As the New Year begins, Bitcoin and the wider cryptocurrency market face renewed challenges following the release of the Federal Open Market Committee’s (FOMC) minutes from their December meeting.

The document clearly indicates that there is little urgency among policymakers to reduce interest rates again before early 2026.

Extended Period of Elevated Rates Dampens Crypto Optimism

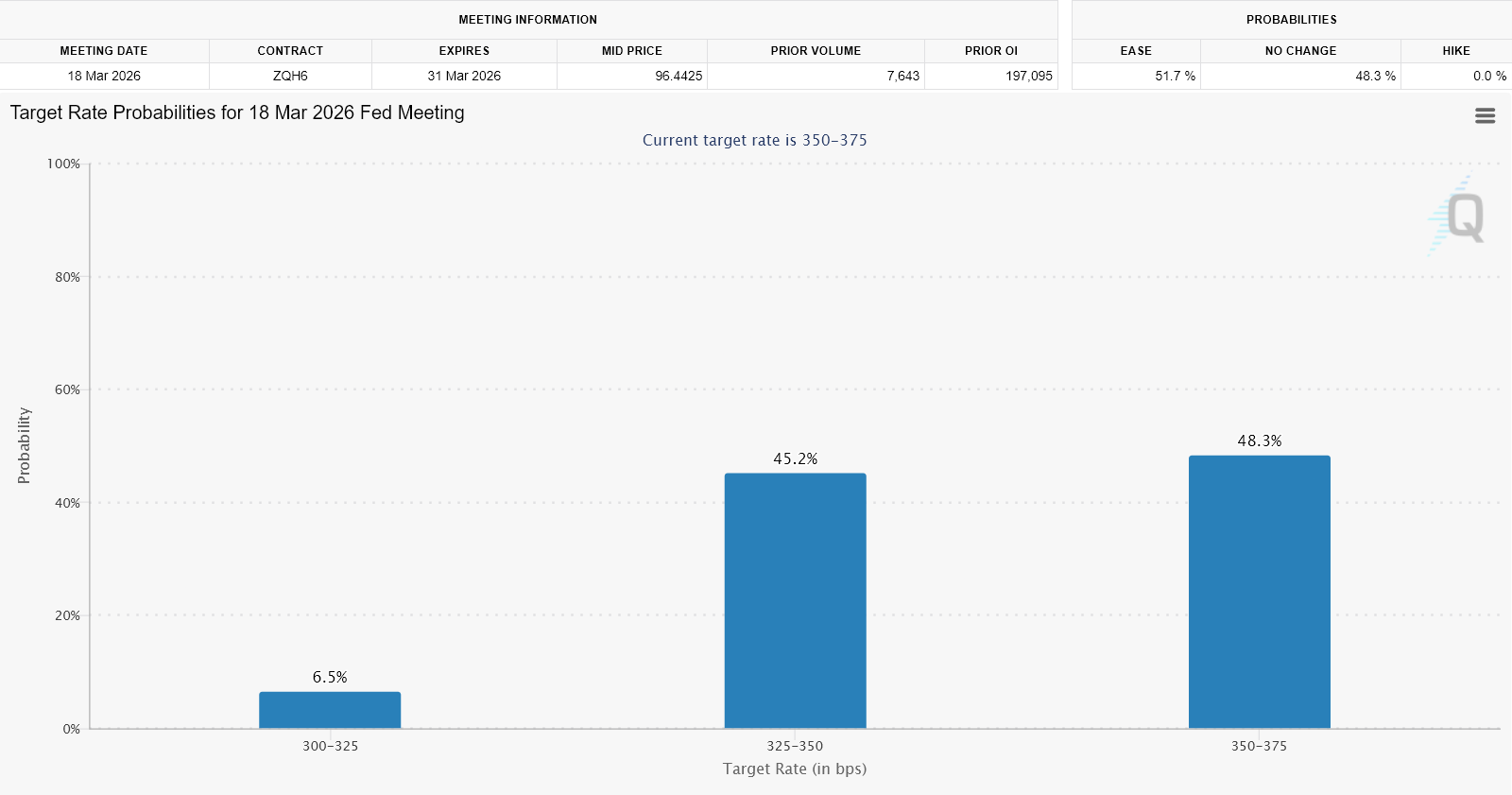

Published on December 30, the FOMC minutes reveal a preference for maintaining current rates after a modest 25-basis-point cut in December. This stance pushes expectations for any further rate reductions to no earlier than March.

Although markets had already discounted a January rate cut, this official communication reinforced those sentiments. The possibility of easing in March now appears uncertain, with April emerging as a more plausible earliest date for another reduction.

The majority of market participants anticipate no interest rate changes by March 2026. Source: CME FedWatch

Bitcoin has recently been confined within a narrow trading band between approximately $85,000 and $90,000.

This price stability masks underlying fragility since attempts to break above stronger resistance levels have failed. Sentiment indicators currently signal caution rather than strong conviction among investors.

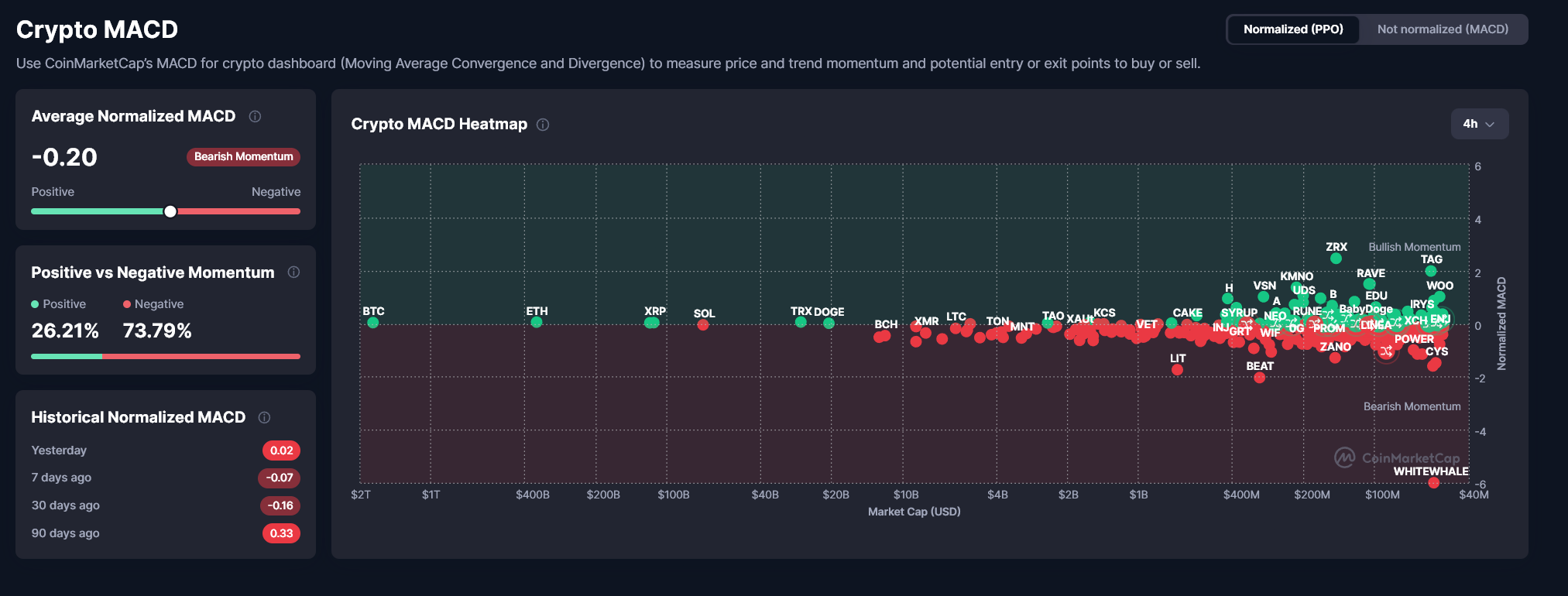

Daily trading volumes across cryptocurrencies remain subdued overall. Risk appetite has yet to rebound significantly following last month’s downturn.

The minutes highlight that several officials favored holding steady at current target ranges “for some time” in order to better evaluate delayed effects stemming from recent monetary easing measures.

A number of members described December’s rate cut as delicately balanced, emphasizing limited enthusiasm for additional cuts without clearer signs that inflation is abating effectively.

Tackling inflation remains central to policy decisions. Despite some softening in labor market conditions over the past year, price pressures have not moved closer toward the Fed’s 2 percent target according to policymakers’ assessments.

Summary from FOMC minutes:

A majority supported reducing rates by 25 basis points down to a range between 3.50% and 3.75% (vote tally: nine in favor versus three opposed), citing increased downside risks related to employment even though inflation “remains somewhat elevated.”

A significant portion noted ongoing inflation above target… pic.twitter.com/zr5ZJsPvVu

— Wall St Engine (@wallstengine) December 30, 2025

The FOMC identified tariffs as an important factor sustaining stubborn goods price inflation while noting gradual improvements within services sector inflation metrics.

Simultaneously, concerns about rising downside risks on employment were raised — including slower hiring trends, cautious business outlooks, and heightened financial stress particularly among lower-income households.

Nonetheless, most committee members preferred awaiting further data before making additional policy adjustments moving forward.

This conveys a clear message for crypto markets: with real yields remaining high and liquidity conditions tight globally near-term catalysts driving prices upward are scarce at best.

The recent consolidation phase seen in Bitcoin prices reflects this tension perfectly — investors are caught weighing hopes for eventual monetary easing against realities imposed by sustained higher interest rates over an extended period.

Overall bearish momentum dominates crypto market activity currently.

(Source: CoinMarketCap)

Looking ahead, march now stands out as a realistic earliest opportunity if both inflation cools sufficiently and labor markets weaken further.

till then, amp;amp;amp;amp;amp;'s struggle will likely continue,→→'s vulnerability increasing should macroeconomic data disappoint early next year.</ p > ;

<p > ;The original article titled " ;Post-Fomc Signals No Rush To Cut Rates Until March-2026 , Crypto Faces Test" ; was first published on BeInCrypto .</ p > ;