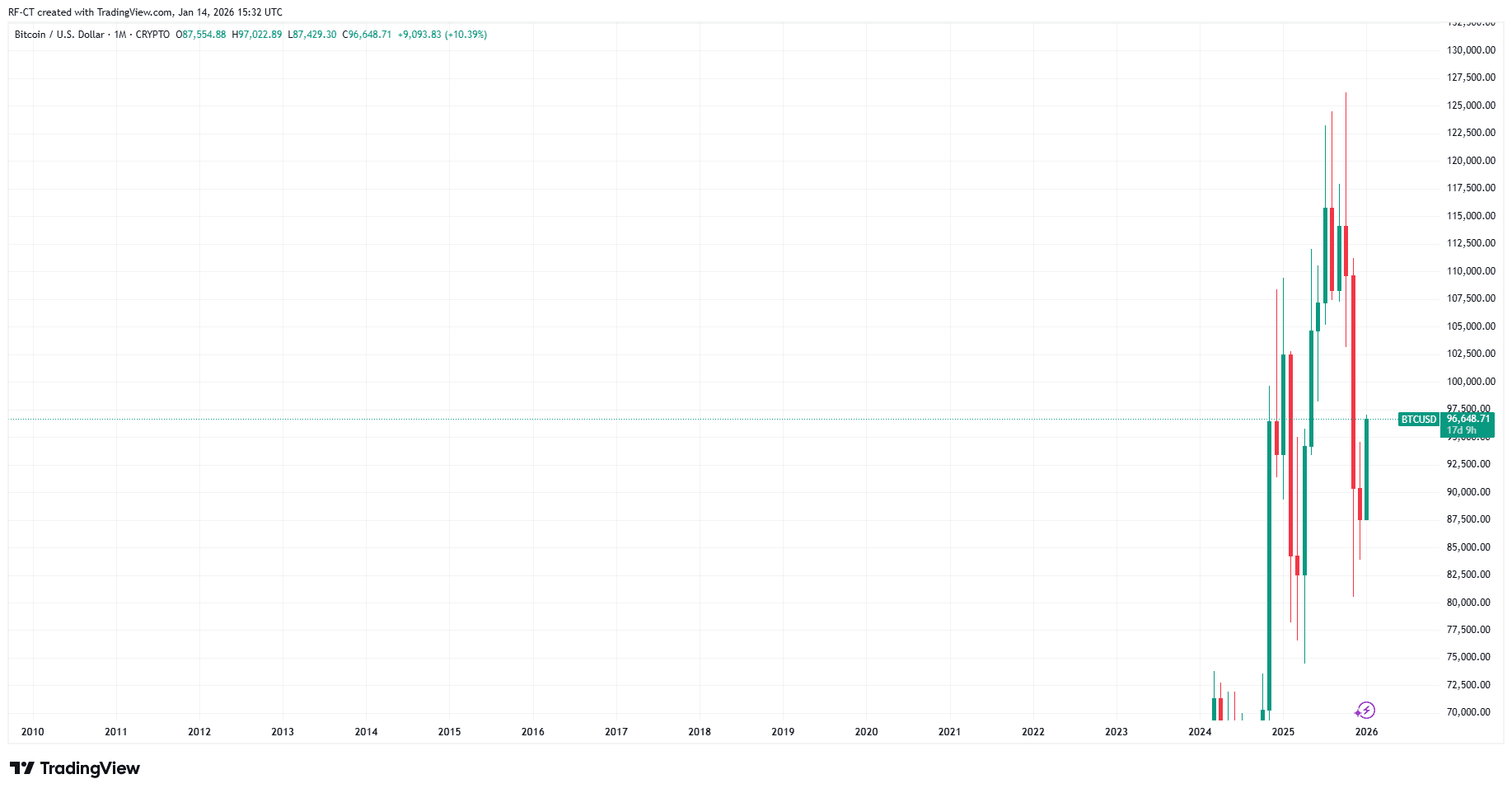

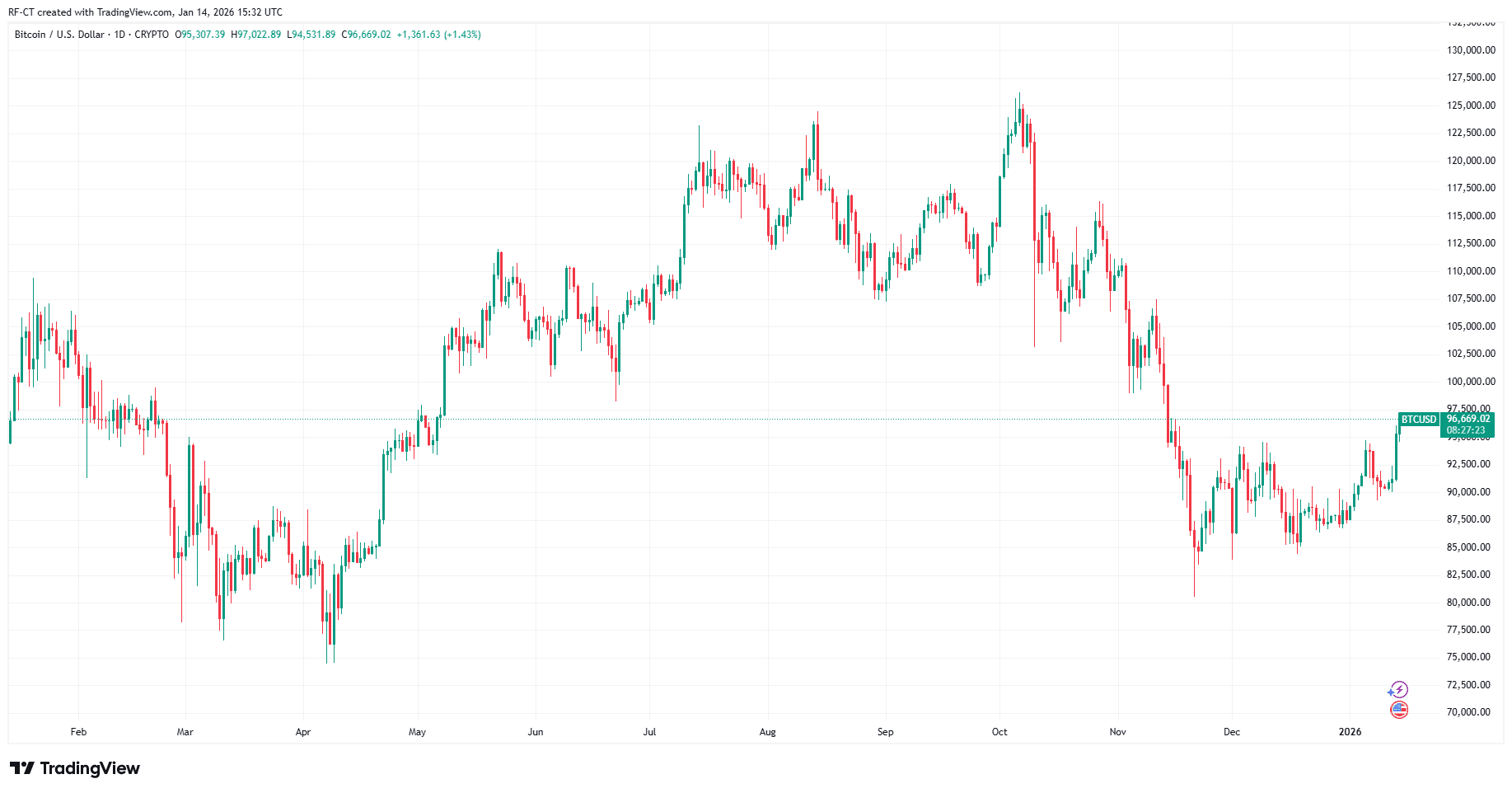

In early 2026, Bitcoin has surged with renewed vigor after surpassing the $97,000 mark. This upward movement was fueled by the US Supreme Court’s decision to delay ruling on President Trump’s tariff case, which alleviated a significant political uncertainty. As a result, risk assets rallied strongly, propelling Bitcoin closer to its next psychological benchmark of $100,000.

Reasons Behind Bitcoin’s Renewed Rally

The recent surge in Bitcoin prices is attributed to a blend of macroeconomic relief and robust technical signals.

Investors had been cautious ahead of the anticipated tariff verdict. When no immediate ruling came through, market uncertainty eased momentarily, sparking a swift rotation back into higher-risk investments.

This translated for Bitcoin into:

- A risk-on sentiment driven by relief

- An acceleration in short position liquidations fueling momentum

- Strong buying pressure breaking past previous resistance levels

With bullish trends already forming prior to this news event, Bitcoin swiftly took advantage of improved investor confidence.

A Technical Perspective: Aggressive Bullish Price Action

From an analytical viewpoint, the price behavior of Bitcoin confirms strengthening momentum.

- A decisive breakout above the resistance range between $95,000 and $96,000

- Sustained upward movement toward around $97,000

- Lack of significant retracement despite increased volatility levels

If prices remain above mid-$96K territory, this bullish structure supports further gains ahead.

The Road Toward The $100K Milestone

The regained momentum positions the coveted $100K level as the primary target for traders and investors alike.

- An expected continuation pushing prices between approximately $98,500 and just under $99,500 in the short term;

- A brief consolidation phase below that round number would be healthy for sustaining strength;

- Pulled-back moves that hold key support zones will likely keep bulls favored over bears;

This price action does not indicate exhaustion but rather suggests growing acceptance at elevated valuations within market participants’ mindset.

The Next Steps For Bitcoin Market Participants

- Sustaining levels above roughly $96,&500 remains critical;

- No emergence of adverse macroeconomic or political developments is essential;

- Broad-based resilience across other risk-sensitive markets will help maintain positive momentum.;

If these conditions persist , buyers could continue driving price action higher , eyeing psychologically important thresholds .

Outlook For The Cryptocurrency Market

With inflationary pressures largely priced in and immediate political uncertainties deferred , bitcoin has reclaimed its role as a leading asset class . Although volatility may stay elevated , current structural factors favor ongoing advances rather than pullbacks . The advance toward one hundred thousand dollars is no longer hypothetical — it is actively unfolding before our eyes .