Last week, Strategy (previously known as MicroStrategy) made significant acquisitions of bitcoin (BTC), yet the amount of BTC held per share by shareholders has actually decreased compared to a few months ago.

On January 5th, Strategy reported having 345,632 assumed diluted shares outstanding for MSTR. By Sunday, following last week’s BTC purchase, this number rose by 1.9% to reach 352,204 shares.

During the same period, the company’s bitcoin holdings grew only slightly—by about 2.0%—from 673,783 BTC to 687,410 BTC.

This time around, unlike previous transactions where dilution was more beneficial for shareholders in terms of value accretion—a metric tied closely to founder Michael Saylor’s commitment to generating long-term shareholder value—the dilution effect was barely noticeable at just one-tenth of a percent.

A mere increase of 0.1% hardly compensates for the steep decline in MSTR’s stock price which has dropped roughly 28% over the past two months. Shareholders have faced not only losses in USD terms but also experienced non-accretive dilution during this timeframe; consequently they now hold less bitcoin per share than they did back in mid-November 2025.

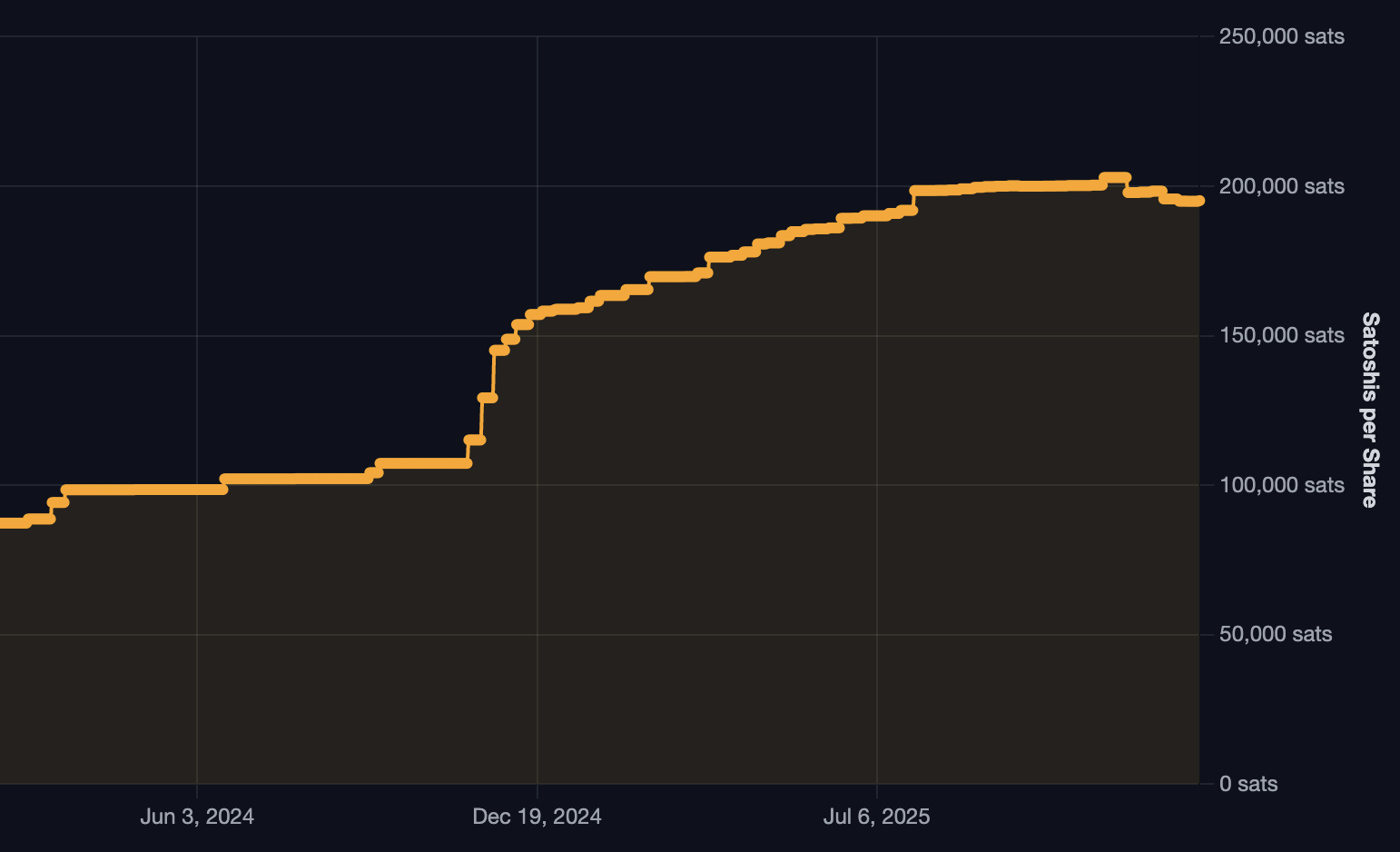

The quantity of Bitcoin ‘satoshi’ units allocated per MSTR share declined in November for the first time since spring of 2024 according to data from StrategyTracker.com.

Interestingly enough, less than ten percent of this recent bitcoin acquisition was financed through selling STRC tokens—a move that does not immediately dilute existing MSTR shareholders’ stakes.

The vast majority—over ninety percent—of funds used for purchasing additional BTC came directly from issuing new MSTR shares and thus diluting current investors’ ownership percentages.

Instead of boosting investor confidence about Strategy’s underlying business prospects and driving up its stock price relative to its Bitcoin assets’ value (known as premium), Michael Saylor’s common stock has plummeted close toward trading at par with its net Bitcoin holdings—that is zero premium above their crypto assets’ worth.

This downturn followed several setbacks: breaking a prior pledge not to allow dilution below a multiple-to-Net Asset Value (‘mNAV’) ratio threshold set at 2.5x; drastically cutting earnings forecasts by no less than seventy-six percent; and opting instead to dilute equity capital primarily aimed at acquiring cash rather than more bitcoins—all contributing factors leading the company into losing tens of billions off its market capitalization valuation.

Even worse is that as recently as last week both market capitalization and enterprise value hovered around or fell beneath total Bitcoin asset values alone — implying investors assign no positive expectations regarding Strategy’s core business operations beyond holding cryptocurrency reserves itself.

‘Ppeople shouldn't buy BTC? Is that what you're trying to say?’

This morning featured an episode on one highly regarded Bitcoin podcast where Michael Saylor appeared amidst growing concerns over waning enthusiasm toward his firm along with poor performance across companies managing large BTC treasuries — sectors strongly promoted by Strategy itself.

The host Danny Knowles asked pointed questions: “Ppeholders invested into other treasury companies are facing severe losses,” he said. “Is there any realistic path back towards achieving even parity — a one times mNAV valuation?”

<em>Read more: How strategy’s bitcoin premium disappeared when mNAV hit parity</P&gT;

Saylor firmly rejected such criticism stating, “I don’t accept those arguments.” He continued:

“You chose voluntarily when investing into our company — why would you do otherwise?”

“My issue lies with assuming it makes sense that four hundred million companies choose NOT TO BUY BITCOIN—and somehow that’s acceptable—but then criticizing two hundred companies who DID invest in it—is supposed brilliance?”

“How can ignoring all those who abstain while targeting those who participate be considered insightful?”

“Essentially you’re faulting someone simply because they bought equity at an unfavorable moment.”

“The real question should focus on decision-makers behind investments since corporations themselves don’t control their stock prices,” he added.

“So Danny my point remains clear – are you suggesting people shouldn’t buy Bitcoin? Is that your message?”