Today, retail Bitcoin traders made a significant impact, leading to $700 million in cryptocurrency liquidations. Despite continued institutional purchases, BTC’s price plummeted by approximately $4,000 amid heightened on-chain activity.

The future trajectory of BTC remains uncertain; however, understanding these market dynamics is crucial. While corporate liquidity holds substantial sway over the market, it does not solely dictate price movements.

Unexpected Liquidations Triggered by Bitcoin

This week saw Bitcoin achieve two consecutive all-time highs, sparking some unease within the community. Institutional investors fueled this growth despite minimal retail participation.

Notably, corporations maintained their substantial acquisitions even as BTC’s value soared.

This situation has raised concerns that such inflows might significantly disrupt traditional market cycles. Arthur Hayes declared that the four-year cycle was obsolete and global institutional liquidity would now govern token prices.

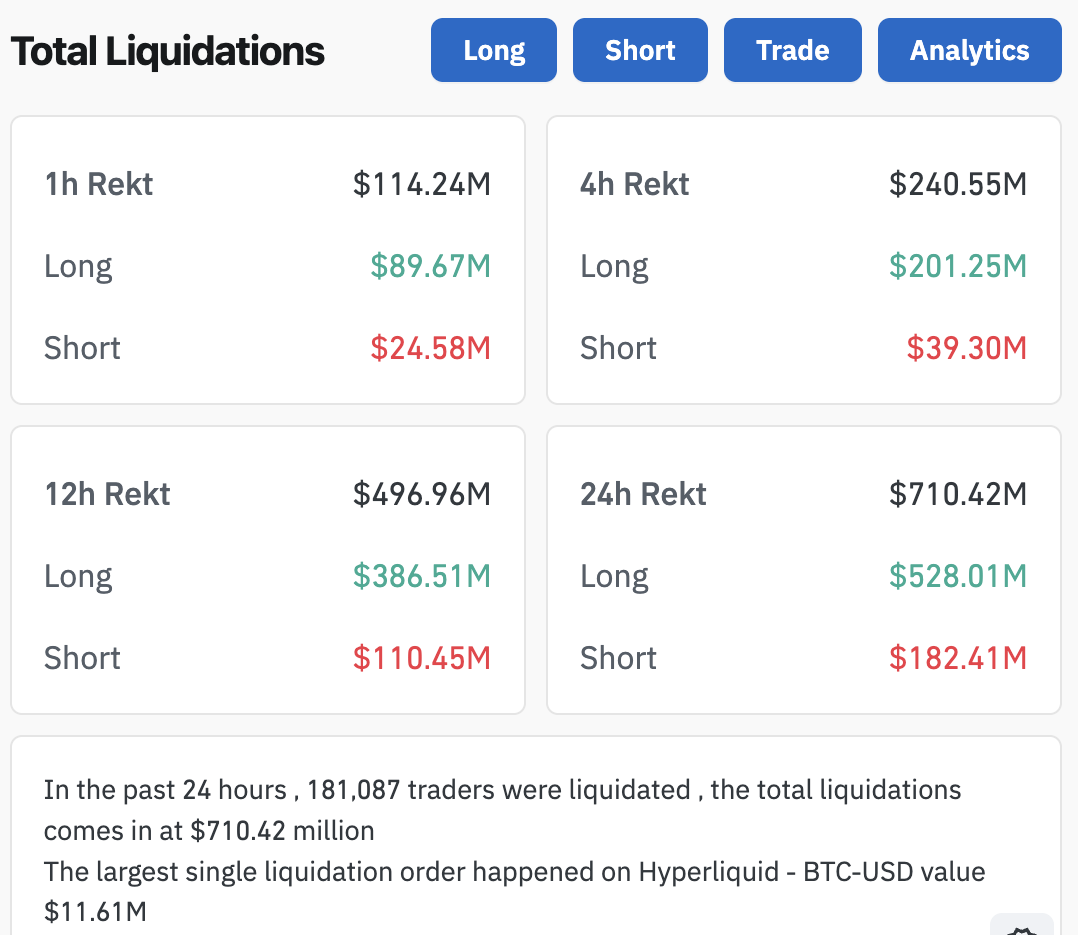

However, today’s developments have somewhat alleviated these worries. In the past 24 hours alone, Bitcoin experienced a $4,000 drop resulting in widespread crypto liquidations totaling over $114 million in short positions within just one hour:

Bitcoin Drops Cause Liquidations Source: CoinGlass

The Influence of Retail Traders

A few key indicators suggest retail traders were behind these extensive liquidations. For instance, ETF issuers continued acquiring BTC at high rates while witnessing significant product inflows. Simultaneously, BTC’s on-chain trading activity surged between 4% & 5%, indicating increased engagement.

Analysts have pinpointed several potential reasons for Bitcoin’s decline to $120K, sparking such liquidation events. These include typical price actions like long-term profit-taking or holder accumulation rates causing diminished confidence among investors.

Additionally, evidence suggests an imminent rebound for BTC may be possible.

This scenario presents valuable opportunities for collecting insightful market data since emerging structural forces possess considerable power but aren’t entirely dominant yet either way around!”””

Retail activity led directly towards major downward pressure upon a cascade effect involving multiple liquidation instances occurring simultaneously across various platforms globally – What new narratives can help explain behavior patterns observed recently enabling accurate predictions moving forward?

Whether upward/downward trends persist further into foreseeable future remains open-ended question worth exploring thoroughly amongst active trader communities worldwide given current circumstances surrounding ongoing institutional stockpile efforts regardless outcome achieved ultimately during course next few months ahead…

$100 Million Lost One Hour:

“Rampaging Liquidation Events Unleashed Following Sudden Drop In Value Occurred Earlier Today!”

– BeInCrypto