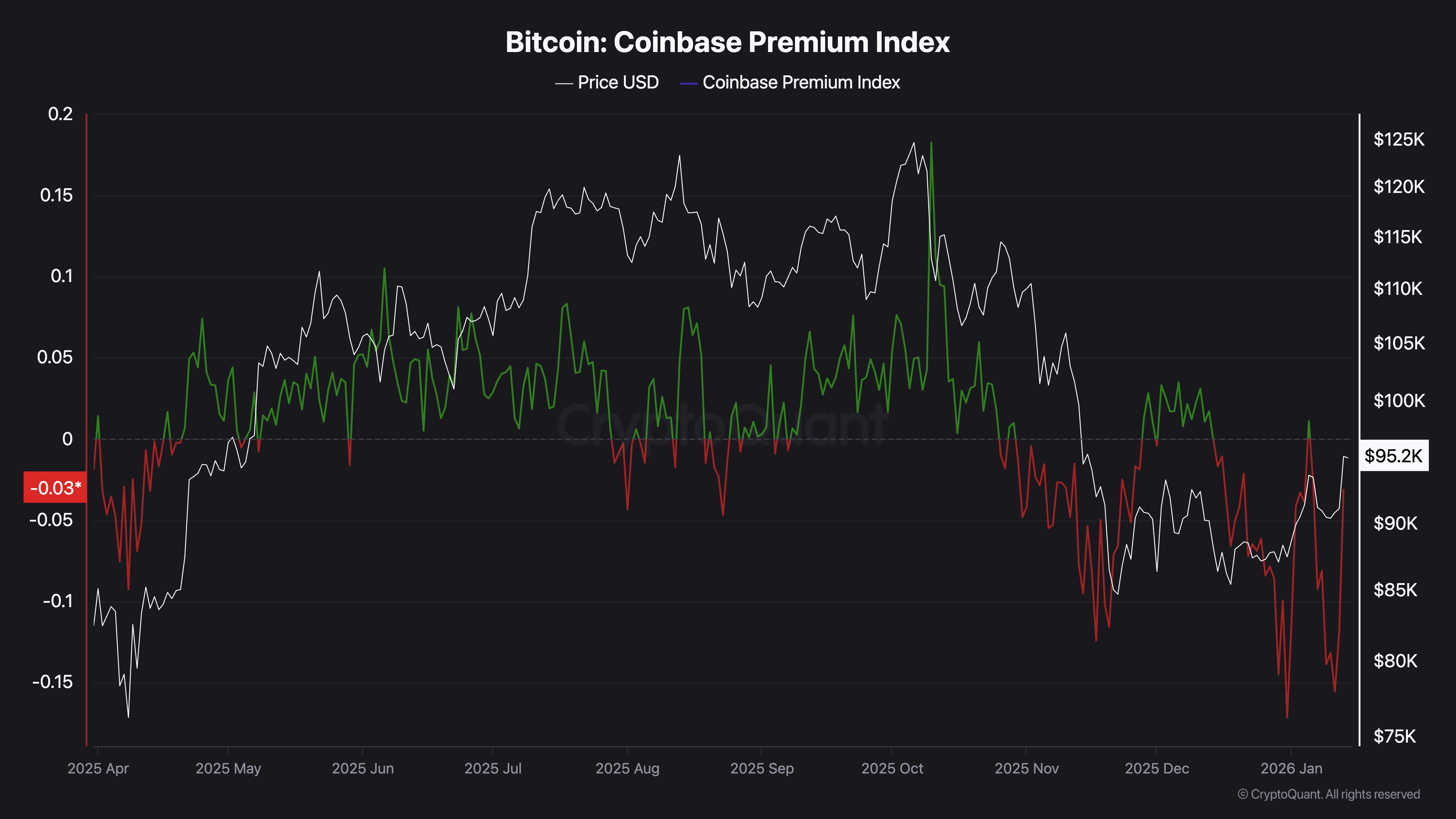

The price of Bitcoin, currently at BTC$95,174.77, reached a two-month peak above $95,000 on Tuesday. However, it appears that U.S. investors are not purchasing as aggressively as their international counterparts. A significant indicator known as the “Coinbase Premium” highlights this disparity.

This indicator assesses the difference in Bitcoin prices between Coinbase—a cryptocurrency exchange listed on Nasdaq—and Binance, which is recognized globally for its high trading volume and open interest. Presently, Bitcoin is priced lower on Coinbase compared to Binance despite an overall increase in prices. This trend suggests that there may be more selling activity among American investors than buying.

Phemex, a crypto exchange based in Singapore, noted in a blog post that “a negative premium indicates lower Bitcoin prices on Coinbase relative to the global average,” which points to considerable selling pressure and possible capital outflows from the U.S. market.

Traditionally, demand from U.S. investors has been a driving force behind significant rallies in Bitcoin’s price; this was particularly evident following President Trump’s reelection in November 2024 and subsequent favorable regulatory developments during his administration.

Bitcoin’s Coinbase Premium Index (CryptoQuant)

The accompanying chart illustrates how the Coinbase premium peaked alongside Bitcoin’s price in October but turned negative by early November—an indication of weak demand from U.S.-based investors since then.

It seems that American traders might be adopting a wait-and-see approach regarding the Clarity Act—a proposed legislation aimed at clarifying regulations surrounding cryptocurrencies—as they anticipate its passage before making further investments. The Senate has postponed critical discussions about this act until late January to garner bipartisan support.

Some analysts predict that if this act becomes law, it could pave the way for new all-time highs for Bitcoin.