On January 9, Bitcoin experienced a rapid climb toward the $92,000 mark following the U.S. Supreme Court’s decision to postpone its ruling on the Trump administration’s reciprocal tariffs. However, this surge was short-lived as prices quickly pulled back, causing approximately $20 million in liquidations and settling Bitcoin back into its familiar trading range between $90,000 and $92,000.

Bitcoin Rallies Amid Supreme Court Delay

The cryptocurrency market saw Bitcoin push close to $92,000 on January 9 amid heightened anticipation surrounding the Supreme Court’s deferment of a critical verdict concerning the legality of tariffs imposed during Trump’s presidency. This momentary boost came after Bitcoin had dipped below $90,000 earlier that day due to reports indicating that major centralized exchanges had sold off roughly $3 billion worth of BTC.

Despite this initial upswing offering some optimism for investors, by early afternoon EST Bitcoin sharply reversed course. The swift decline erased most gains from the court-related optimism and triggered a wave of liquidations totaling around $20 million within just four hours. Ultimately, BTC retreated into its established consolidation band ranging from $90K to just under $92K—a zone it has consistently hovered around over recent days.

Leading up to what turned out to be an anticlimactic session for traders and analysts alike was speculation about potential outcomes: if ruled against the administration’s tariffs, refunds estimated between approximately $133 billion and up to nearly $140 billion could flood markets with liquidity. Advocates for this scenario believe such an influx might provide enough momentum for Bitcoin to break through psychological resistance at the six-figure level.

Concerns Over Broader Market Risks

On the flip side are voices cautioning that invalidating these tariffs might trigger widespread disruption across U.S. equities and bond markets due to fears over rising budget deficits leading investors toward safer assets—potentially dragging cryptocurrencies down alongside traditional financial instruments during such risk-off episodes.

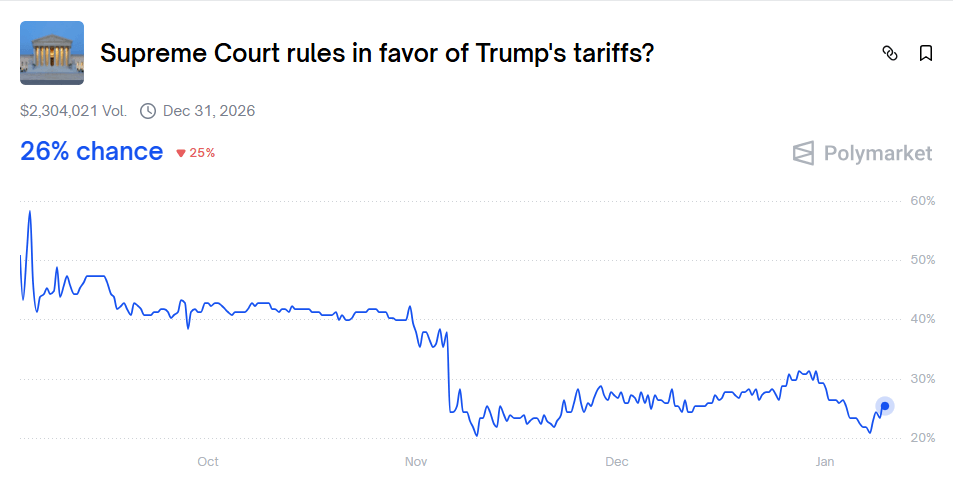

The Supreme Court is now anticipated to announce its decision by January 14; meanwhile sentiment indicators have shifted somewhat following postponement news. Some market participants interpret this delay as uncertainty among justices—particularly given their conservative majority—about dismantling one of Trump’s key trade policies outright. This interpretation aligns with odds movements seen on platforms like Polymarket where chances of tariff continuation rose modestly from about 21% on January 7 up near 26% post-delay announcement.

Despite prevailing uncertainties regarding legal outcomes—and their economic ramifications—the consensus among many analysts remains that these levies will eventually be struck down by courts dealing a blow against current trade frameworks upheld by previous administrations. Nevertheless officials hint President Trump may resort instead to other executive authorities like Section 301 or Section 232 powers should he need alternative means for enforcing duties going forward.

From a technical perspective within crypto circles today,the price corridor between ninety thousand dollars ($90k) through ninety-two thousand dollars ($92k) acts as a significant volume “magnet.” Traders expect BTC prices will remain confined here until at least five days post-ruling date—with any temporary breakout attempts likely viewed skeptically until definitive clarity arrives after January fourteenth (1/14).

Frequently Asked Questions ❓

Why did bitcoin approach nearly ninety-two thousand dollars ($92K) on Jan ninth?

It surged following news that America's highest court delayed ruling related issues surrounding reciprocal tariffs implemented under former President Trump's administration.

What caused bitcoin's sharp fall later in day?

A cascade of liquidations wiped out twenty million US dollars (&$20M;) worth short positions pushing price back inside established range between &$90K;& &$92K;

If decided against tariffs how might global crypto markets react?

Potential refunds totaling upwards near one hundred forty billion US dollars (&$140B;) could inject liquidity boosting assets including bitcoin—but contagion risks affecting American stocks may simultaneously pressure digital currencies downward amid broader sell-offs.

Date expected when supreme court delivers verdict?

Judgment is scheduled for Jan fourteenth (1/14), considered pivotal catalyst potentially breaking bitcoin free from current sideways movement pattern.