still being unwound.

The Complex Landscape of Bitcoin Derivatives

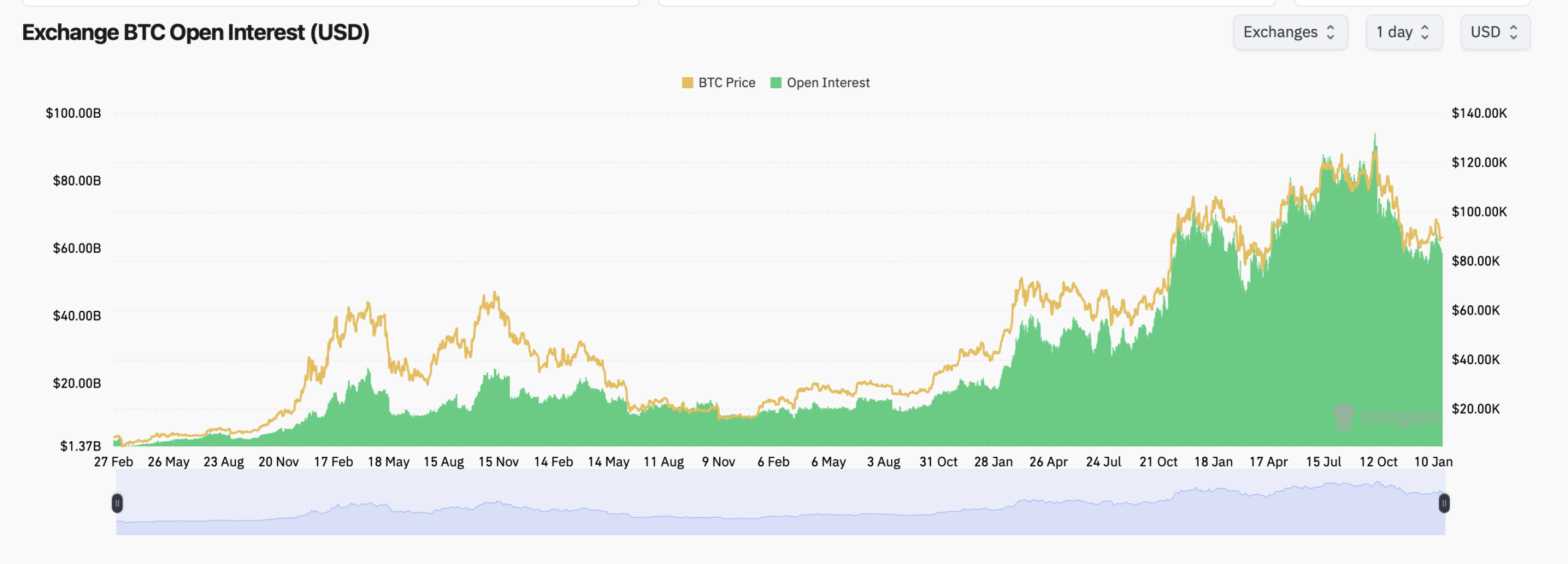

According to coinglass.com data, the total open interest in Bitcoin futures across all platforms is approximately 656,880 BTC—equivalent to around $58.64 billion in nominal value. Although open interest saw a slight increase of 0.20% over the last hour, it declined by nearly 2.89% within the past day. This trend points toward a broader reduction in leverage rather than aggressive new market entries.

Binance leads among futures exchanges with about 135,340 BTC in open interest; CME follows closely with roughly 124,740 BTC held open. CME’s near-19% share underscores strong institutional involvement while Binance remains dominant for retail directional trades and proprietary strategies.

Short-term positioning across various exchanges shows mixed adjustments: Bybit and Gate have seen notable increases over four hours whereas Binance and CME experienced modest declines during the same timeframe—highlighting that traders are repositioning cautiously rather than aggressively re-entering markets.

Data from cryptoquant.com on liquidations further supports this cautious stance: mid-January witnessed sharp spikes in long liquidations exceeding $300 million on several days—with one event surpassing half a billion dollars—typically coinciding with price dips as leveraged longs were forced out amid weakening momentum.

Although short liquidations were less pronounced but still significant (multiple instances above $150 million), their lower frequency compared to longs indicates downside volatility has inflicted greater damage than upward moves—a clear sign that overconfidence continues to be penalized by market dynamics.

The order flow also reflects this guarded sentiment; bitcoin’s taker buy-sell ratio hovers below neutral at about 0.96 — signaling persistent selling pressure outweighs aggressive buying activity despite brief earlier-month surges above parity where buyers briefly dominated.

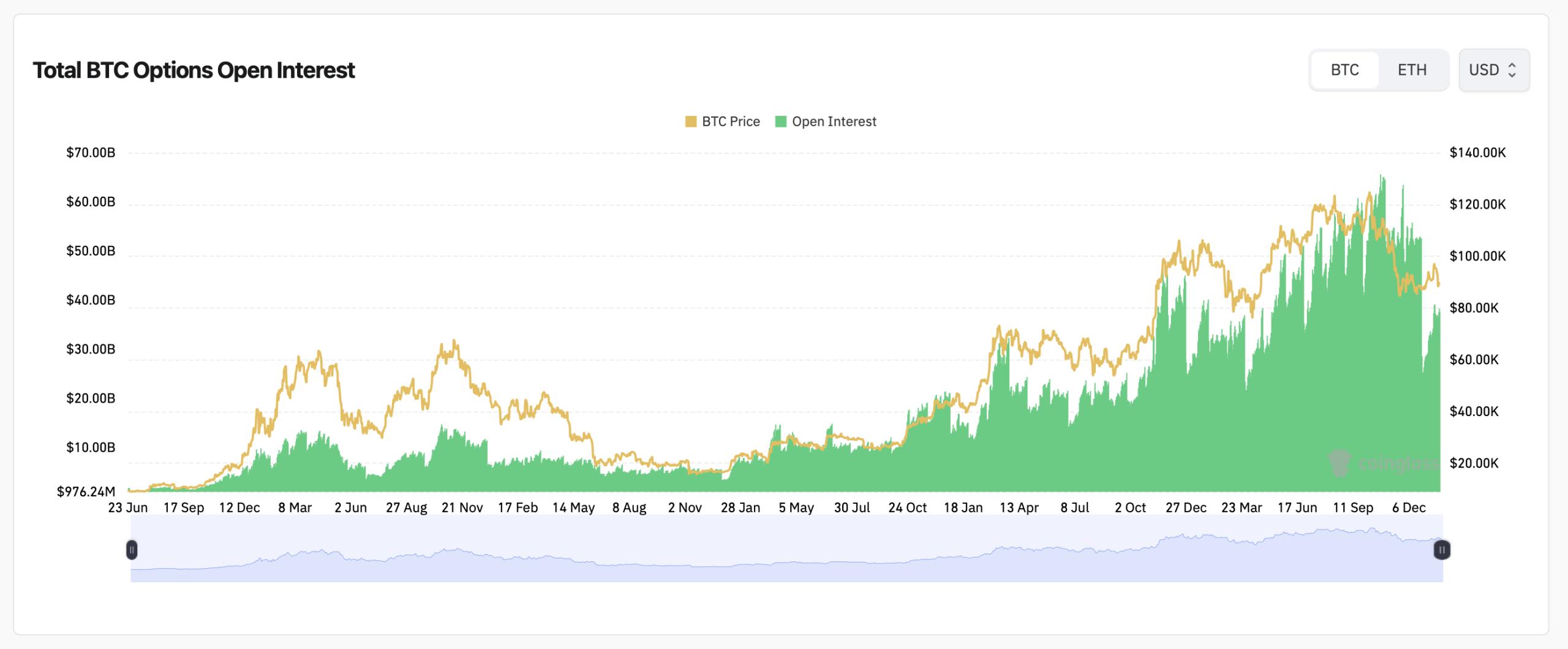

The options arena paints a more layered picture: total bitcoin options open interest remains high with calls making up roughly 57.7% of outstanding contracts versus puts at around 42.3%. On a daily volume basis this call dominance grows stronger (over 62%), suggesting participants remain inclined toward upside bets but prefer defined risk parameters through option structures.

A concentration of strikes reveals heavy demand for longer-dated calls priced above $100K particularly on Deribit exchange alongside protective puts clustered under $90K — implying expectations for ongoing volatility even if immediate price movements stay limited or range-bound.

Also read: Bitwise Introduces Bitcoin-Linked Debasement ETF as Hedge Against Dollar Weakness

An analysis of max pain levels offers additional insight: Deribit’s max pain hovers near $90K for upcoming expiries while Binance shows slightly higher max pain zones within low-to-mid-$90Ks range; OKX aligns similarly close to current prices around $90K — collectively indicating these levels may act as stabilizing anchors amid option expiry cycles.

Taken together these signals suggest bitcoin derivatives markets are undergoing measured recalibration instead of panic-driven sell-offs: futures leverage is diminishing steadily; liquidation events continue clearing residual risks; meanwhile options players maintain selective bullishness betting on volatility without complacency or reckless exposure.

Frequently Asked Questions ❓

What does current bitcoin futures open interest indicate? Daily declines point towards deleveraging rather than fresh leveraged inflows into bitcoin futures positions.

Why do long liquidations dominate recent activity? Price retracements have disproportionately impacted highly leveraged long holders compared to shorts.

Are options traders optimistic or pessimistic right now? The skew towards call contracts suggests cautious optimism combined with controlled downside risk management.

What implications does max pain have for bitcoin pricing? Max pain clustering near $90,000 could provide short-term support acting as an equilibrium zone during option expiries.