Welcome to the morning briefing of US Crypto News, your go-to source for the most significant updates in the cryptocurrency world as we gear up for another day.

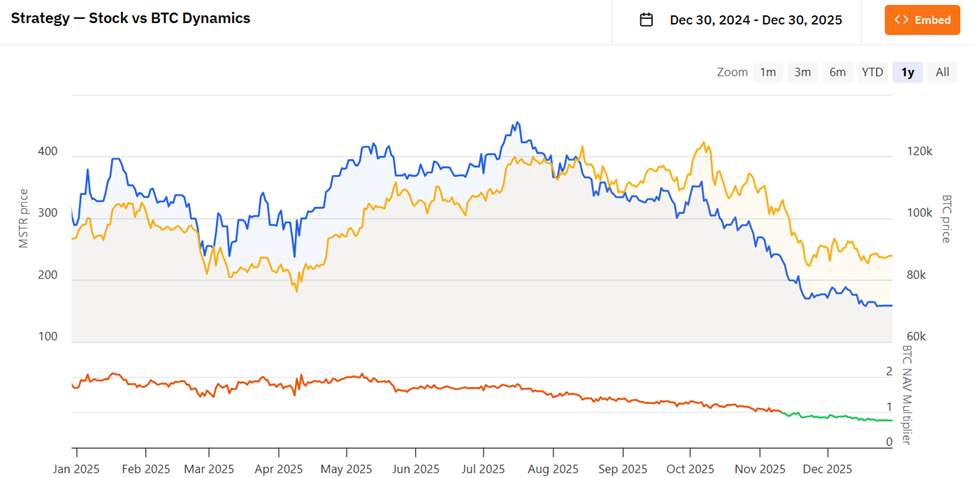

Pour yourself a cup of coffee, get comfortable, and consider looking beyond Bitcoin’s daily price fluctuations. What if the real narrative isn’t about market timing but rather how a company’s framework gradually enhances its value over time? This is precisely what Jeff Walton, Chief Investment Officer at Strive, argues regarding MicroStrategy (MSTR). While it may seem that MSTR’s stock price fluctuates with crypto markets, Walton contends that it functions like a well-oiled machine that consistently increases Bitcoin exposure per share.

Today’s Crypto Insight: Why Strive CIO Jeff Walton Believes Investing in MSTR at 2.5x mNAV Outperforms Spot Bitcoin

Jeff Walton emphasizes that many investors fundamentally misinterpret MicroStrategy (MSTR).

Reflecting on his acquisitions from 2021, he insists that this stock should not be seen merely as a leveraged proxy for Bitcoin. Instead, he encourages investors to view MSTR as an engine within capital markets designed to enhance Bitcoin exposure per share over time.

Walton disclosed that he began purchasing MSTR shares in June 2021 at approximately 2.5 times mNAV when he believed the stock had already declined by half.

“Little did I know I would witness an additional drop of 80% from my purchase price,” he noted as MSTR plummeted nearly 90% from its peak in February 2021.

By late 2022, MicroStrategy was trading around 1.3 times mNAV while holding onto an impressive total of 129,999 Bitcoins; however, its nominal debt briefly surpassed asset value. Despite being “down significantly on paper,” Walton maintained that the fundamental math remained intact.

“The company possessed REAL hard assets; debt covenants were manageable and structurally everything looked promising for crypto,” he stated while referencing upcoming events such as halving cycles and ETF developments along with elections and interest rate changes.

By mid-2023, Walton declared himself “all-in,” convinced that it was not market movements but rather capital structure which formed his core investment thesis.

This conviction is what allowed long-term investors to endure one of crypto equity’s most severe downturns historically.

The Evolution of Risk Dynamics Surrounding MicroStrategy Over Time

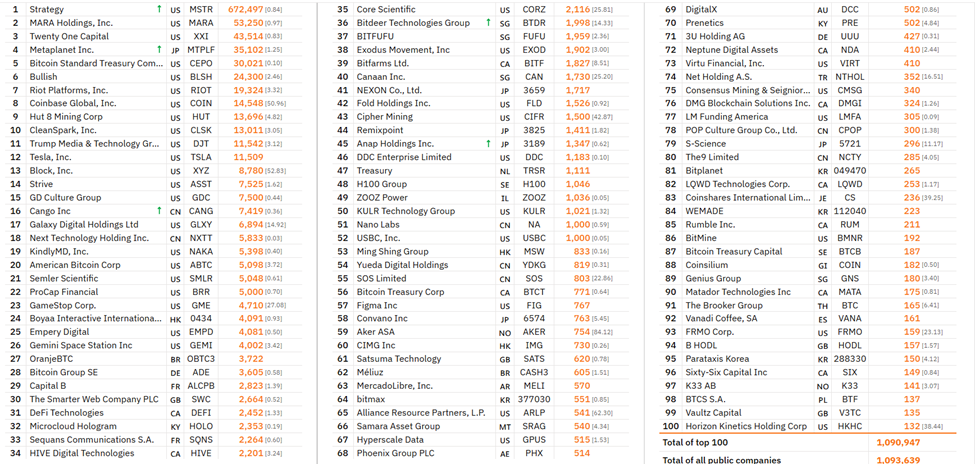

If we fast forward to late 2025 according to Walton’s observations—MicroStrategy now holds an astounding total of **672**497 Bitcoins—more than twelve times greater than any other publicly traded corporate holder!

Top Public BTC Treasury Companies:

Source: Bitcoin Treasuries

A Glimpse into Today’s Additional US Crypto News:

- META Planet: Reports indicate a staggering (568.20%) BTC yield forecasted for (2025) , following their holdings reaching (35),102.

- “Grayscale” : Highlights six promising privacy coins including Zcash among others.

- The XRP price faces potential risks with estimates suggesting up to “(41%)” decline despite widespread buying activity among holders.

- “Gold” – experienced its sharpest single-day drop observed over two months indicating possible end-of-metal season trends.

- The CEO from Bitwise points towards potential benefits stemming from rising bitcoin amidst Iran’s deepening currency crisis.*[Ref]*.

- Michaël van de Poppe elaborates on why numerous altcoins might struggle through “(2026)”.

Lighter launches LIT token distributing (25%) supply via Airdrop!