The value of Bitcoin (BTC) has remained stable at approximately $90,000, even as tensions between the United States and Venezuela escalated dramatically early Saturday morning.

On Saturday, Bitcoin experienced a brief dip below the $90,000 mark but quickly recovered to trade above this threshold at the time of writing.

“The US launched an airstrike on a nation and captured its leader over the weekend, yet Bitcoin’s price barely flinched,” remarked Nic Puckrin, a market analyst and founder of Coin Bureau in a post on X.

The stability of Bitcoin’s price is notable given the recent military actions by the US against Venezuela that captured headlines on Saturday. Source: TradingView

Currently trading above its 21-day moving average indicates that if BTC maintains this position as short-term support throughout January it could signal further price increases ahead according to market analyst Michaël van de Poppe.

The resilience shown by BTC in light of recent geopolitical events is noteworthy since risk-sensitive assets like cryptocurrencies often experience sharp declines during times of international crisis or economic uncertainty.

Related: The national debt in the US surpasses $38.5 trillion while Bitcoin enthusiasts celebrate ‘Genesis Day’

US President Trump orders strikes on Venezuela; will tensions escalate?

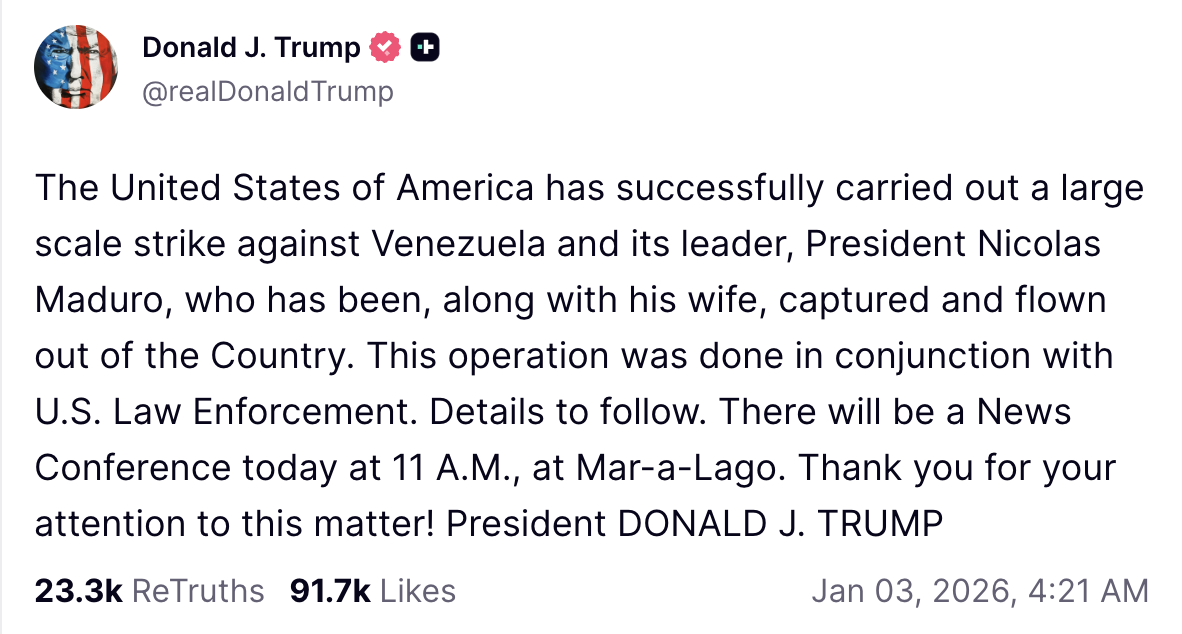

<pPresident Donald Trump announced airstrikes targeting Caracas—the capital city of Venezuela—on Saturday leading to President Nicolas Maduro’s capture.

Source: Donald Trump

This announcement sparked mixed reactions across social media platforms ranging from approval to criticism but has so far had minimal effect on financial markets overall.

“With heightened geopolitical tension and major players returning next week we can expect increased volatility for Bitcoin following this weekend,” noted crypto market analyst Lennaert Snyder.

Typically institutional investors within traditional finance refrain from trading during weekends or holidays. However they may react when markets open Monday morning potentially leading to asset sell-offs which could increase volatility further within cryptocurrency markets.

This scenario might intensify selling pressure contributing to recent declines in BTC prices which began after an abrupt crash back in October disrupted its upward trajectory towards new highs.

The value plummeted over 30% from an all-time peak exceeding $125k downwards hitting around $80k before bouncing back up toward levels near $90k again recently.

A magazine article states:‘Bitcoin becomes just ‘funny internet money’ amid crises,’ remarks Tezos co-founder.’</P