Bitcoin is currently navigating crucial thresholds within the Ichimoku Cloud, and its ability to maintain levels above this zone will be pivotal in shaping its forthcoming price trajectory.

The cryptocurrency kicked off 2026 with notable strength, swiftly bouncing back from the setbacks experienced in December 2025. Early January saw Bitcoin reclaiming the $90,000 benchmark. Despite facing external challenges such as geopolitical tensions—including U.S. actions targeting Venezuela—Bitcoin managed to stay above this vital support throughout the weekend.

This optimistic momentum extended into the workweek, propelling Bitcoin beyond $94,000 by Monday night. The upward surge persisted on Tuesday, pushing prices close to a multi-week peak just shy of $95,000.

Nevertheless, a recent 2.8% decline over the last 24 hours indicates some resistance as Bitcoin consolidates between $90,000 and $92,500. Despite this brief setback, resilience remains evident with an intact medium-term bullish trend. The question now is: where will BTC head next?

Bitcoin Price Outlook

Analyzing daily charts reveals that Bitcoin is trading inside the Ichimoku Cloud—a technical indicator offering valuable clues about future price directions. Currently hovering near $90,000, it faces immediate resistance at approximately $93,997 along the cloud’s upper boundary.

If Bitcoin successfully breaks through this resistance level, it could aim for higher targets ranging from $94,000 up to around $95,000. Conversely, support lies near $88,300, tied closely to the lower boundary of the cloud which offers some protection. a fall below this point might trigger further declines toward approximately $87,650.

The Average True Range (ATR) indicator currently reads at 2,511.89, a metric used to gauge volatility. a higher ATR signals greater market swings either way. yet here we observe a gradual decrease in ATR values suggesting that volatility may be calming down temporarily.

Insights From Bitcoin Liquidation Data

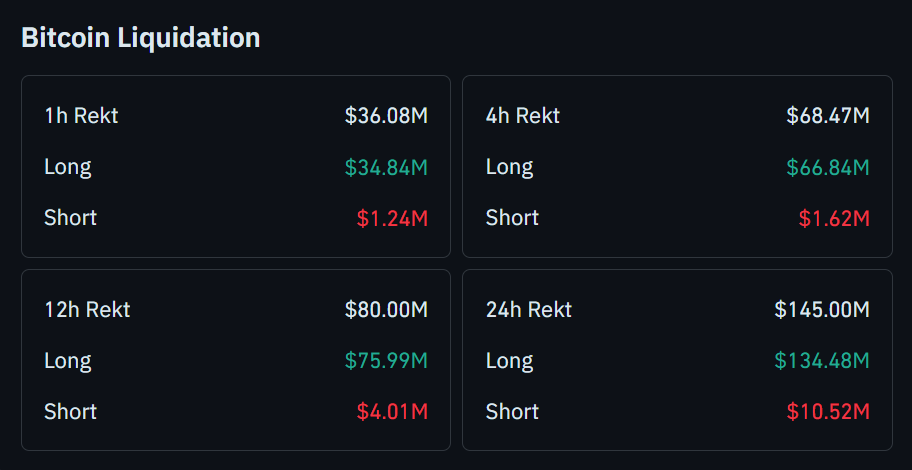

Additionally, lately observed liquidation data from CoinGlass highlights intense market activity indicating elevated volatility and potential risks for traders. numbers show that over $ 򠅅 million worth of liquidations occurred within twenty-four hours—with long positions accounting for most losses totaling $򠄴⹈ million.

A closer look at shorter intervals reveals significant liquidation volumes during both twelve-hour and four-hour windows—approximately $ ;80 million and $;68.;47 million respectively—with long positions predominantly affected ($,75.,99 million and $,66.,84 million wiped out).

The relatively minor short position liquidations across all timeframes—especially within one-hour ($,1.,24 million) and four-hour ($,1.,62 million) periods—suggests short sellers have faced comparatively less pressure recently..