Matthew Sigel from VanEck has observed that long-term Bitcoin holders have shifted into net buyers, suggesting that the significant selling phase they experienced since 2019 may have come to an end.

According to CoinGecko data, earlier today Bitcoin surged to an intraday peak of $89,201.

Significant Selling Pressure Event

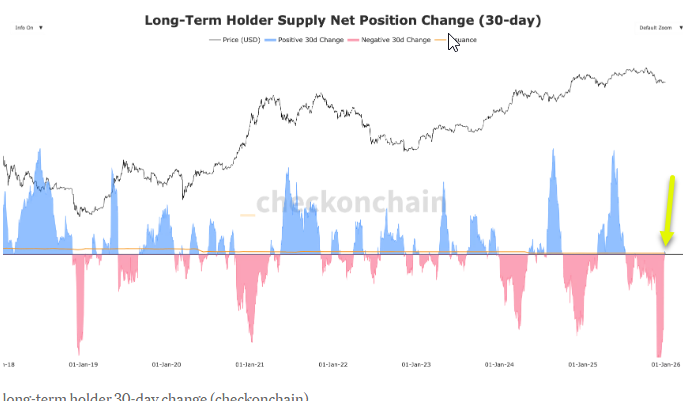

The chart shared by Sigel tracks the 30-day variation in Bitcoin held by Long-Term Holders (LTHs), who are typically defined as those holding coins for at least 155 days in on-chain analysis.

When the bars appear blue and rise above zero, it indicates LTHs are accumulating and securing their coins—usually during market downturns or price corrections. Conversely, red bars below zero signify these holders are offloading their assets into the market, a behavior common during bullish trends when prices soar.

LTHs often act contrary to retail investors: purchasing amid widespread fear and selling when greed dominates sentiment.

The highlighted arrow points out that this recent period of intense profit-taking by LTHs is effectively over—they’ve sold off most of what they planned at current price levels.

This cessation of selling removes a major source of downward pressure. Provided demand stays steady or grows, this creates room for a strong upward movement due to fewer large-scale sellers influencing prices negatively.

Historically, after heavy sell-offs push supply changes back toward zero, markets tend to enter consolidation phases or resume accumulation periods.

Bitcoin’s year-to-date performance shows a decline of 5.19%. Notably though, every time Bitcoin closed with a negative annual candle previously, it was followed by a positive year averaging returns around 124.5%.

However Mike Novogratz points out that for bulls to regain control decisively, Bitcoin must first break above the $100,000 threshold before turning fully bullish again.