US credit markets are currently experiencing unprecedented strength, yet Bitcoin is struggling to attract new investment—a contradiction that highlights the challenges facing the cryptocurrency sector today.

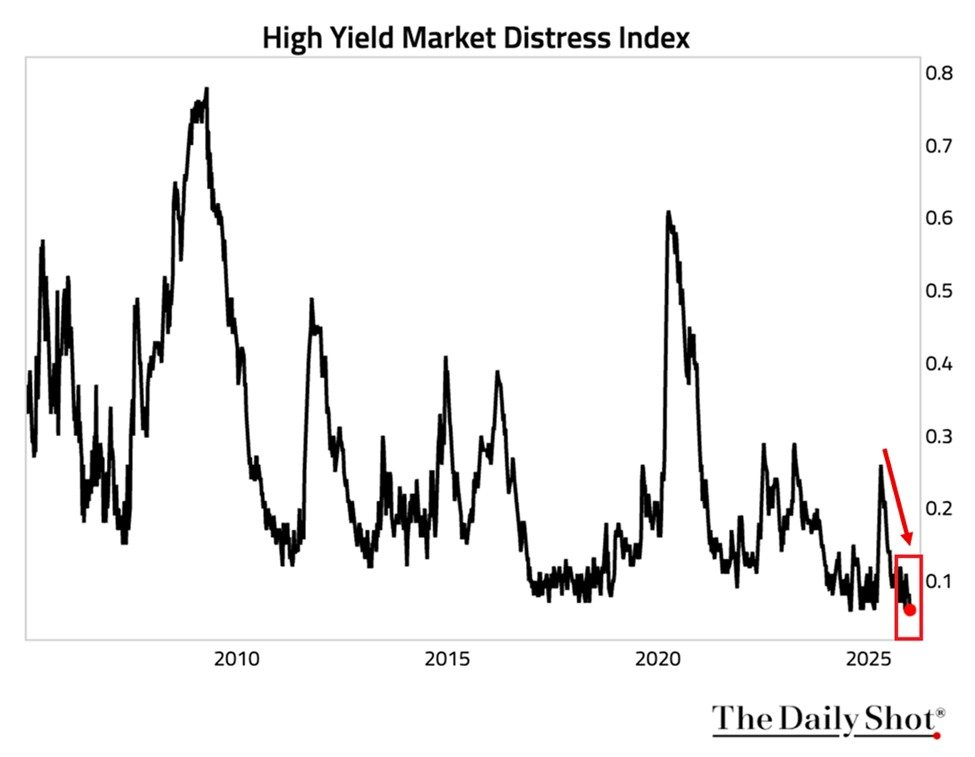

The high-yield distress index from the New York Federal Reserve has dropped to an all-time low of 0.06 points. This indicator assesses stress in the junk bond market by evaluating liquidity, market efficiency, and corporate borrowing conditions.

Credit Markets Flourish While Capital Flows Elsewhere

To put this into perspective, during the 2020 pandemic-induced market chaos, this index spiked above 0.60 and nearly reached 0.80 amid the 2008 financial crisis. The current figure signals exceptionally favorable circumstances for risk assets.

The optimism is mirrored by high-yield corporate bond ETFs like HYG, which have posted gains for three consecutive years with roughly a 9% return projected for 2025 according to iShares data. Under normal macroeconomic assumptions, such robust liquidity and appetite for risk should also boost Bitcoin and other cryptocurrencies.

However, blockchain analytics paint a contrasting picture. Ki Young Ju, CEO of CryptoQuant, observed that capital inflows into Bitcoin have essentially dried up as investors shift their focus toward equities and gold instead.

Capital inflows into Bitcoin have dried up.

Liquidity channels are more diverse now, so timing inflows is pointless. Institutions holding long-term killed the old whale-retail sell cycle. MSTR won't dump any significant chunk of their 673k BTC.

Money just rotated to stocks and… pic.twitter.com/Ha866TP857

— Ki Young Ju (@ki_young_ju) January 8, 2026

This observation aligns with broader trends in financial markets where US stock indices remain near record highs while sectors like AI and Big Tech continue absorbing much of available risk capital. For institutional investors seeking optimal risk-adjusted returns, equities currently present a more attractive option than crypto assets.

This situation creates a difficult reality for Bitcoin enthusiasts: although systemic liquidity abounds across markets generally, crypto remains lower down on investors’ priority lists when allocating capital.

A Shift Toward Sideways Movement Instead of Sharp Declines

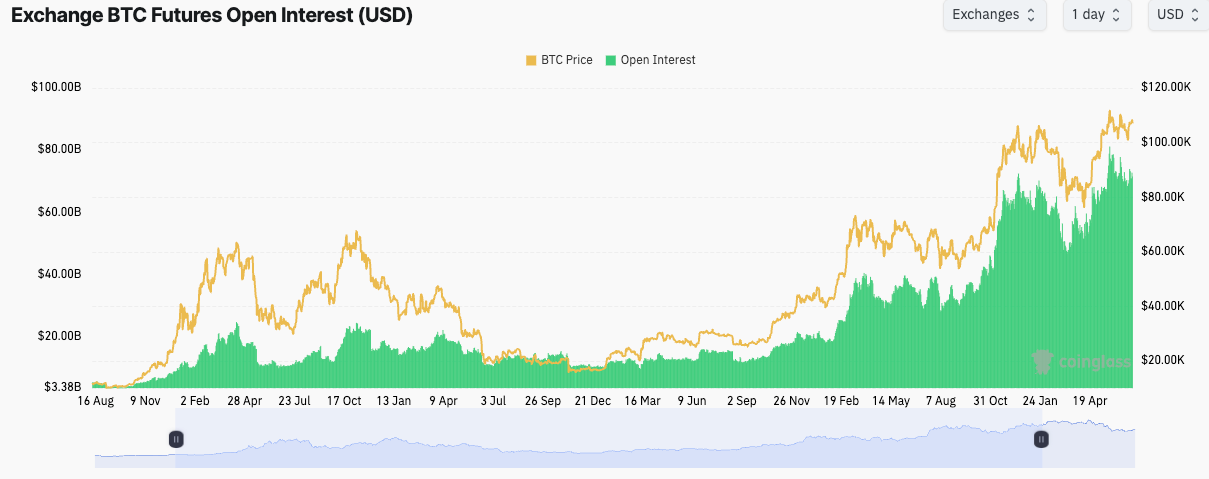

The derivatives market further supports this narrative of stagnation. Total open interest in Bitcoin futures stands at $61.76 billion spanning approximately 679K BTC based on Coinglass data. Despite a modest increase of about three percent over one day’s trading activity, prices hover within a tight range around $91K with support near $89K holding firm.

Binance leads exchanges with $11.88 billion (19.23%) open interest followed by CME at $10.32 billion (16.7%) and Bybit at $5.90 billion (9 .55%). Such stable positioning suggests traders are managing hedges rather than betting heavily on directional moves upward or downward.

The traditional pattern where large holders (“whales”) sell off holdings triggering retail panic appears broken as institutional players embrace longer-term strategies—MicroStrategy alone holds over six hundred seventy-three thousand BTC without signs they intend significant liquidation soon.

The emergence of spot Bitcoin ETFs has introduced patient capital classes that help dampen volatility from both sides.

“I don’t expect another crash exceeding -50% from all-time highs like previous bear markets,” Ki forecasted. “Instead we’re likely headed toward dull sideways trading over coming months.”

Bears face an uphill battle here since major holders aren’t panicking out positions which reduces risks tied to forced liquidations while longs lack immediate drivers pushing prices higher swiftly enough to break consolidation zones significantly.

Potential Catalysts That Could Alter Market Dynamics

Several factors might eventually redirect funds back into cryptocurrencies: equity valuations reaching levels prompting rotation towards alternative investments ; aggressive Federal Reserve rate cuts boosting overall risk tolerance ; clearer regulatory frameworks opening doors wider for institutional participation ; or specific bitcoin events such as supply changes post-halving combined with ETF options becoming more active .

Until these catalysts come into play , crypto may linger through prolonged periods marked by stability — avoiding sharp declines but lacking strong momentum needed for notable price advances .

Thus , despite abundant global liquidity , bitcoin still awaits its fair share among competing asset classes .

The original article & quot ; Liquidity Paradox : Credit Markets Hit Record Health While Bitcoin Starves & quot ; was first published on BeInCrypto .