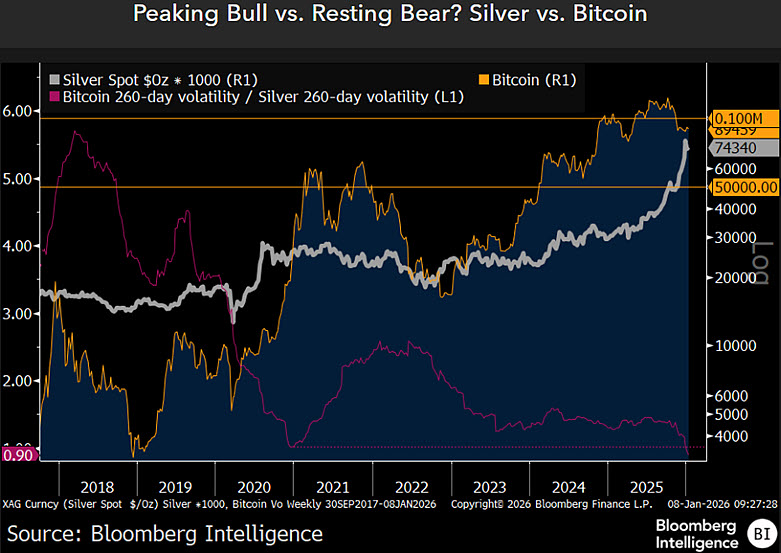

Once again, silver is taking the lead in speculative investments, while Bitcoin appears to be biding its time for a potential resurgence. According to Mike McGlone from Bloomberg Intelligence, the ratio of Bitcoin to silver is nearing a significant threshold of 1,000x. This level was previously reached during the market corrections in 2018 and 2020; however, it currently faces pressure as U.S. stocks remain significantly overvalued.

The S&P 500 index stands nearly 10% above its average over the past two hundred days, with the market capitalization-to-GDP ratio at historically high levels. This situation is driving investment towards tangible assets like silver while leaving riskier assets such as cryptocurrencies starved for capital.

In essence, although silver thrives amidst stock market exuberance, Bitcoin finds itself increasingly undervalued. A comparison chart between BTC/XAG and the U.S. market cap-to-GDP illustrates this growing disparity clearly.

2026 Could Mirror 2021—But In Reverse

McGlone cautions that we might see a reversal of fortunes in 2026 compared to what occurred in 2021. The recent surge of silver reaching up to 2.25 times its long-term moving average has only been observed during previous parabolic surges; notably this spike occurs while Bitcoin remains below its own critical threshold of equivalence at around one times its average value. This widening gap suggests that metals and cryptocurrencies are experiencing different levels of risk.

The fundamental scenario? A soft landing where silver could pull back toward $50 and Bitcoin may find itself returning to $50,000—a perspective that doesn’t paint an optimistic picture for either asset but rather serves as a reality check on their current standings. Ultimately, it implies that while silver’s strong performance may not be sustainable indefinitely, Bitcoin’s lackluster showing might not be entirely justified either.

At present momentarily favors Silver’s robust performance which could stem from emotional trading dynamics; conversely, Bitcoin’s relative stagnation might indicate institutional investors are adopting a wait-and-see approach regarding future developments.