During a recent episode of the What Bitcoin Did podcast, Michael Saylor, the chairman of Strategy, defended companies that hold Bitcoin in their treasury against various criticisms.

When asked about smaller firms that raise capital through equity or debt to invest in Bitcoin (BTC), Saylor emphasized that the choice hinges on how companies allocate their capital. He argued that firms with surplus cash should consider investing it in Bitcoin rather than keeping it in Treasury securities or distributing it back to shareholders.

Saylor likened corporate treasury management to individual investment strategies, noting that while ownership stakes may differ across businesses, the fundamental rationale for holding BTC remains logical regardless of a company’s size or operational model.

The chairman also challenged the notion that unprofitable enterprises deserve special scrutiny. He suggested that having Bitcoin assets could mitigate poor financial performance. “If a company is losing $10 million annually but gains $30 million from its Bitcoin investments, haven’t I just improved its financial health?” he remarked.

Saylor (left) converses with Danny Knowles on Monday’s What Bitcoin Did podcast. Source: YouTube

Saylor further differentiated between purchasing Bitcoins and other uses for excess funds. He claimed stock buybacks and low-yield Treasury investments can exacerbate challenges for struggling businesses. “Repurchasing shares in an unprofitable company only accelerates your losses,” he stated, asserting instead that investing in Bitcoin presents a significantly different risk-reward scenario for corporate finances.

The chairman noted how companies holding Bitcoins often face stricter judgment compared to those who choose not to engage with this asset class at all: “The crypto community tends to be critical of its own,” he said and added:

You seem comfortable allowing 400 million firms not to invest in BTC while criticizing just 200 who have chosen otherwise.

Strategy began acquiring Bitcoins back in 2020 and has since become the largest corporate holder of cryptocurrency. As per data from BitcoinTreasuries.NET, they currently possess 687,410 BTC.

An Increase In Public Companies Adopting BTC as Treasury Asset

The trend toward adopting BTC as part of treasury strategies gained momentum throughout 2025 as more publicly traded entities incorporated it into their long-term asset portfolios.

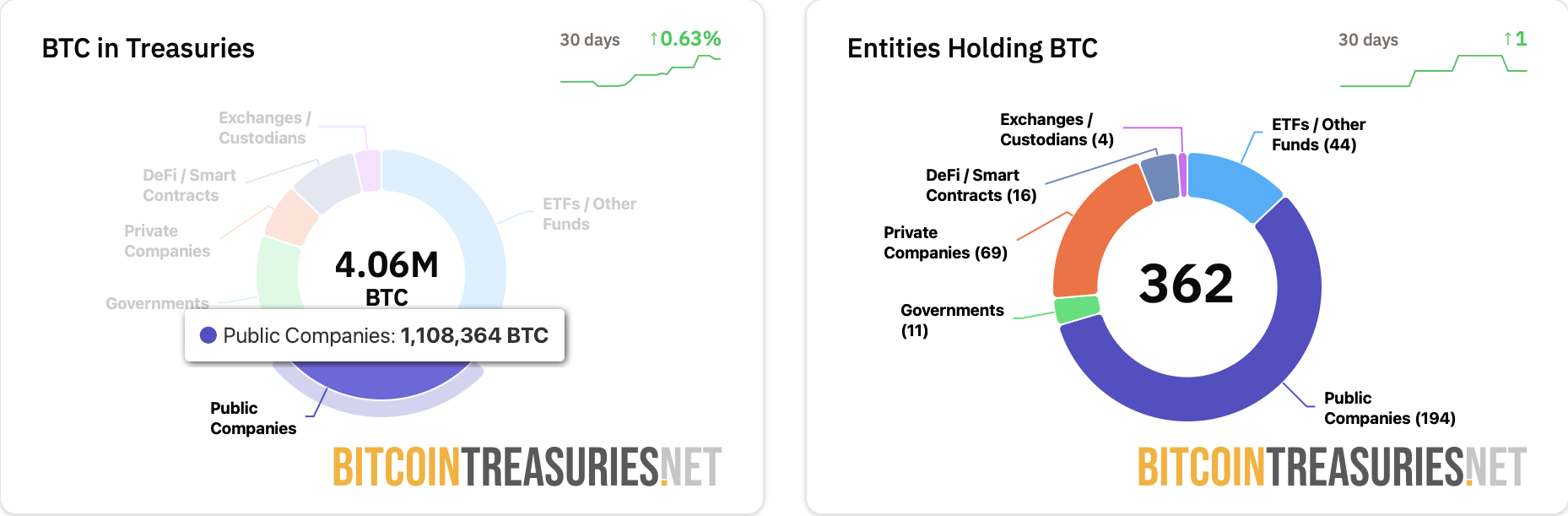

As reported recently, public corporations collectively held around 1.1 million BTC, which accounts for approximately 5.5% of all coins currently available—19.97 million total.

Source: BitcoinTreasuries.NET

This past year saw many companies adopt treasury strategies despite facing less favorable market conditions.

Markus Thiele from 10x Research pointed out how numerous digital asset treasuries experienced declines in net asset values during November which hindered fundraising efforts and left existing investors grappling with increasing paper losses.

A report by Cointelegraph indicated a slowdown regarding new corporate adoptions towards end-2025; only about 117 firms integrated BTC reserves within this timeframe.

Nevertheless , ownership among corporations remains highly concentrated , exemplified by MARA Holdings possessing approximately53 ,250 BTC onitsbalance sheetandTwentyOneCapitalholding43 ,514 BTC secondonlytoStrategy .

Top20Bitcointreasurycompanies.Source:BitcoinTreasuries.NET